Are you searching for effective money-saving tips to achieve your financial goals? “How Not To Save The World” is a guide to financial freedom, providing practical money management advice, resources, and actionable strategies for budgeting, smart spending, and long-term savings. Explore SaveWhere.net for comprehensive support and start transforming your financial future today.

1. What Are the Common Pitfalls in Trying to Save the World (and Your Money)?

Saving money and the planet require more than just good intentions; it requires understanding the common mistakes. The most frequent pitfalls include:

1.1. Overlooking the Urgency of Change

Many people understand the need for change but fail to act because they do not feel it is immediately necessary. According to Pollard’s Law of Human Behavior, individuals prioritize immediate needs and pleasures over important but non-urgent tasks.

1.2. Underestimating the Difficulty of Systemic Change

Substantial change requires more than just superficial efforts; it demands systemic adjustments. Large-scale concerted efforts often fail because they run into powerful opposition or create new problems worse than the original ones.

1.3. Reliance on Oversimplified Models and Constructs

The human mind often relies on simplified models and constructs to understand complex systems. These models, while useful, are inadequate representations of reality and can lead to ineffective solutions. As Einstein noted, theories should be as simple as possible, but no simpler, acknowledging the inherent fragility of human inventions compared to evolved living processes.

1.4. Ignoring the Jevons Paradox

The Jevons Paradox illustrates that technological improvements increasing efficiency can lead to higher overall consumption, negating the intended benefits. For example, more fuel-efficient cars may lead to more driving, increasing total fuel consumption.

1.5. Neglecting Personal Well-being and Joy

Focusing solely on saving the world or money can lead to burnout and neglect of personal well-being. It’s important to balance efforts to make a difference with the need to live a full, enjoyable life.

Common Pitfalls

Common Pitfalls

2. What Is Pollard’s Law of Human Behavior and Complexity?

Pollard’s Law of Human Behavior and Complexity provides insights into why large-scale change efforts often fail and what strategies are more likely to succeed.

2.1. Understanding Pollard’s Law of Human Behavior

Pollard’s Law of Human Behavior states that individuals prioritize actions based on immediate needs and ease. The law includes:

- We do what we must: Addressing immediate, unavoidable imperatives.

- Then we do what’s easy: Choosing convenient and straightforward tasks.

- And then we do what’s fun: Pursuing enjoyable activities.

- Result: Important tasks often get neglected.

2.2. Understanding Pollard’s Law of Complexity

Pollard’s Law of Complexity highlights the challenges of changing complex systems without understanding their underlying reasons. It includes:

- Things are the way they are for a reason: Everything exists due to specific underlying causes.

- If you want to change something, it helps to know that reason: Understanding the root cause is crucial for effective change.

- If that reason is complex, success at changing it is unlikely: Complex reasons make change difficult.

- Result: Adapting to the system is often a better strategy.

2.3. How the Laws Interact

These laws suggest that significant change is unlikely unless it addresses immediate needs and is relatively easy to implement. Efforts to save the world often fail because they require difficult, long-term commitments that don’t align with immediate human priorities.

2.4. Application in Finance

Applying these laws to personal finance suggests that successful saving strategies should be easy to implement and address immediate needs. Automating savings, setting clear, achievable goals, and making saving fun can increase success.

3. How Can You Distinguish Between Constructs and Organic Processes?

Understanding the difference between constructs and organic processes can help manage complex financial systems and plans effectively.

3.1. Defining Constructs

Constructs are human-made models, tools, and theories designed to simplify and control systems. Examples include:

- Organizations (companies, political entities)

- Systems (political, economic, social)

- Scientific laws and theories

- Technologies (computers, cars, money)

3.2. Defining Organic Processes

Organic processes are dynamic, evolving systems influenced by countless unpredictable factors. Examples include:

- The processes of living creatures

- The behaviors of people in an organization

- The processes occurring in a garden or forest

- Evolution and emergent human behaviors

3.3. Contrasting Examples

| Category | Constructs | Organic Processes |

|---|---|---|

| Nature | Static, finite components | Dynamic, infinite components |

| Predictability | Predictable cause and effect | Unpredictable cause and effect |

| Examples | An organization’s structure | The behaviors of people within that organization |

| A system chart or map | The processes occurring in the mapped territory | |

| Scientific laws and theories | The processes of living organisms adhering to those laws | |

| Cars on the road | The behavior of drivers | |

| Agriculture | The processes in a garden or forest | |

| Technologies (e.g., money, computers) | Learning, instinct, communication processes | |

| Democracy, property rights | Evolution, emergent human behaviors |

3.4. Implications for Financial Management

In financial management, constructs might include budgeting apps, investment strategies, and economic models. Organic processes involve individual financial behaviors, market trends, and unexpected life events. Acknowledging both can lead to more resilient and adaptive financial planning.

3.5. Effective Use of Constructs

While constructs simplify, they should not be mistaken for reality. Using multiple models and adapting strategies based on real-world feedback can improve financial outcomes.

4. What Role Does Urgency vs. Ease Play in Saving the World and Money?

The balance between urgency and ease significantly influences the success of movements and individual efforts to save the world and manage money.

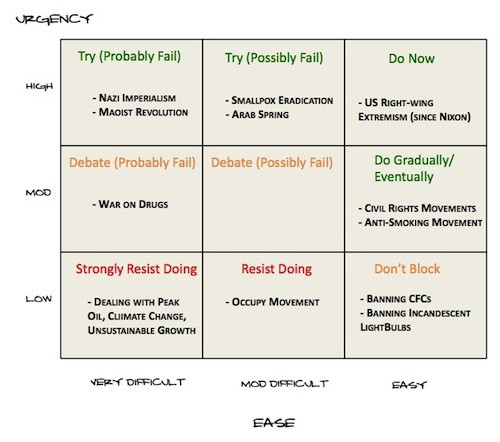

4.1. Understanding the Urgency/Ease Matrix

The Urgency/Ease matrix helps categorize actions based on how urgent they feel and how easy they are to implement. Actions that are both urgent and easy are most likely to be undertaken.

4.2. Examples in Social Movements

- Civil Rights Movements: Moderate urgency due to inherent fairness, easy implementation for most.

- Right-Wing Extremism in the US: High urgency due to feeling threatened, easy implementation via deregulation.

- Saving Civilization: Low urgency as the threat is not widely perceived, extremely difficult implementation due to numerous interrelated crises.

4.3. Applying the Matrix to Personal Finance

| Financial Action | Urgency | Ease |

|---|---|---|

| Paying Bills | High | Easy |

| Saving for Retirement | Low | Difficult |

| Creating a Budget | Moderate | Moderate |

| Cutting Unnecessary Expenses | Moderate | Moderate |

| Investing in Stocks | Low | Difficult |

4.4. Strategies to Increase Urgency and Ease

- Increase Urgency: Set clear, short-term financial goals. Visualize the consequences of not saving.

- Increase Ease: Automate savings. Use budgeting apps. Break down large goals into smaller, manageable steps.

4.5. Balancing Urgency and Ease

Effective financial planning balances immediate needs with long-term goals, making both feel more urgent and achievable.

5. What Are Some Examples of Jevons Paradox in Personal Finance and Environmental Efforts?

The Jevons Paradox, where increased efficiency leads to increased consumption, can undermine well-intentioned efforts.

5.1. Defining the Jevons Paradox

The Jevons Paradox states that when technological progress increases the efficiency with which a resource is used, consumption of that resource tends to increase rather than decrease.

5.2. Examples in Environmental Efforts

- Fuel-Efficient Cars: More efficient cars lead to more driving, increasing overall fuel consumption.

- Energy-Efficient Appliances: Lower energy bills encourage higher usage of appliances, negating savings.

5.3. Examples in Personal Finance

- Credit Card Rewards: Earning rewards encourages more spending, leading to debt.

- Budgeting Apps: Increased awareness may lead to more spending as individuals feel more in control.

5.4. Mitigating the Jevons Paradox

- Set Consumption Limits: Consciously limit consumption despite increased efficiency.

- Reinvest Savings: Use savings from efficiency gains to further reduce consumption or invest in sustainable practices.

- Focus on Reducing Overall Demand: Prioritize reducing demand for resources over merely increasing efficiency.

5.5. Long-Term Sustainability

Addressing the Jevons Paradox requires a shift in mindset towards sustainability and conscious consumption.

6. What Practical Steps Can Individuals Take Instead of Trying to “Save the World?”

Instead of trying to “save the world,” individuals can take practical steps that foster resilience, adaptability, and personal well-being.

6.1. Embracing Local Resilience

Focus on building resilience within local communities. This includes:

- Community Building: Get to know neighbors and build supportive relationships.

- Local Skills: Learn and share essential skills like gardening, cooking, and basic repairs.

- Local Economies: Support local businesses and create local economic networks.

6.2. Adapting to Change

Accept the inevitability of change and focus on adaptation:

- Flexibility: Cultivate flexibility in financial and lifestyle choices.

- Continuous Learning: Stay informed about global and local trends.

- Resourcefulness: Develop resourcefulness to cope with unexpected challenges.

6.3. Fostering Personal Well-being

Prioritize personal well-being:

- Mindfulness: Practice mindfulness to appreciate the present moment.

- Health: Focus on physical and mental health through exercise, nutrition, and stress management.

- Joyful Living: Make time for activities that bring joy and fulfillment.

6.4. Skills for Coping with Collapse

Acquire skills that will be valuable in a resource-constrained future:

- Permaculture: Learn sustainable agriculture techniques.

- Facilitation: Develop skills in group dynamics and conflict resolution.

- Basic Repair: Master basic repair skills for household items and tools.

6.5. Voluntary Simplicity

Simplify your life by reducing consumption and focusing on experiences:

- Minimalism: Embrace a minimalist lifestyle.

- Reduce Waste: Reduce waste and recycle.

- Experiences over Possessions: Prioritize experiences over material possessions.

7. How Can SaveWhere.net Help You Save Money Effectively?

SaveWhere.net offers a variety of resources to help you save money effectively and achieve financial stability.

7.1. Budgeting Tools and Resources

SaveWhere.net provides:

- Budgeting Templates: Easy-to-use templates for tracking income and expenses.

- Budgeting Apps: Reviews and comparisons of top budgeting apps.

- Budgeting Guides: Step-by-step guides to creating and maintaining a budget.

7.2. Smart Spending Strategies

Discover strategies for smart spending:

- Discount Programs: Information on discount programs and loyalty rewards.

- Couponing Tips: Tips and tricks for effective couponing.

- Price Comparison: Tools for comparing prices and finding the best deals.

7.3. Long-Term Savings Advice

Access expert advice on long-term savings:

- Retirement Planning: Guides to retirement planning and investment strategies.

- Emergency Funds: Advice on building and maintaining an emergency fund.

- Investment Options: Information on various investment options.

7.4. Community Support

Join a community of like-minded individuals:

- Forums: Discuss financial challenges and share tips.

- Success Stories: Read inspiring stories of financial success.

- Expert Q&A: Get answers to your financial questions from experts.

7.5. Stay Updated with the Latest Trends

Stay informed with up-to-date information:

- Newsletter: Subscribe to receive the latest tips and advice.

- Blog: Read articles on current financial trends and opportunities.

- Social Media: Follow SaveWhere.net on social media for daily updates.

7.6. Contact Information

For more information, contact:

- Address: 100 Peachtree St NW, Atlanta, GA 30303, United States

- Phone: +1 (404) 656-2000

- Website: SaveWhere.net

SaveWhere.net

SaveWhere.net

8. What Financial Actions Align with the Urgency/Ease Matrix for Quick Wins?

Quick wins in personal finance can be achieved by focusing on actions that are both urgent and easy to implement.

8.1. High Urgency, High Ease Actions

| Action | Description | Benefits |

|---|---|---|

| Paying Bills on Time | Ensure all bills are paid by their due dates. | Avoid late fees, maintain good credit score. |

| Automating Savings | Set up automatic transfers to savings accounts. | Consistent savings without active effort. |

| Tracking Daily Spending | Use a budgeting app or notebook to monitor expenses. | Increased awareness of spending habits, identify areas to cut back. |

| Canceling Unused Subscriptions | Identify and cancel subscriptions that are no longer needed or used. | Immediate savings on recurring expenses. |

| Meal Planning | Plan meals for the week to avoid impulsive eating out. | Reduced food costs, healthier eating habits. |

8.2. Benefits of Focusing on Quick Wins

- Motivation: Seeing immediate results boosts motivation.

- Momentum: Quick wins create momentum for tackling larger financial goals.

- Reduced Stress: Managing urgent tasks reduces financial stress.

8.3. Combining Quick Wins with Long-Term Strategies

Incorporate quick wins into a broader financial plan to achieve both immediate relief and long-term stability.

9. How Can You Apply Voluntary Simplicity to Your Financial Life?

Voluntary simplicity involves intentionally reducing consumption and focusing on values that promote well-being and sustainability.

9.1. Defining Voluntary Simplicity

Voluntary simplicity is a conscious choice to reduce material possessions and simplify one’s lifestyle, focusing instead on non-material values.

9.2. Steps to Implement Voluntary Simplicity

- Declutter: Remove unnecessary items from your home and life.

- Reduce Consumption: Buy less and choose quality over quantity.

- Focus on Experiences: Prioritize experiences over material possessions.

- Sustainable Choices: Make environmentally friendly choices in consumption.

- Mindful Spending: Be conscious of your spending habits and motivations.

9.3. Benefits of Voluntary Simplicity

- Financial Freedom: Reduced expenses lead to greater financial freedom.

- Reduced Stress: Less focus on material possessions reduces stress.

- Environmental Impact: Lower consumption reduces environmental impact.

- Increased Well-being: More time and resources for meaningful activities.

9.4. Examples of Voluntary Simplicity in Action

- Downsizing: Moving to a smaller home or apartment.

- Transportation: Using public transport, biking, or walking instead of driving.

- Entertainment: Choosing free or low-cost entertainment options.

- Clothing: Buying fewer clothes and choosing durable, timeless pieces.

- Gifts: Giving experiences or handmade gifts instead of material items.

9.5. Balancing Simplicity with Practicality

Voluntary simplicity should enhance, not hinder, quality of life. It’s about making conscious choices that align with your values.

10. What Are Some Common Financial Myths That Hinder Saving Efforts?

Financial myths can lead to poor decisions and hinder saving efforts. Identifying and debunking these myths is crucial for effective financial planning.

10.1. Common Financial Myths

| Myth | Reality |

|---|---|

| You Need a High Income to Save | Anyone can save money, regardless of income, by budgeting and reducing expenses. |

| Debt Is Always Bad | Some debt, like mortgages or investments in education, can be beneficial. |

| You Should Wait to Save for Retirement | The earlier you start, the more time your investments have to grow. |

| Credit Cards Are Dangerous | Credit cards can be useful if used responsibly for rewards and credit building. |

| Investing Is Only for the Rich | Anyone can start investing with small amounts through ETFs, mutual funds, and robo-advisors. |

| You Should Always Buy New | Buying used items can save significant money, especially for cars, furniture, and electronics. |

| Renting Is Throwing Money Away | Renting provides flexibility and avoids costs associated with homeownership like maintenance and property taxes. |

| You Should Always Follow the Crowd | Investing decisions should be based on personal goals and risk tolerance, not on popular trends. |

| More Money Solves All Problems | Financial well-being depends on managing money wisely, not just having a high income. |

| Financial Planning Is Too Complicated | Basic financial planning is simple and accessible through budgeting apps, online resources, and consultations with professionals. |

10.2. Overcoming Financial Myths

- Educate Yourself: Learn about personal finance through books, websites, and courses.

- Seek Professional Advice: Consult with a financial advisor.

- Question Assumptions: Challenge common financial beliefs.

- Create a Plan: Develop a financial plan based on your goals and values.

- Track Your Progress: Monitor your financial progress and adjust your plan as needed.

Saving money and the planet requires understanding both the big picture and the small details. By embracing practical strategies, debunking myths, and focusing on what you can control, you can achieve financial well-being while contributing to a more sustainable future. Explore savewhere.net for more tips and resources to help you on your journey to financial freedom. Start making smart money moves today and transform your life for the better.