Saving money can feel like restoring a whole island, but with the right strategies, it’s achievable. This article from savewhere.net will explore the most effective methods for managing your personal finances and accumulating wealth. Let’s explore practical tips and valuable resources, including insights into financial planning, budgeting techniques, and investment opportunities.

1. Understanding Your Financial Landscape

Before embarking on any savings journey, it’s crucial to understand your current financial situation. What are your income sources, expenses, debts, and assets? This initial assessment forms the bedrock of any successful savings plan.

1.1. Tracking Your Income and Expenses

Why is tracking income and expenses the first step to financial freedom? Because you cannot improve what you do not measure.

Tracking your income and expenses is the foundational step toward achieving financial freedom, as it provides a clear picture of where your money is going. Utilize budgeting apps, spreadsheets, or even a simple notebook to monitor every dollar that comes in and out. According to the Consumer Financial Protection Bureau (CFPB), understanding your spending habits is critical to identifying areas where you can cut back and save more effectively. This awareness enables you to make informed decisions about your spending and prioritize your financial goals.

- Budgeting Apps: Mint, YNAB (You Need a Budget), and Personal Capital.

- Spreadsheets: Google Sheets or Microsoft Excel.

- Traditional Method: Notebook and pen.

1.2. Creating a Realistic Budget

How do you create a budget that aligns with your financial goals? By creating a budget that’s both realistic and tailored to your individual financial goals.

Creating a budget involves categorizing your expenses into needs and wants, and then allocating funds accordingly. Start by listing all essential expenses such as rent, utilities, groceries, and transportation. Then, identify discretionary spending like dining out, entertainment, and subscriptions. Aim to reduce unnecessary spending and allocate those savings towards your financial goals. A well-structured budget helps you stay on track, avoid overspending, and ensure you’re consistently saving money.

- 50/30/20 Rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Zero-Based Budget: Allocate every dollar to a specific category.

- Envelope System: Use cash for variable expenses to control spending.

1.3. Assessing Your Debts

What’s the best strategy for managing and reducing debt? Prioritize high-interest debts and explore debt consolidation options.

Assessing your debts involves listing all outstanding loans, credit card balances, and other liabilities, along with their interest rates and minimum payments. Prioritize paying off high-interest debts first to minimize the total interest paid over time. Consider options like balance transfers, debt consolidation loans, or debt management plans to simplify repayment and potentially lower interest rates. Managing your debt effectively frees up more money for savings and investments.

- Debt Snowball Method: Pay off the smallest debt first for quick wins.

- Debt Avalanche Method: Pay off the highest interest debt first to save money on interest.

2. Smart Spending Strategies

Now that you have a clear understanding of your financial landscape, let’s dive into smart spending strategies that will help you save money without sacrificing your quality of life.

2.1. Mindful Shopping

How can you practice mindful shopping to save money? Plan purchases in advance, compare prices, and avoid impulse buys.

Mindful shopping involves being aware of your spending habits and making conscious decisions about your purchases. Before heading to the store or browsing online, create a shopping list and stick to it. Compare prices across different retailers to ensure you’re getting the best deal. Avoid impulse buys by waiting at least 24 hours before making a non-essential purchase. This practice helps you differentiate between needs and wants, leading to significant savings over time.

- Wait 24 Hours Rule: Delay non-essential purchases to avoid impulse buys.

- Price Comparison Tools: Use apps like ShopSavvy or PriceGrabber.

- Avoid Emotional Shopping: Recognize and avoid shopping when feeling stressed or bored.

2.2. Cutting Down on Dining and Entertainment Costs

What are some practical ways to reduce dining and entertainment expenses? Cook at home more often, take advantage of free activities, and seek out discounts.

Dining out and entertainment can quickly eat into your budget. Reduce these expenses by cooking at home more often and packing your own lunch. Explore free or low-cost activities like hiking, visiting local parks, or attending community events. Look for discounts and deals on entertainment options, such as matinee movie tickets or restaurant coupons. Small changes in your dining and entertainment habits can lead to substantial savings.

- Meal Planning: Plan your meals for the week to reduce food waste and dining out.

- Happy Hour Deals: Take advantage of discounts on drinks and appetizers.

- Free Activities: Explore free events in your community.

2.3. Negotiating Bills and Subscriptions

Why should you negotiate your bills and subscriptions regularly? It can lead to significant savings on recurring expenses.

Negotiating your bills and subscriptions can result in considerable savings on recurring expenses. Contact your service providers, such as internet, cable, and phone companies, and inquire about potential discounts or lower rates. Review your subscriptions and cancel any that you no longer use or need. Many companies are willing to negotiate to retain your business, so don’t hesitate to ask for a better deal.

- Call and Negotiate: Contact service providers to negotiate lower rates.

- Subscription Audit: Review and cancel unused subscriptions.

- Bundle Services: Combine services for potential discounts.

2.4. Energy Efficiency at Home

How can you make your home more energy-efficient to save money? Use energy-efficient appliances, adjust your thermostat, and seal drafts.

Making your home more energy-efficient not only benefits the environment but also reduces your utility bills. Use energy-efficient appliances and light bulbs. Adjust your thermostat to save on heating and cooling costs. Seal drafts around windows and doors to prevent energy loss. These simple changes can lead to significant savings on your monthly utility bills.

- Energy-Efficient Appliances: Look for Energy Star certified appliances.

- Programmable Thermostat: Adjust temperature settings automatically.

- Seal Drafts: Use weather stripping and caulk to seal air leaks.

3. Maximizing Your Savings

Saving money is not just about cutting expenses; it’s also about making the most of your income. Let’s explore strategies to maximize your savings and build wealth.

3.1. Automating Your Savings

What’s the easiest way to ensure consistent savings? Set up automatic transfers to a savings account each month.

Automating your savings is one of the most effective ways to ensure consistent progress towards your financial goals. Set up automatic transfers from your checking account to a savings account each month. Treat savings like a non-negotiable bill and prioritize it in your budget. Automating the process eliminates the temptation to skip savings and helps you build a substantial nest egg over time.

- Set It and Forget It: Automate transfers to a savings account.

- Pay Yourself First: Prioritize savings in your budget.

- Increase Gradually: Increase the amount you save each month.

3.2. Utilizing High-Yield Savings Accounts

Why should you use a high-yield savings account? To earn more interest on your savings compared to traditional savings accounts.

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, allowing your money to grow faster. Shop around for the best rates and consider online banks, which often offer more competitive interest rates. Transfer your savings to a high-yield account to maximize your earnings and reach your financial goals sooner.

- Shop Around: Compare interest rates from different banks.

- Online Banks: Often offer higher interest rates.

- Compounding Interest: Take advantage of the power of compounding.

3.3. Taking Advantage of Employer-Sponsored Retirement Plans

What are the benefits of participating in employer-sponsored retirement plans like 401(k)s? Tax advantages and employer matching contributions.

Participating in employer-sponsored retirement plans, such as 401(k)s, is a smart way to save for retirement while taking advantage of tax benefits. Many employers offer matching contributions, which is essentially free money towards your retirement savings. Contribute enough to your 401(k) to maximize the employer match and take advantage of the tax-deferred growth.

- Employer Match: Take full advantage of employer matching contributions.

- Tax-Deferred Growth: Your investments grow tax-free until retirement.

- Contribution Limits: Be aware of annual contribution limits.

3.4. Exploring Investment Opportunities

How can you diversify your savings and potentially earn higher returns? Explore investment options such as stocks, bonds, and real estate.

While saving is crucial, investing is essential for long-term wealth building. Explore investment options such as stocks, bonds, mutual funds, and real estate. Diversify your portfolio to reduce risk and potentially earn higher returns. Consider consulting with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

- Diversify Your Portfolio: Spread your investments across different asset classes.

- Long-Term Investing: Focus on long-term growth rather than short-term gains.

- Financial Advisor: Seek professional advice to develop an investment strategy.

4. Saving on Everyday Expenses

Saving money doesn’t always require big changes; sometimes, it’s the small, everyday expenses that add up. Let’s explore strategies to save on everyday costs.

4.1. Grocery Shopping Strategies

What are some effective grocery shopping strategies to save money? Plan meals, use coupons, and buy in bulk when appropriate.

Grocery shopping can be a significant expense, but with the right strategies, you can save money without sacrificing quality. Plan your meals for the week to avoid impulse purchases and reduce food waste. Use coupons and look for sales and discounts. Buy in bulk when appropriate, especially for non-perishable items. These simple strategies can lead to substantial savings on your grocery bill.

- Meal Planning: Plan your meals to reduce food waste and impulse purchases.

- Coupons and Discounts: Use coupons and look for sales.

- Buy in Bulk: Purchase non-perishable items in bulk when it makes sense.

4.2. Transportation Savings

How can you save money on transportation costs? Consider public transportation, carpooling, or biking.

Transportation costs can be a major expense, especially if you commute daily. Consider using public transportation, carpooling with colleagues, or biking to work to save on gas and parking costs. If you need a car, research fuel-efficient models and maintain your vehicle to optimize fuel economy.

- Public Transportation: Use buses, trains, or subways.

- Carpooling: Share rides with colleagues or neighbors.

- Fuel-Efficient Vehicles: Choose cars with good gas mileage.

4.3. Affordable Healthcare Options

What are some ways to reduce healthcare costs without compromising on quality? Compare insurance plans, utilize preventative care, and ask about generic medications.

Healthcare expenses can be a significant burden, but there are ways to reduce costs without compromising on quality. Compare different health insurance plans to find the best coverage at an affordable price. Utilize preventative care services, such as annual check-ups and screenings, to catch potential health issues early. Ask your doctor about generic medications, which are often significantly cheaper than brand-name drugs.

- Compare Insurance Plans: Shop around for the best coverage.

- Preventative Care: Utilize annual check-ups and screenings.

- Generic Medications: Ask about generic alternatives.

4.4. Negotiating Insurance Premiums

Why should you negotiate your insurance premiums annually? To ensure you’re getting the best rate based on your current circumstances.

Negotiating your insurance premiums annually can result in significant savings. Contact your insurance providers and inquire about potential discounts or lower rates. Compare quotes from different companies to ensure you’re getting the best deal. Factors like your driving record, credit score, and home security systems can influence your insurance premiums, so make sure to highlight any positive changes.

- Shop Around: Compare quotes from different insurance companies.

- Bundle Policies: Combine policies for potential discounts.

- Review Coverage: Adjust coverage based on your current needs.

5. Setting and Achieving Financial Goals

Saving money is more meaningful when you have specific financial goals in mind. Let’s explore how to set and achieve those goals.

5.1. Defining Your Financial Goals

How do you define your financial goals effectively? Make them specific, measurable, achievable, relevant, and time-bound (SMART).

Defining your financial goals is crucial for staying motivated and focused on your savings journey. Make your goals specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to save money,” set a goal like “I want to save $10,000 for a down payment on a house within two years.” Having clear and well-defined goals makes it easier to create a plan and track your progress.

- SMART Goals: Specific, Measurable, Achievable, Relevant, Time-bound.

- Prioritize Goals: Rank your goals based on importance.

- Visualize Success: Imagine achieving your financial goals.

5.2. Creating a Savings Plan

What are the key components of a successful savings plan? A budget, savings goals, and a timeline.

Creating a savings plan involves outlining the steps you’ll take to achieve your financial goals. Start with a budget to track your income and expenses. Set specific savings goals and determine how much you need to save each month to reach those goals. Establish a timeline and monitor your progress regularly. Adjust your plan as needed to stay on track.

- Budgeting: Track your income and expenses.

- Savings Goals: Set specific savings targets.

- Timeline: Establish a timeline for achieving your goals.

5.3. Staying Motivated

How can you stay motivated on your savings journey? Celebrate milestones, track progress, and remind yourself of your goals.

Staying motivated on your savings journey can be challenging, but there are strategies to keep you inspired. Celebrate milestones, such as reaching a specific savings target or paying off a debt. Track your progress regularly to see how far you’ve come. Remind yourself of your financial goals and the benefits of achieving them. Consider finding a savings buddy or joining a financial community for support and encouragement.

- Celebrate Milestones: Acknowledge and reward your progress.

- Track Progress: Monitor your savings and investments.

- Savings Buddy: Find someone to share your journey with.

5.4. Adjusting Your Plan as Needed

Why is it important to adjust your savings plan periodically? To adapt to changing circumstances and ensure you stay on track.

Adjusting your savings plan periodically is essential to adapt to changing circumstances and ensure you stay on track towards your financial goals. Life events, such as job changes, unexpected expenses, or changes in interest rates, can impact your savings plan. Review your plan regularly and make adjustments as needed to stay aligned with your goals.

- Regular Review: Review your savings plan periodically.

- Adapt to Change: Adjust your plan based on life events.

- Stay Flexible: Be willing to modify your plan as needed.

6. Utilizing Technology and Resources

In today’s digital age, there are numerous tools and resources available to help you save money and manage your finances more effectively. Let’s explore some of them.

6.1. Budgeting Apps

What are the benefits of using budgeting apps? Automated tracking, expense categorization, and financial insights.

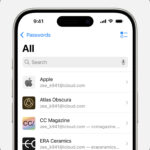

Budgeting apps can simplify the process of tracking your income and expenses, categorizing your spending, and providing valuable financial insights. Many apps offer features like automated transaction tracking, goal setting, and personalized recommendations. Popular budgeting apps include Mint, YNAB (You Need a Budget), and Personal Capital.

- Automated Tracking: Automatically track transactions.

- Expense Categorization: Categorize spending for analysis.

- Financial Insights: Provide insights into your spending habits.

6.2. Coupon Websites and Apps

How can you maximize savings using coupon websites and apps? Find discounts, promo codes, and cashback offers.

Coupon websites and apps can help you save money on a wide range of products and services. These platforms aggregate discounts, promo codes, and cashback offers from various retailers. Popular coupon websites and apps include RetailMeNot, Coupons.com, and Honey.

- Discounts and Promo Codes: Find discounts on various products.

- Cashback Offers: Earn cashback on purchases.

- Browser Extensions: Automatically find and apply coupons.

6.3. Financial Education Websites

What kind of information can you find on financial education websites? Articles, tutorials, and tools on personal finance topics.

Financial education websites offer a wealth of information on various personal finance topics, including budgeting, saving, investing, and debt management. These resources provide articles, tutorials, and tools to help you improve your financial literacy and make informed decisions. Reputable financial education websites include Investopedia, NerdWallet, and The Balance.

- Articles and Tutorials: Learn about personal finance topics.

- Financial Tools: Use calculators and budgeting templates.

- Expert Advice: Get insights from financial professionals.

6.4. Online Financial Communities

What are the benefits of joining online financial communities? Support, advice, and shared experiences from other savers.

Online financial communities provide a platform for individuals to connect, share experiences, and offer support and advice on various financial topics. These communities can be a valuable resource for staying motivated, learning new strategies, and getting feedback on your savings plan. Popular online financial communities include Reddit’s r/personalfinance and BiggerPockets.

- Support and Advice: Get advice from other savers.

- Shared Experiences: Learn from others’ successes and challenges.

- Motivation and Encouragement: Stay motivated on your savings journey.

7. Protecting Your Savings

While saving money is important, it’s equally important to protect your savings from potential risks. Let’s explore strategies to safeguard your financial assets.

7.1. Emergency Fund

Why is an emergency fund essential for financial security? To cover unexpected expenses without derailing your savings plan.

An emergency fund is a dedicated savings account used to cover unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund can prevent you from going into debt or derailing your savings plan when unforeseen events occur. Aim to save three to six months’ worth of living expenses in your emergency fund.

- Unexpected Expenses: Cover unforeseen costs.

- Avoid Debt: Prevent the need for credit cards or loans.

- Peace of Mind: Provide financial security and peace of mind.

7.2. Insurance Coverage

What types of insurance coverage are essential for protecting your financial assets? Health, auto, home, and life insurance.

Insurance coverage is essential for protecting your financial assets from potential risks. Health insurance covers medical expenses, auto insurance protects against car accidents, home insurance safeguards your property, and life insurance provides financial support to your loved ones in the event of your death. Review your insurance coverage regularly to ensure it meets your current needs.

- Health Insurance: Cover medical expenses.

- Auto Insurance: Protect against car accidents.

- Home Insurance: Safeguard your property.

- Life Insurance: Provide financial support to your loved ones.

7.3. Identity Theft Protection

How can you protect yourself from identity theft and financial fraud? Monitor your credit reports, use strong passwords, and be cautious of phishing scams.

Identity theft and financial fraud can have devastating consequences on your savings and credit score. Protect yourself by monitoring your credit reports regularly, using strong passwords, and being cautious of phishing scams. Consider using identity theft protection services, which monitor your personal information and alert you to any suspicious activity.

- Monitor Credit Reports: Check for unauthorized activity.

- Strong Passwords: Use complex and unique passwords.

- Phishing Scams: Be cautious of suspicious emails and websites.

7.4. Estate Planning

Why is estate planning important, even if you don’t have significant wealth? To ensure your assets are distributed according to your wishes.

Estate planning involves creating a plan for how your assets will be distributed in the event of your death. This includes creating a will, designating beneficiaries for your accounts, and establishing trusts if necessary. Estate planning ensures that your assets are distributed according to your wishes and can help minimize estate taxes.

- Will: Specify how your assets should be distributed.

- Beneficiaries: Designate beneficiaries for your accounts.

- Trusts: Establish trusts for asset protection and management.

8. Common Mistakes to Avoid

Even with the best intentions, it’s easy to make mistakes that can hinder your savings progress. Let’s explore some common pitfalls to avoid.

8.1. Not Having a Budget

What’s the biggest mistake people make when trying to save money? Not having a budget to track income and expenses.

One of the biggest mistakes people make when trying to save money is not having a budget. Without a budget, it’s difficult to track your income and expenses, identify areas where you can cut back, and set realistic savings goals. Creating and sticking to a budget is essential for taking control of your finances.

- Track Income and Expenses: Monitor your cash flow.

- Identify Areas to Cut Back: Find opportunities to save.

- Set Savings Goals: Establish targets for your savings.

8.2. Ignoring High-Interest Debt

Why is it crucial to address high-interest debt aggressively? To minimize the total interest paid over time.

Ignoring high-interest debt, such as credit card balances, can quickly derail your savings efforts. The interest charges can eat into your savings and make it more difficult to reach your financial goals. Prioritize paying off high-interest debt as quickly as possible to minimize the total interest paid over time.

- Minimize Interest Paid: Reduce the amount you pay in interest.

- Free Up Cash Flow: Allocate more money to savings.

- Improve Credit Score: Boost your creditworthiness.

8.3. Neglecting Emergency Savings

What are the consequences of neglecting emergency savings? Increased debt and financial stress.

Neglecting emergency savings can leave you vulnerable to financial shocks when unexpected expenses arise. Without an emergency fund, you may have to rely on credit cards or loans to cover these costs, leading to increased debt and financial stress. Prioritize building an emergency fund to protect yourself from unforeseen events.

- Financial Security: Protect yourself from unexpected costs.

- Avoid Debt: Prevent the need for credit cards or loans.

- Peace of Mind: Reduce financial stress and anxiety.

8.4. Investing Without Knowledge

Why is it important to educate yourself before investing? To make informed decisions and avoid costly mistakes.

Investing without knowledge can lead to costly mistakes and significant financial losses. Before investing in stocks, bonds, or other assets, take the time to educate yourself about the risks and potential rewards. Consider consulting with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

- Informed Decisions: Make wise investment choices.

- Risk Management: Understand and manage potential risks.

- Financial Advisor: Seek professional advice.

9. Staying Informed and Adapting to Change

The world of personal finance is constantly evolving, so it’s important to stay informed and adapt to change. Let’s explore strategies to stay up-to-date on the latest financial trends and best practices.

9.1. Following Financial News

How can staying informed about financial news benefit your savings efforts? Awareness of economic trends and investment opportunities.

Following financial news can help you stay informed about economic trends, investment opportunities, and changes in interest rates. This knowledge can empower you to make informed decisions about your savings and investments. Reputable sources of financial news include The Wall Street Journal, Bloomberg, and CNBC.

- Economic Trends: Stay informed about economic developments.

- Investment Opportunities: Identify potential investment opportunities.

- Interest Rate Changes: Be aware of changes in interest rates.

9.2. Attending Financial Seminars and Workshops

What are the benefits of attending financial seminars and workshops? In-depth knowledge and personalized advice from experts.

Attending financial seminars and workshops can provide you with in-depth knowledge and personalized advice from experts. These events cover a wide range of topics, including budgeting, saving, investing, and retirement planning. Look for seminars and workshops offered by reputable financial institutions or non-profit organizations.

- In-Depth Knowledge: Gain detailed insights into financial topics.

- Personalized Advice: Get tailored advice from experts.

- Networking Opportunities: Connect with other savers and investors.

9.3. Reading Financial Books and Blogs

How can reading financial books and blogs improve your financial literacy? Learn from experienced authors and gain practical tips.

Reading financial books and blogs can help you improve your financial literacy and learn from experienced authors and financial professionals. These resources provide practical tips, strategies, and insights on various personal finance topics. Popular financial books include “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki.

- Practical Tips: Learn actionable strategies for saving money.

- Expert Insights: Gain insights from financial professionals.

- Motivation and Inspiration: Stay inspired to achieve your goals.

9.4. Utilizing Savewhere.net Resources

How can Savewhere.net help you save money? Diverse information sources, easy-to-implement tips, and constant updates on saving methods.

Savewhere.net offers a wide array of resources designed to help you save money effectively. From practical saving tips to updated discount programs, savewhere.net is your ultimate destination for taking control of your finances. Don’t miss the chance to explore savewhere.net and connect with others pursuing similar financial aspirations in the United States. Located at 100 Peachtree St NW, Atlanta, GA 30303, United States, or by phone at +1 (404) 656-2000. Discover more at savewhere.net.

- Diverse Information Sources: Access a wide range of saving strategies.

- Easy-to-Implement Tips: Get actionable advice for immediate savings.

- Constant Updates: Stay informed on the latest saving methods.

By implementing these strategies, you can save money effectively and achieve your financial goals. Visit savewhere.net today to explore more resources and take control of your financial future!

10. Frequently Asked Questions (FAQs)

10.1. How Can I Start Saving Money If I Have a Low Income?

Start by tracking your expenses, creating a budget, and automating savings.

If you have a low income, start by meticulously tracking your expenses to identify areas where you can cut back. Create a budget that prioritizes essential expenses and allocates a small amount for savings. Automate your savings by setting up regular transfers to a savings account, even if it’s just a few dollars each month. Over time, these small savings can add up.

10.2. What Is the Best Budgeting Method for Beginners?

The 50/30/20 rule is a simple and effective method for beginners.

The 50/30/20 rule is a simple and effective budgeting method for beginners. Allocate 50% of your income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings and debt repayment. This method provides a clear framework for managing your finances and prioritizing your savings goals.

10.3. How Much Should I Save for an Emergency Fund?

Aim to save three to six months’ worth of living expenses in your emergency fund.

Aim to save three to six months’ worth of living expenses in your emergency fund. This amount will provide a financial cushion to cover unexpected expenses, such as medical bills, car repairs, or job loss, without derailing your savings plan.

10.4. What Are the Best Investment Options for Beginners?

Mutual funds and ETFs are good options for beginners due to their diversification.

Mutual funds and ETFs (exchange-traded funds) are good investment options for beginners because they offer diversification, which reduces risk. These investment vehicles pool money from multiple investors to purchase a variety of stocks, bonds, or other assets, providing instant diversification.

10.5. How Can I Improve My Credit Score Quickly?

Pay bills on time, reduce credit card balances, and avoid opening new accounts.

To improve your credit score quickly, prioritize paying your bills on time, as payment history is a major factor in credit scoring. Reduce your credit card balances to lower your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit. Avoid opening new credit accounts, as this can lower your average account age and potentially impact your credit score.

10.6. What Are Some Ways to Save Money on Groceries?

Plan meals, use coupons, buy in bulk, and avoid impulse purchases.

To save money on groceries, start by planning your meals for the week to avoid impulse purchases and reduce food waste. Use coupons and look for sales and discounts. Buy non-perishable items in bulk when appropriate. These strategies can help you reduce your grocery bill significantly.

10.7. How Can I Negotiate Lower Bills?

Call service providers, compare rates, and be willing to switch providers.

To negotiate lower bills, call your service providers (such as internet, cable, and phone companies) and inquire about potential discounts or lower rates. Compare rates from different providers to see if you can get a better deal elsewhere. Be willing to switch providers if necessary to save money.

10.8. What Are the Tax Advantages of Retirement Savings Plans?

401(k)s and IRAs offer tax-deferred growth and potential tax deductions.

Retirement savings plans, such as 401(k)s and IRAs (individual retirement accounts), offer tax advantages, such as tax-deferred growth and potential tax deductions. Contributions to traditional 401(k)s and traditional IRAs may be tax-deductible, and your investments grow tax-free until retirement. Roth 401(k)s and Roth IRAs don’t offer a tax deduction upfront, but your withdrawals in retirement are tax-free.

10.9. How Can I Protect Myself from Identity Theft?

Monitor credit reports, use strong passwords, and be cautious of phishing scams.

To protect yourself from identity theft, monitor your credit reports regularly for unauthorized activity. Use strong, unique passwords for your online accounts and avoid using the same password for multiple sites. Be cautious of phishing scams, which are fraudulent emails or websites that attempt to steal your personal information.

10.10. What Are the Benefits of Working with a Financial Advisor?

Personalized advice, investment management, and help achieving financial goals.

Working with a financial advisor can provide you with personalized advice, investment management, and help achieving your financial goals. A financial advisor can assess your financial situation, develop a customized plan, and provide ongoing support and guidance.

By following these tips and strategies, you can take control of your finances, save money, and achieve your financial goals. Remember to stay informed, adapt to change, and seek professional advice when needed. With dedication and perseverance, you can secure your financial future. Visit savewhere.net for more resources and tips on saving money and managing your finances effectively.