Can you switch play Save the World? Unfortunately, the answer is no, Fortnite Save the World is not available on the Nintendo Switch. While the Battle Royale version thrives on the Switch, the cooperative PvE campaign hasn’t made its way to Nintendo’s popular console, but don’t worry, savewhere.net is here to provide you with the best tips and tricks for money-saving alternatives. Discovering effective financial strategies and seeking ways to optimize your spending can transform your monetary habits and ultimately help you reach your financial aspirations by taking your fiscal success to the next level.

1. Understanding the Absence of “Save the World” on Nintendo Switch

Why isn’t Fortnite Save the World available on the Nintendo Switch? The primary reasons involve technical limitations and strategic priorities.

1.1. Technical Constraints of the Nintendo Switch

The Nintendo Switch, while innovative, faces hardware constraints compared to other platforms.

1.1.1. Processing Power and Memory Demands

Fortnite Save the World requires substantial processing power and memory due to its complex gameplay mechanics, detailed environments, and real-time calculations. The Switch’s hardware, optimized for portability and battery life, may struggle to deliver a smooth and consistent experience without significant compromises.

1.1.2. Storage Limitations

Save the World’s expansive content, including maps, characters, and missions, demands considerable storage space. The Switch’s internal storage is limited, and while expandable via microSD cards, this adds an extra cost and potential inconvenience for users.

1.2. Strategic Priorities of Epic Games

Epic Games, the developer of Fortnite, has focused on the Battle Royale mode due to its immense popularity and revenue generation.

1.2.1. Global Popularity of Battle Royale

The Battle Royale mode has attracted a massive global audience, making it the primary focus for updates, optimizations, and platform support. Epic Games likely prioritizes resources towards this mode to maximize its reach and profitability.

1.2.2. Resource Allocation

Porting and maintaining Save the World on the Switch would require significant resources, including development, testing, and ongoing support. Epic Games may have determined that these resources are better allocated to enhancing the Battle Royale experience or developing new content for existing platforms.

1.3. Potential Future Developments

While Save the World is currently unavailable on the Switch, future developments could change this.

1.3.1. Hardware Upgrades

If Nintendo releases a more powerful version of the Switch, it could potentially handle the demands of Save the World. A hardware upgrade could address the processing power and memory limitations that currently prevent the game from running smoothly.

1.3.2. Optimization Efforts

Epic Games could invest in optimizing Save the World to reduce its resource requirements. This could involve streamlining the game’s code, optimizing assets, and implementing performance enhancements specifically for the Switch.

1.3.3. Shift in Strategic Focus

If the popularity of Battle Royale wanes or if there is a significant demand for Save the World on the Switch, Epic Games might reconsider its priorities. A shift in strategic focus could lead to a renewed interest in porting the game to Nintendo’s console.

2. Exploring Alternatives and Similar Games on Nintendo Switch

Although Save the World isn’t available, there are numerous alternatives on the Nintendo Switch that offer similar cooperative and survival gameplay experiences.

2.1. Fortnite Battle Royale

The free-to-play Battle Royale mode offers intense PvP action and strategic building elements.

2.1.1. Core Gameplay Mechanics

Players are dropped onto an island and must scavenge for weapons, build structures, and eliminate opponents to be the last one standing. The game combines shooting, building, and strategic decision-making.

2.1.2. Accessibility and Free-to-Play Model

Fortnite Battle Royale is free to download and play, making it accessible to a wide audience. The game offers cosmetic items for purchase, but these do not affect gameplay balance.

2.2. Minecraft

Minecraft’s creative and survival modes provide endless possibilities for cooperative gameplay.

2.2.1. Sandbox Environment

Minecraft features a vast sandbox environment where players can build, explore, and craft. The game offers both creative and survival modes, allowing players to tailor their experience.

2.2.2. Cooperative Gameplay

Players can team up to build elaborate structures, explore dangerous caves, and fight off hordes of monsters. The game promotes collaboration and creativity.

2.3. Terraria

Terraria’s 2D sandbox adventure offers exploration, crafting, and combat.

2.3.1. Exploration and Discovery

Terraria features a vast world to explore, filled with unique biomes, hidden treasures, and challenging enemies. Players can dig deep underground, explore floating islands, and battle formidable bosses.

2.3.2. Crafting and Building

The game offers a deep crafting system, allowing players to create weapons, armor, and tools. Players can also build houses, fortresses, and entire cities.

2.4. Other Notable Alternatives

Several other games on the Nintendo Switch offer similar experiences.

2.4.1. Dragon Quest Builders 2

Combines RPG elements with sandbox building, tasking players with rebuilding a destroyed world.

2.4.2. Stardew Valley

A farming simulator with social elements, allowing players to build and manage their own farm while interacting with a charming cast of characters.

2.4.3. Don’t Starve: Nintendo Switch Edition

A survival game with a dark and quirky atmosphere, challenging players to survive in a harsh and unforgiving wilderness.

3. How to Save Money on Nintendo Switch Games

Maximize your gaming budget by using these smart strategies to save money on Nintendo Switch games.

3.1. Digital vs. Physical Copies

Decide whether to buy digital or physical games based on your preferences and budget.

3.1.1. Advantages of Digital Copies

Digital copies offer convenience and portability, as games are stored on your Switch’s internal memory or microSD card. You can easily switch between games without swapping cartridges.

3.1.2. Advantages of Physical Copies

Physical copies can be resold or traded, allowing you to recoup some of your investment. They also provide a tangible collectible for fans.

3.2. Nintendo eShop Sales and Promotions

Take advantage of regular sales and promotions on the Nintendo eShop.

3.2.1. Seasonal Sales

Nintendo frequently offers seasonal sales, such as summer, holiday, and anniversary sales. These sales often feature deep discounts on a wide range of games.

3.2.2. Indie Game Sales

Indie games are often heavily discounted on the eShop. These sales provide an opportunity to discover hidden gems and support independent developers.

3.3. Nintendo Switch Online

Subscribe to Nintendo Switch Online for access to classic games and exclusive deals.

3.3.1. Classic Game Library

Nintendo Switch Online subscribers gain access to a library of classic NES and SNES games. This provides a nostalgic gaming experience and a cost-effective way to enjoy retro titles.

3.3.2. Exclusive Deals and Discounts

Subscribers also receive exclusive deals and discounts on select games and DLC. These discounts can help you save money on new releases and popular titles.

3.4. Used Games and Trade-Ins

Consider buying used games or trading in your old games to save money.

3.4.1. Local Game Stores

Local game stores often offer a selection of used games at discounted prices. Check your local stores for deals and promotions.

3.4.2. Online Marketplaces

Online marketplaces like eBay and Facebook Marketplace can be a great source for used games. Be sure to check the seller’s reputation and read reviews before making a purchase.

3.5. Game Bundles and Special Editions

Look for game bundles and special editions that offer multiple games or bonus content at a discounted price.

3.5.1. Console Bundles

Nintendo often releases console bundles that include a Switch console and a popular game. These bundles can be a cost-effective way to get a new console and a game at the same time.

3.5.2. Game Packs

Some games are released in packs that include multiple titles or DLC. These packs offer a great value for fans of the series.

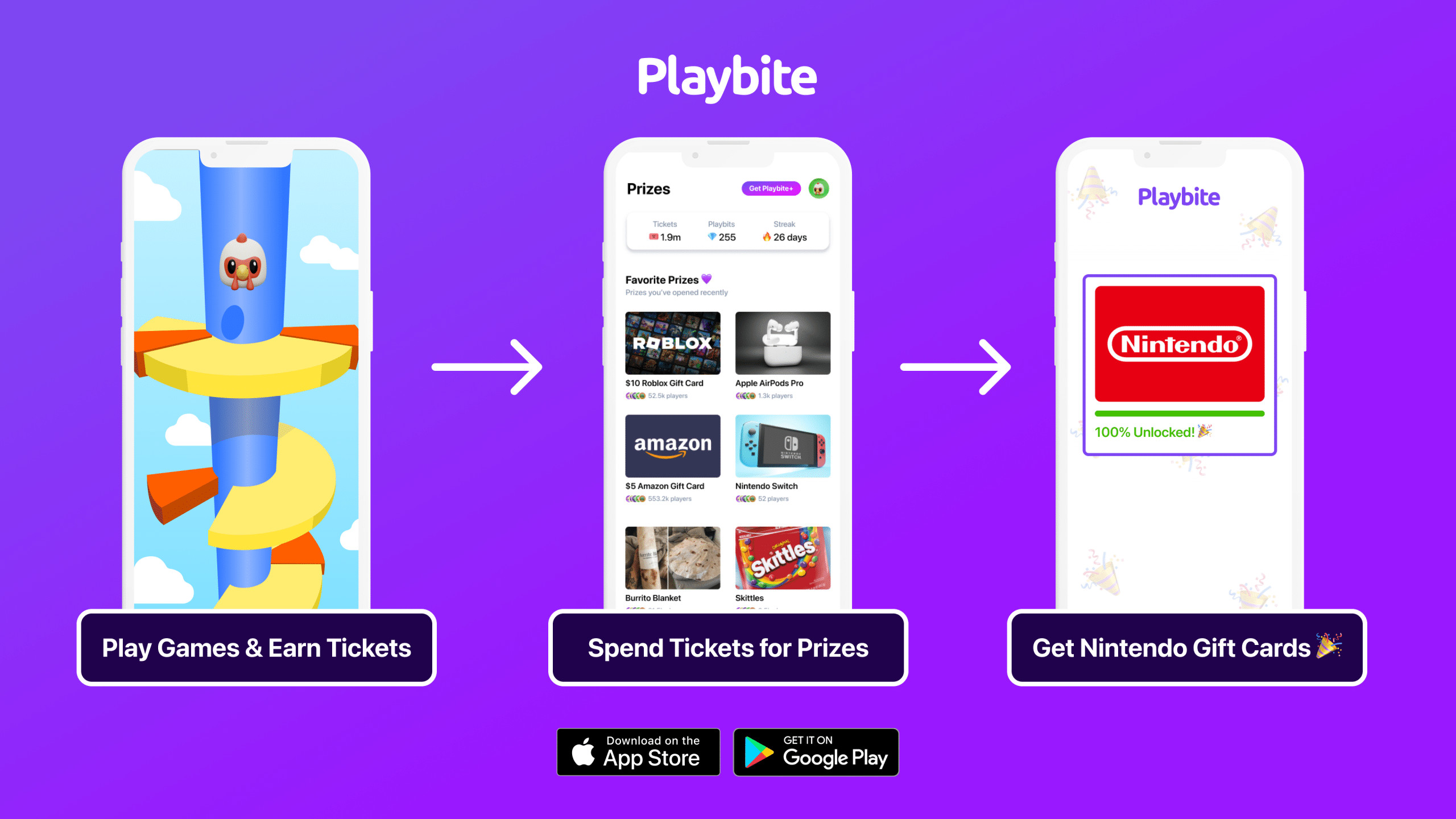

Win official Nintendo gift cards by playing games on Playbite!

Win official Nintendo gift cards by playing games on Playbite!

3.6. Utilizing Rewards Programs

Leverage rewards programs to earn points or discounts on game purchases.

3.6.1. Credit Card Rewards

Use a credit card that offers rewards points or cashback on purchases. These rewards can be redeemed for gift cards or statement credits, effectively reducing the cost of your games.

3.6.2. Retailer Loyalty Programs

Sign up for retailer loyalty programs to earn points or discounts on game purchases. These programs often offer exclusive deals and promotions for members.

4. Optimizing Your Budget for Gaming and Beyond

Gaming is a great hobby, but balancing it with other financial goals is essential. Here’s how to optimize your budget effectively.

4.1. Creating a Budget

Start by creating a detailed budget to track your income and expenses.

4.1.1. Listing Income and Expenses

List all sources of income and categorize your expenses. This will give you a clear picture of your financial situation.

4.1.2. Using Budgeting Tools and Apps

Use budgeting tools and apps like Mint, YNAB (You Need a Budget), or Personal Capital to automate the budgeting process. These tools can help you track your spending, set goals, and identify areas where you can save money.

4.2. Setting Financial Goals

Define your financial goals to stay motivated and focused.

4.2.1. Short-Term Goals

Set short-term goals, such as saving for a new game, paying off a small debt, or building an emergency fund.

4.2.2. Long-Term Goals

Establish long-term goals, such as buying a house, saving for retirement, or funding your children’s education.

4.3. Cutting Unnecessary Expenses

Identify and cut unnecessary expenses to free up more money for gaming and other financial goals.

4.3.1. Subscriptions and Memberships

Review your subscriptions and memberships and cancel any that you don’t use regularly. This could include streaming services, gym memberships, or magazine subscriptions.

4.3.2. Dining Out and Entertainment

Reduce your spending on dining out and entertainment. Cook meals at home and find free or low-cost activities to enjoy.

4.4. Saving on Everyday Expenses

Implement strategies to save money on everyday expenses.

4.4.1. Grocery Shopping

Plan your meals, make a shopping list, and stick to it. Buy generic brands and take advantage of sales and coupons.

4.4.2. Transportation

Use public transportation, bike, or walk whenever possible. Consider carpooling or sharing rides to save on gas and parking.

4.5. Investing for the Future

Invest a portion of your income to grow your wealth over time.

4.5.1. Retirement Accounts

Contribute to retirement accounts like 401(k)s or IRAs to take advantage of tax benefits and build a nest egg for the future.

4.5.2. Diversified Investments

Invest in a diversified portfolio of stocks, bonds, and other assets to reduce risk and maximize returns.

5. Understanding Consumer Financial Health in the U.S.

Financial health is crucial for overall well-being. Understanding the state of consumer finances in the U.S. can provide valuable insights.

5.1. Key Statistics and Trends

Examine key statistics and trends related to consumer debt, savings, and financial literacy.

5.1.1. Debt Levels

According to the U.S. Bureau of Economic Analysis (BEA), consumer debt levels have been rising in recent years, with significant increases in credit card debt, student loans, and auto loans. High debt levels can strain household budgets and limit financial flexibility.

5.1.2. Savings Rates

The personal savings rate in the U.S. fluctuates but generally remains low compared to historical levels. Insufficient savings can leave individuals vulnerable to financial emergencies and hinder long-term financial goals.

5.2. Impact of Economic Factors

Explore how economic factors like inflation, interest rates, and unemployment affect consumer financial health.

5.2.1. Inflation

Inflation erodes purchasing power, making it more expensive to buy goods and services. This can strain household budgets and make it harder to save money.

5.2.2. Interest Rates

Interest rates affect the cost of borrowing money. Higher interest rates can increase the cost of debt payments, while lower rates can make borrowing more affordable.

5.3. Resources for Improving Financial Literacy

Take advantage of resources that promote financial literacy and provide guidance on managing money.

5.3.1. Consumer Financial Protection Bureau (CFPB)

The CFPB offers a wealth of educational resources on topics like budgeting, saving, debt management, and investing. Their website provides articles, guides, and tools to help consumers make informed financial decisions.

5.3.2. Non-Profit Organizations

Non-profit organizations like the National Foundation for Credit Counseling (NFCC) and the Association for Financial Counseling & Planning Education (AFCPE) offer financial counseling and education services. These organizations can provide personalized guidance and support to help you achieve your financial goals.

6. Innovative Ways to Save Money in Atlanta, GA

For those living in Atlanta, GA, here are some innovative ways to save money tailored to the local context.

6.1. Transportation Savings

Reduce transportation costs by using public transit, biking, or walking.

6.1.1. MARTA (Metropolitan Atlanta Rapid Transit Authority)

MARTA offers affordable public transit options, including trains and buses. Consider purchasing a monthly pass to save money on commuting costs.

6.1.2. Biking and Walking

Atlanta has been investing in bike lanes and pedestrian infrastructure. Take advantage of these resources to bike or walk to work, school, or errands.

6.2. Entertainment and Leisure

Find affordable entertainment and leisure activities in Atlanta.

6.2.1. Free Events and Festivals

Atlanta hosts numerous free events and festivals throughout the year, including music festivals, art shows, and cultural celebrations. Check local event listings for free activities.

6.2.2. Parks and Recreation

Explore Atlanta’s parks and recreation areas. Many parks offer free activities like hiking, biking, and picnicking.

6.3. Dining and Food

Save money on dining and food by cooking at home and taking advantage of local deals.

6.3.1. Farmers Markets

Shop at local farmers markets for fresh, affordable produce. Farmers markets often offer lower prices than grocery stores.

6.3.2. Restaurant Deals and Discounts

Look for restaurant deals and discounts on websites like Groupon and LivingSocial. Many restaurants offer specials and promotions during off-peak hours.

6.4. Housing and Utilities

Reduce housing and utility costs by implementing energy-efficient practices and exploring affordable housing options.

6.4.1. Energy-Efficient Appliances

Use energy-efficient appliances to reduce your electricity consumption. Look for appliances with the Energy Star label.

6.4.2. Affordable Housing Programs

Explore affordable housing programs offered by the city of Atlanta and non-profit organizations. These programs can help you find safe and affordable housing.

6.5. Community Resources

Utilize community resources to access free or low-cost services.

6.5.1. Libraries

Visit your local library for free access to books, movies, and internet. Libraries also offer free classes and workshops.

6.5.2. Community Centers

Participate in programs and activities offered by community centers. These centers often offer free or low-cost services like childcare, job training, and recreational activities.

7. Utilizing Savewhere.net for Financial Empowerment

Savewhere.net is your go-to resource for financial empowerment, offering a wealth of tips, tricks, and resources to help you save money and achieve your financial goals.

7.1. Comprehensive Savings Tips

Access a wide range of savings tips covering various aspects of your life.

7.1.1. Shopping Strategies

Learn effective shopping strategies to save money on groceries, clothing, and other essentials. This could include comparison shopping, using coupons, and buying in bulk.

7.1.2. Travel Deals

Discover travel deals and discounts to save money on flights, hotels, and vacation packages. This might involve traveling during off-peak seasons, using travel rewards programs, and booking accommodations through discount websites.

7.2. Financial Tools and Calculators

Use financial tools and calculators to make informed decisions.

7.2.1. Budgeting Templates

Download budgeting templates to track your income and expenses. These templates can help you create a budget that works for you.

7.2.2. Investment Calculators

Use investment calculators to estimate your potential returns. These calculators can help you plan for retirement, college, or other long-term goals.

7.3. Success Stories and Inspiration

Get inspired by success stories from people who have achieved their financial goals.

7.3.1. Interviews with Financial Experts

Read interviews with financial experts who share their insights and advice. These experts can provide valuable guidance on topics like saving, investing, and debt management.

7.3.2. Case Studies

Explore case studies of individuals who have successfully saved money, paid off debt, and achieved financial freedom. These stories can provide inspiration and practical tips for your own financial journey.

7.4. Community Engagement

Connect with a community of like-minded individuals who are passionate about saving money and achieving financial success.

7.4.1. Forums and Discussion Boards

Participate in forums and discussion boards to share your tips and ask questions. These platforms can provide a supportive and collaborative environment.

7.4.2. Social Media Groups

Join social media groups dedicated to saving money and personal finance. These groups can provide a constant stream of tips, advice, and inspiration.

7.5. Regularly Updated Content

Benefit from regularly updated content that keeps you informed about the latest savings opportunities.

7.5.1. Blog Posts

Read blog posts covering a wide range of financial topics. These posts can provide in-depth information and actionable advice.

7.5.2. Newsletters

Subscribe to newsletters to receive regular updates on sales, promotions, and other savings opportunities. Newsletters can help you stay informed and take advantage of timely deals.

By leveraging the resources available on savewhere.net, you can take control of your finances and achieve your financial goals.

8. Integrating Financial Literacy into Daily Life

Making financial literacy a part of your daily routine can lead to better financial habits and outcomes.

8.1. Educating Yourself Daily

Dedicate time each day to learn about personal finance.

8.1.1. Reading Financial News

Stay informed about financial news and trends by reading reputable sources like The Wall Street Journal, Bloomberg, and Forbes.

8.1.2. Taking Online Courses

Enroll in online courses on platforms like Coursera, Udemy, and edX to deepen your knowledge of personal finance.

8.2. Tracking Your Spending

Monitor your spending habits to identify areas where you can save money.

8.2.1. Using a Spending Journal

Keep a spending journal to record every purchase you make. This will help you identify patterns and track your spending habits.

8.2.2. Reviewing Bank Statements

Regularly review your bank and credit card statements to identify unauthorized transactions and track your spending.

8.3. Making Informed Purchasing Decisions

Research before making purchases to ensure you’re getting the best value.

8.3.1. Comparison Shopping

Compare prices from different retailers before making a purchase. Use websites like Google Shopping and PriceGrabber to find the best deals.

8.3.2. Reading Reviews

Read reviews from other customers before making a purchase. This will help you avoid buying products that are low quality or don’t meet your needs.

8.4. Setting Financial Goals Regularly

Revisit and adjust your financial goals regularly to stay on track.

8.4.1. Monthly Reviews

Review your budget and financial goals each month to ensure you’re making progress.

8.4.2. Annual Assessments

Conduct an annual assessment of your financial situation to evaluate your progress and make adjustments as needed.

8.5. Seeking Professional Advice

Consult with a financial advisor to get personalized guidance.

8.5.1. Certified Financial Planners (CFPs)

Work with a Certified Financial Planner (CFP) to develop a comprehensive financial plan.

8.5.2. Fee-Only Advisors

Choose a fee-only advisor to ensure they’re acting in your best interest.

9. Addressing Common Financial Challenges

Understanding and addressing common financial challenges can help you navigate potential pitfalls.

9.1. Managing Debt

Develop strategies for managing and paying off debt.

9.1.1. Debt Consolidation

Consider consolidating your debt to simplify your payments and potentially lower your interest rate.

9.1.2. Debt Snowball Method

Use the debt snowball method to pay off your smallest debts first, creating momentum and motivation.

9.2. Building an Emergency Fund

Create an emergency fund to cover unexpected expenses.

9.2.1. Setting a Savings Goal

Aim to save at least three to six months’ worth of living expenses in your emergency fund.

9.2.2. Automating Savings

Automate your savings by setting up regular transfers from your checking account to your savings account.

9.3. Saving for Retirement

Plan for retirement early to ensure you have enough money to live comfortably.

9.3.1. Contributing to Retirement Accounts

Contribute to retirement accounts like 401(k)s or IRAs to take advantage of tax benefits.

9.3.2. Diversifying Investments

Diversify your investments to reduce risk and maximize returns.

9.4. Dealing with Unexpected Expenses

Prepare for unexpected expenses by having a plan in place.

9.4.1. Emergency Fund

Use your emergency fund to cover unexpected expenses like medical bills or car repairs.

9.4.2. Insurance Coverage

Maintain adequate insurance coverage to protect yourself from financial losses due to accidents, illness, or property damage.

9.5. Avoiding Scams and Fraud

Protect yourself from financial scams and fraud.

9.5.1. Recognizing Scams

Learn to recognize common scams like phishing emails, lottery scams, and investment scams.

9.5.2. Protecting Personal Information

Protect your personal information by using strong passwords, avoiding suspicious links, and monitoring your credit report.

10. Maximizing Savings with Technology and Apps

Leverage technology and apps to automate your savings and track your progress.

10.1. Budgeting Apps

Use budgeting apps to track your spending, set goals, and manage your budget.

10.1.1. Mint

Mint is a free budgeting app that helps you track your spending, create a budget, and set financial goals.

10.1.2. YNAB (You Need a Budget)

YNAB is a budgeting app that helps you allocate every dollar to a specific purpose.

10.2. Savings Apps

Use savings apps to automate your savings and earn rewards.

10.2.1. Acorns

Acorns is a savings app that rounds up your purchases and invests the spare change.

10.2.2. Digit

Digit is a savings app that analyzes your spending and automatically saves small amounts of money for you.

10.3. Investing Apps

Use investing apps to start investing with small amounts of money.

10.3.1. Robinhood

Robinhood is an investing app that allows you to buy and sell stocks, ETFs, and cryptocurrencies without commission fees.

10.3.2. Betterment

Betterment is an investing app that provides automated investment management services.

10.4. Coupon and Cashback Apps

Use coupon and cashback apps to save money on purchases.

10.4.1. Honey

Honey is a browser extension that automatically finds and applies coupons when you shop online.

10.4.2. Rakuten

Rakuten is a cashback app that gives you a percentage of your purchase back when you shop at participating retailers.

10.5. Financial Management Tools

Utilize online financial management tools to track your net worth and plan for the future.

10.5.1. Personal Capital

Personal Capital is a financial management tool that helps you track your net worth, manage your investments, and plan for retirement.

10.5.2. Credit Karma

Credit Karma is a financial management tool that provides free credit scores and credit reports.

By implementing these strategies and utilizing the resources available on savewhere.net, you can take control of your finances, save money, and achieve your financial goals. Although you can’t “Switch Play Save The World” on Nintendo Switch, you can certainly switch up your financial habits to save money and create a brighter financial future. Start exploring savewhere.net today and unlock the power of smart saving, plus consider visiting us at 100 Peachtree St NW, Atlanta, GA 30303, United States, or call +1 (404) 656-2000!

Playbite

Playbite

FAQ: Can You Switch Play Save The World?

-

Why can’t I play Fortnite Save the World on my Nintendo Switch?

- Unfortunately, Fortnite Save the World is not available on the Nintendo Switch due to technical limitations and strategic priorities of Epic Games. The Switch’s hardware may not fully support the game’s demands without compromising performance.

-

What are some alternatives to Fortnite Save the World on the Nintendo Switch?

- Great alternatives include Fortnite Battle Royale, Minecraft, Terraria, Dragon Quest Builders 2, and Stardew Valley, all offering similar cooperative and survival gameplay experiences.

-

How can I save money on Nintendo Switch games?

- Consider buying digital vs physical copies, take advantage of Nintendo eShop sales and promotions, subscribe to Nintendo Switch Online for exclusive deals, and look for used games and trade-ins.

-

What are some budgeting tools and apps I can use to manage my finances?

- Popular choices include Mint, YNAB (You Need a Budget), and Personal Capital, which help you track your spending, set goals, and identify areas where you can save money.

-

How can I utilize Savewhere.net for financial empowerment?

- savewhere.net offers comprehensive savings tips, financial tools and calculators, success stories and inspiration, community engagement, and regularly updated content to help you save money and achieve your financial goals.

-

What are some innovative ways to save money in Atlanta, GA?

- Utilize MARTA for public transit, attend free events and festivals, shop at local farmers markets, use energy-efficient appliances, and take advantage of community resources like libraries and community centers.

-

How can I integrate financial literacy into my daily life?

- Educate yourself daily by reading financial news and taking online courses, track your spending using a spending journal, make informed purchasing decisions by comparison shopping, and set financial goals regularly.

-

What should I do if I have a lot of debt?

- Consider debt consolidation to simplify payments and lower interest rates, and use the debt snowball method to pay off your smallest debts first for motivation.

-

Why is building an emergency fund important?

- An emergency fund helps cover unexpected expenses like medical bills or car repairs, providing financial security and preventing you from going into debt.

-

How can technology and apps help me save money?

- Budgeting apps like Mint and YNAB, savings apps like Acorns and Digit, investing apps like Robinhood and Betterment, and coupon apps like Honey and Rakuten can automate your savings and help you track your progress.