Saving money isn’t just about cutting costs; it’s about making informed decisions that lead to a more secure and fulfilling financial future, and at savewhere.net, we’re dedicated to providing you with actionable strategies to achieve your financial goals. Learn how to navigate difficult choices in gaming scenarios while mastering real-world money-saving techniques. Let’s explore how you can apply resourcefulness in games and in your daily life.

1. What Happens to Buddy in Dying Light 2?

In the “True Friends” quest, Buddy tragically succumbs to his wounds, leaving players with a poignant reminder of the harsh realities within the game’s world. The “True Friends” quest in Dying Light 2 leaves many players questioning if there’s a way to save Buddy, the wounded dog. Unfortunately, the game’s narrative dictates Buddy’s fate, offering players no direct option to rescue him. This lack of choice has sparked considerable discussion among players, who feel it contrasts with the game’s theme of saving people in various other scenarios. The inability to save Buddy has led to disappointment and a desire for alternative outcomes, perhaps through future game updates or mods.

1.1 Why Can’t You Save Buddy?

Buddy’s death serves a narrative purpose, highlighting the grim realities of the game’s world. The storyline is designed to evoke emotional responses and challenge players’ sense of morality, even if it means facing a seemingly unavoidable outcome. It reinforces the “tough world” ideology present in the game.

1.2 Player Reactions to Buddy’s Fate

The inability to save Buddy has sparked strong reactions from players. Many feel frustrated and saddened by the lack of agency in this particular quest, especially when the game otherwise offers numerous opportunities to rescue other characters. Players have expressed their dissatisfaction online, calling for the developers to introduce alternative outcomes or modders to create solutions.

2. Exploring Alternative Outcomes: What Could Have Been?

Many players wish for alternative outcomes that would allow them to save Buddy, and these suggestions often involve resource management and difficult choices.

2.1 The Rare Item Solution

One suggestion involves using a rare or expensive item, such as a military-grade medkit or inhibitor, to save Buddy. This option would force players to make a difficult decision, weighing the value of the item against the desire to save the dog.

2.2 The Hustle and Pay Solution

Another idea is to allow players to hustle and earn a large sum of money to pay someone to save Buddy. This would reflect the game’s economy and require players to invest time and effort into rescuing the dog.

2.3 The Combined Effort Solution

A more complex solution could involve a combination of both, requiring players to find a rare item and pay a substantial amount of money. This would create a truly challenging and rewarding experience for players who are determined to save Buddy.

3. Parallels to Real-Life Financial Decisions

The in-game dilemma of whether to save Buddy mirrors real-life financial decisions where resources are limited, and choices must be made based on priorities and values.

3.1 Budgeting and Prioritization

Just as players must decide how to allocate resources in the game, individuals and families must budget and prioritize their spending in real life. This involves making tough choices about what is most important and allocating resources accordingly, as highlighted by the Consumer Financial Protection Bureau (CFPB).

3.2 Emergency Funds

Having an emergency fund is like having a rare item in the game that can be used to solve unexpected problems. It provides a financial safety net that can be used to cover unexpected expenses, such as medical bills or car repairs, without derailing your financial goals.

3.3 Investing in What Matters

Choosing to save Buddy, even at a cost, reflects investing in what matters most. Similarly, in real life, this could mean investing in education, healthcare, or other areas that improve your quality of life.

4. How to Make Smart Financial Choices Like a Dying Light 2 Survivor

Being resourceful like a survivor in Dying Light 2 can translate into smart financial habits. Here’s how:

4.1 Assess Your Resources

Just as Aiden assesses his inventory, take stock of your financial resources. Calculate your income, savings, and investments to understand your financial standing.

4.2 Identify Your Priorities

Determine what is most important to you, whether it’s paying off debt, saving for a down payment on a home, or securing retirement. Prioritize your financial goals and allocate your resources accordingly.

4.3 Create a Budget

Develop a budget to track your income and expenses. This will help you identify areas where you can cut back and save more money. Numerous budgeting apps and tools are available to simplify this process.

4.4 Seek Opportunities for Savings

Look for opportunities to save money on everyday expenses, such as groceries, transportation, and entertainment. Use coupons, discounts, and rewards programs to maximize your savings.

4.5 Protect Your Assets

Just as Aiden protects himself from the infected, safeguard your financial assets by investing in insurance, diversifying your investments, and taking steps to prevent identity theft and fraud.

5. Budgeting Like a Pro: Real-World Tips Inspired by Gaming

Gamers often master resource management, a skill applicable to budgeting.

5.1 Track Every Dollar

Like tracking every bullet in a firefight, monitor your spending meticulously. Use budgeting apps or spreadsheets to record every transaction.

5.2 Find Hidden Resources

Discover “loot” in your budget by identifying unnecessary expenses. Cut back on subscriptions, dine out less, and find free entertainment options.

5.3 Plan Ahead

Strategize your spending like planning a mission. Anticipate upcoming expenses and save for them in advance.

5.4 Optimize Your Spending

Find the most efficient ways to use your money. Compare prices, use coupons, and negotiate better deals to get the most value for your money.

5.5 Stay Flexible

Be ready to adjust your budget when unexpected expenses arise. Like adapting to a change in game strategy, flexibility is key to staying on track.

6. Mastering Resource Management: From Post-Apocalyptic City to Your Wallet

Effective resource management is crucial in both Dying Light 2 and personal finance.

6.1 The Scarcity Mindset

In a post-apocalyptic world, resources are scarce. Adopt this mindset to appreciate the value of every dollar.

6.2 Prioritize Needs Over Wants

Distinguish between essential needs and non-essential wants. Focus on meeting your needs first and allocate remaining resources to your wants.

6.3 Avoid Waste

Minimize waste in all areas of your life. Reduce food waste, conserve energy, and avoid impulse purchases.

6.4 Reuse and Repurpose

Find creative ways to reuse and repurpose items instead of buying new ones. This saves money and reduces your environmental impact.

6.5 Invest Wisely

Invest your money in assets that will grow over time, such as stocks, bonds, or real estate. Seek professional advice to make informed investment decisions.

7. Earning Extra Income: Side Quests for Your Bank Account

In Dying Light 2, side quests provide additional resources. Similarly, earning extra income can boost your financial resources.

7.1 Freelance Work

Offer your skills and services as a freelancer. Numerous online platforms connect freelancers with clients seeking various services, such as writing, graphic design, and web development.

7.2 Part-Time Jobs

Take on a part-time job to supplement your income. Many retailers, restaurants, and other businesses offer flexible part-time positions.

7.3 Sell Unused Items

Declutter your home and sell unwanted items online or at a consignment shop. This is a great way to generate extra cash and free up space.

7.4 Rent Out Your Space

If you have a spare room or property, consider renting it out on platforms like Airbnb. This can provide a significant source of passive income.

7.5 Participate in Online Surveys

Participate in online surveys to earn small amounts of money or gift cards. While this won’t make you rich, it’s an easy way to earn extra cash in your spare time.

8. Saving on Essential Expenses: The Survivor’s Guide to Cutting Costs

Survivors in Dying Light 2 are resourceful in finding ways to save resources. Here’s how you can apply that to your essential expenses.

8.1 Housing

Explore affordable housing options, such as renting a smaller apartment or sharing accommodation with roommates. Consider refinancing your mortgage to lower your monthly payments.

8.2 Transportation

Use public transportation, bike, or walk whenever possible to save on transportation costs. If you own a car, maintain it properly to avoid costly repairs.

8.3 Food

Plan your meals, shop with a list, and cook at home to save on food expenses. Reduce food waste by using leftovers and freezing excess food.

8.4 Utilities

Conserve energy by turning off lights, unplugging electronics, and using energy-efficient appliances. Reduce water consumption by taking shorter showers and fixing leaks promptly.

8.5 Healthcare

Take advantage of preventive care services to avoid costly medical treatments. Compare prices for prescriptions and explore generic alternatives.

9. Dealing with Debt: Fighting the Infected of Your Finances

Debt can feel like the infected in Dying Light 2, constantly threatening your progress. Here’s how to fight back.

9.1 Assess Your Debt

List all your debts, including the interest rates and minimum payments. Prioritize paying off high-interest debt first.

9.2 Create a Debt Repayment Plan

Develop a plan to pay off your debt as quickly as possible. Consider using the debt snowball or debt avalanche method.

9.3 Negotiate with Creditors

Contact your creditors and negotiate lower interest rates or payment plans. Many creditors are willing to work with you to avoid default.

9.4 Avoid New Debt

Resist the temptation to take on new debt while you are paying off existing debt. Focus on living within your means and avoiding unnecessary expenses.

9.5 Seek Professional Help

If you are struggling with debt, seek professional help from a credit counselor or financial advisor. They can provide guidance and support to help you get back on track.

10. Building a Financial Fortress: Saving for the Future

Just as survivors build fortresses to protect themselves, build a financial fortress to secure your future.

10.1 Set Savings Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) savings goals. This will help you stay motivated and track your progress.

10.2 Automate Your Savings

Automate your savings by setting up automatic transfers from your checking account to your savings account each month. This makes saving effortless and consistent.

10.3 Take Advantage of Employer Benefits

Participate in your employer’s retirement savings plan, such as a 401(k) or 403(b). Take advantage of any employer matching contributions, as this is essentially free money.

10.4 Invest for the Long Term

Invest your savings in a diversified portfolio of stocks, bonds, and other assets. This will help your money grow over time and provide financial security in retirement.

10.5 Review Your Progress

Regularly review your savings progress and adjust your strategy as needed. Stay informed about changes in the financial markets and make adjustments to your portfolio accordingly.

11. Financial Tools and Resources: Your Dying Light 2 Toolkit for Savings

Just as Aiden has his tools, you have financial tools to help you save.

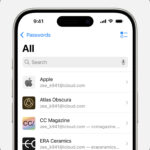

11.1 Budgeting Apps

Apps like Mint, YNAB (You Need a Budget), and Personal Capital help track spending and create budgets.

11.2 Savings Apps

Apps like Acorns and Digit automate savings by rounding up purchases or analyzing spending habits.

11.3 Investment Platforms

Platforms like Robinhood, Fidelity, and Charles Schwab offer tools for investing in stocks, bonds, and mutual funds.

11.4 Credit Monitoring Services

Services like Credit Karma and Experian provide credit scores and monitor credit reports for potential fraud.

11.5 Financial Education Websites

Websites like Investopedia and the CFPB offer free financial education resources.

12. Maintaining Motivation: The Survivor’s Mindset for Financial Success

Staying motivated is key to achieving your financial goals.

12.1 Celebrate Small Wins

Acknowledge and celebrate your progress along the way. This will help you stay motivated and maintain momentum.

12.2 Visualize Your Goals

Create a vision board or write down your financial goals and visualize yourself achieving them. This will help you stay focused and motivated.

12.3 Find an Accountability Partner

Share your financial goals with a friend or family member and ask them to hold you accountable. This will provide support and encouragement.

12.4 Reward Yourself

Reward yourself for reaching milestones, but make sure the rewards are aligned with your financial goals. For example, treat yourself to a budget-friendly activity instead of a splurge purchase.

12.5 Stay Positive

Maintain a positive attitude and focus on the progress you are making. Remember that setbacks are temporary and that you can overcome any challenges with persistence and determination.

13. The Ethical Dilemma: Balancing Needs and Values

The decision to save Buddy mirrors ethical dilemmas in personal finance.

13.1 Values-Based Spending

Align your spending with your values. Support businesses that share your ethical standards.

13.2 Charitable Giving

Donate to causes you believe in. Giving back can provide a sense of purpose and fulfillment.

13.3 Sustainable Choices

Make environmentally sustainable choices. Reduce your carbon footprint and support eco-friendly products.

13.4 Fair Trade

Purchase fair trade products. Support fair wages and working conditions for producers in developing countries.

13.5 Community Involvement

Invest in your community. Volunteer your time and support local businesses.

14. Real-Life Examples of Financial Resourcefulness

Here are examples of people who have successfully applied resourcefulness to their finances.

14.1 The Debt-Free Journey

A couple paid off $100,000 in debt by tracking expenses, cutting costs, and increasing income.

14.2 The Early Retirement

A person retired in their 30s by saving aggressively and investing wisely.

14.3 The Homeowner

A family saved for a down payment by creating a strict budget and eliminating unnecessary expenses.

14.4 The Investor

An individual built wealth by investing in the stock market and diversifying their portfolio.

14.5 The Entrepreneur

A person started a successful business by bootstrapping and managing resources carefully.

15. Staying Updated: Adapting to the Ever-Changing Financial Landscape

The financial world is always changing, so staying informed is crucial.

15.1 Follow Financial News

Stay updated on financial news and trends. Read reputable financial publications and follow financial experts on social media.

15.2 Attend Financial Workshops

Attend financial workshops and seminars to learn new skills and strategies. Many organizations offer free or low-cost financial education programs.

15.3 Consult with a Financial Advisor

Consult with a financial advisor to get personalized advice and guidance. A financial advisor can help you develop a comprehensive financial plan and make informed decisions.

15.4 Join Financial Communities

Join online or in-person financial communities to connect with like-minded individuals. Share tips, ask questions, and learn from others’ experiences.

15.5 Embrace Lifelong Learning

Commit to lifelong learning and continuously improve your financial knowledge. Read books, take online courses, and stay curious about the world of finance.

16. Common Financial Pitfalls and How to Avoid Them

Be aware of common financial mistakes and take steps to avoid them.

16.1 Impulse Buying

Avoid making impulse purchases. Wait 24 hours before buying non-essential items.

16.2 Ignoring Debt

Don’t ignore your debt. Take action to pay it off as quickly as possible.

16.3 Not Budgeting

Create a budget and stick to it. Track your spending and identify areas where you can save money.

16.4 Living Beyond Your Means

Live within your means and avoid spending more than you earn. Save for the future and avoid unnecessary debt.

16.5 Neglecting Emergency Savings

Build an emergency fund to cover unexpected expenses. Aim to save at least three to six months’ worth of living expenses.

17. The Role of Savewhere.net in Your Financial Journey

Savewhere.net is your companion in navigating the world of personal finance, offering resources, tips, and community support to help you achieve your financial goals.

17.1 Access to Information

Savewhere.net provides access to a wealth of information on various financial topics, including budgeting, saving, investing, and debt management. Our articles, guides, and tools are designed to empower you to make informed decisions.

17.2 Practical Tips and Strategies

We offer practical tips and strategies that you can implement in your daily life to save money and improve your financial situation. Our advice is based on real-world experience and expert insights.

17.3 Community Support

Savewhere.net is a community of like-minded individuals who are passionate about personal finance. Connect with others, share your experiences, and learn from their successes and challenges.

17.4 Personalized Recommendations

We provide personalized recommendations based on your individual circumstances and goals. Our tools and resources are designed to help you tailor your financial plan to your specific needs.

17.5 Motivation and Inspiration

Savewhere.net is a source of motivation and inspiration for your financial journey. We share success stories, provide encouragement, and help you stay focused on your goals.

18. The Psychology of Saving: How to Train Your Brain for Financial Success

Understand the psychology behind saving to improve your financial habits.

18.1 Set Clear Goals

Clearly define your financial goals to create a sense of purpose.

18.2 Visualize Success

Imagine achieving your financial goals to stay motivated.

18.3 Break Down Goals

Divide large goals into smaller, manageable steps.

18.4 Automate Savings

Make saving automatic to reduce the need for willpower.

18.5 Practice Gratitude

Appreciate what you have to avoid overspending.

19. The Future of Saving: Trends and Innovations to Watch

Stay informed about emerging trends in personal finance.

19.1 Fintech Innovations

Explore new financial technologies like blockchain and AI.

19.2 Sustainable Investing

Invest in companies with positive environmental and social impact.

19.3 Digital Currencies

Understand the risks and opportunities of cryptocurrencies.

19.4 Financial Wellness Programs

Take advantage of workplace financial wellness programs.

19.5 Personalized Financial Advice

Use AI-powered tools for customized financial planning.

20. Building a Legacy: Passing on Financial Wisdom

Teach future generations about financial literacy.

20.1 Start Early

Teach children about money from a young age.

20.2 Lead by Example

Demonstrate good financial habits in your own life.

20.3 Open Communication

Talk openly about money with your family.

20.4 Financial Education

Support financial education programs in schools.

20.5 Legacy Planning

Plan your estate to pass on your wealth and values.

Just like mastering the challenges in Dying Light 2, effective financial management requires strategy, resourcefulness, and a commitment to your goals. Savewhere.net is here to equip you with the knowledge and tools you need to navigate your financial journey successfully.

Ready to transform your financial life? Visit savewhere.net today and discover a wealth of resources, tips, and a supportive community to help you save money, achieve your financial goals, and build a secure future. Start your journey towards financial freedom now! Our address is 100 Peachtree St NW, Atlanta, GA 30303, United States. You can also reach us at Phone: +1 (404) 656-2000.

FAQ: Saving Money Like a Pro in the USA

1. Can You Really Save Money in a High-Cost Area Like Atlanta?

Absolutely! With strategic budgeting, utilizing local discounts, and taking advantage of resources like Savewhere.net, you can effectively manage your finances and save money even in cities with a high cost of living such as Atlanta.

2. What Are the First Steps to Take When Starting a Budget?

Start by tracking your income and expenses for a month to understand where your money is going. Then, identify areas where you can cut back and allocate funds to your savings goals. Budgeting apps can simplify this process.

3. How Can I Save Money on Groceries?

Plan your meals, shop with a list, use coupons, and buy in bulk when appropriate. Reduce food waste by using leftovers and freezing excess food. Comparing prices at different stores can also lead to significant savings.

4. What Are Some Ways to Reduce Transportation Costs?

Consider using public transportation, biking, or walking whenever possible. If you own a car, ensure it’s well-maintained to avoid costly repairs, and compare insurance rates annually to secure the best deal.

5. How Important Is an Emergency Fund, and How Do I Build One?

An emergency fund is crucial for covering unexpected expenses without derailing your financial goals. Aim to save at least three to six months’ worth of living expenses. Automate your savings by setting up regular transfers to a dedicated savings account.

6. What’s the Best Way to Pay Off Debt?

Prioritize paying off high-interest debt first. Consider using the debt snowball (paying off the smallest debt first for motivation) or the debt avalanche method (paying off the highest interest debt first to save money). Negotiate with creditors for lower interest rates if possible.

7. How Can I Start Investing with a Small Amount of Money?

Many investment platforms allow you to start with a small amount of money. Consider investing in low-cost index funds or ETFs, which offer diversification and lower risk. Robo-advisors can also provide automated investment management for beginners.

8. What Are Some Free Resources for Financial Education?

Websites like Investopedia and the Consumer Financial Protection Bureau (CFPB) offer free financial education resources. Local libraries and community centers often host free financial workshops and seminars.

9. How Can Savewhere.net Help Me Save Money?

savewhere.net provides a wealth of information on various financial topics, practical tips and strategies, a supportive community, and personalized recommendations to help you save money and achieve your financial goals.

10. How Do I Stay Motivated on My Savings Journey?

Set clear, achievable goals, celebrate small wins, find an accountability partner, and reward yourself for reaching milestones. Stay positive and focus on the progress you are making. Remember, financial success is a marathon, not a sprint.