Can You Save Fred Activity is an engaging and educational game that subtly teaches valuable skills applicable to money-saving strategies. Savewhere.net offers creative ways to improve your financial literacy while having fun. Discover how to apply these insights to build a more secure future.

1. What is the “Can You Save Fred” Activity?

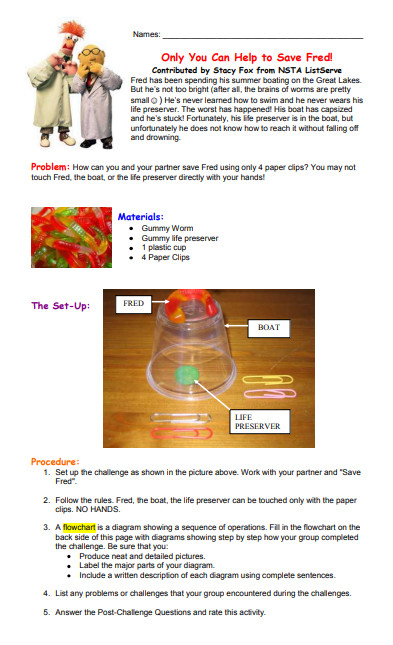

The Can You Save Fred activity is a popular STEM challenge where participants use limited resources to rescue a gummy worm (Fred) from a capsized boat (cup) and get him to his life preserver. This activity teaches problem-solving, resource management, and creative thinking, all essential skills for effective money management.

1.1 The Premise of the Activity

Fred the gummy worm is in a predicament: his boat has capsized, and he needs to reach his life preserver. The challenge is to get Fred into the lifesaver and back into his boat using only four paperclips. Participants cannot touch Fred, the boat, or the lifesaver with their hands.

1.2 Why is “Can You Save Fred” a Great Activity?

The “Can You Save Fred” activity is popular for several reasons:

- Easy to set up: It requires minimal and inexpensive materials.

- Engaging: It’s fun and involves candy, which appeals to many.

- Brain-Stimulating: It encourages creative problem-solving.

- Adaptable: It works for various age groups.

- STEM-Related: It incorporates science, technology, engineering, and mathematics principles.

Fred the gummy worm

Fred the gummy worm

Alt text: Gummy worm named Fred in a glass with a gummy ring

2. How Can “Can You Save Fred” Skills Help You Save Money?

The skills honed in the “Can You Save Fred” activity, such as problem-solving, resourcefulness, and creative thinking, are directly transferable to money-saving strategies. By thinking creatively and managing resources effectively, you can find innovative ways to cut costs and save more.

2.1 Problem-Solving in Budgeting

Budgeting often involves overcoming financial obstacles, such as unexpected expenses or debt. According to the Consumer Financial Protection Bureau (CFPB), effective problem-solving is crucial in managing finances. The “Can You Save Fred” activity encourages analytical thinking to find solutions using limited resources, mirroring the budgeting process.

2.2 Resourcefulness in Finding Deals

Just as participants must be resourceful with paperclips to save Fred, consumers can be resourceful in finding deals and discounts. Savewhere.net provides resources for finding the best deals, coupons, and promotional offers. This involves researching and thinking outside the box to maximize savings.

2.3 Creative Thinking in Reducing Expenses

Finding new ways to reduce expenses requires creative thinking. This might involve DIY solutions, negotiating bills, or finding free entertainment options. The “Can You Save Fred” activity encourages this type of creative problem-solving, which can lead to innovative money-saving strategies.

3. Applying “Can You Save Fred” Lessons to Real-Life Savings

The lessons learned from the “Can You Save Fred” activity can be directly applied to various aspects of personal finance, helping individuals and families save money more effectively.

3.1 Grocery Shopping Strategies

- Problem: High grocery bills.

- “Can You Save Fred” Solution: Plan meals ahead of time, use coupons, and compare prices at different stores.

- Real-Life Application: Create a weekly meal plan based on items on sale, use coupon apps like Ibotta or Rakuten, and shop at discount grocery stores. According to a study by the U.S. Department of Agriculture (USDA), meal planning can reduce food waste and lower grocery costs by up to 20%.

3.2 Transportation Savings

- Problem: High fuel costs and car maintenance.

- “Can You Save Fred” Solution: Find alternative transportation methods or carpool to reduce expenses.

- Real-Life Application: Use public transportation, bike, or walk when possible. Carpool with colleagues or neighbors. Consider a more fuel-efficient vehicle. Savewhere.net offers tips on finding the best gas prices in your area.

3.3 Utility Bill Reduction

- Problem: High electricity, gas, and water bills.

- “Can You Save Fred” Solution: Conserve energy and water by finding creative ways to reduce consumption.

- Real-Life Application: Turn off lights when leaving a room, use energy-efficient appliances, take shorter showers, and fix leaky faucets. According to the U.S. Energy Information Administration (EIA), energy-efficient practices can lower utility bills by up to 30%.

3.4 Entertainment Cost Cutting

- Problem: Spending too much on entertainment.

- “Can You Save Fred” Solution: Find free or low-cost entertainment options.

- Real-Life Application: Attend free community events, visit parks and museums on free admission days, host game nights at home, or stream movies and TV shows using subscription services. Savewhere.net lists free events and activities in Atlanta and other U.S. cities.

3.5 Debt Management

- Problem: High-interest debt payments.

- “Can You Save Fred” Solution: Prioritize debt repayment by finding creative ways to free up funds.

- Real-Life Application: Create a debt repayment plan, consolidate debts, or negotiate lower interest rates with creditors. The CFPB offers resources and tools for managing debt effectively.

4. Incorporating STEM Principles into Financial Planning

The “Can You Save Fred” activity inherently involves STEM principles that can be applied to financial planning. Understanding these principles can lead to more informed and effective money management.

4.1 Science: Understanding Financial Trends

- STEM Principle: Observing and understanding natural phenomena.

- Financial Application: Analyzing economic trends and market conditions to make informed investment decisions.

- Example: Monitoring inflation rates to adjust savings and investment strategies. According to the Bureau of Labor Statistics (BLS), tracking the Consumer Price Index (CPI) helps understand inflation trends.

4.2 Technology: Utilizing Financial Tools

- STEM Principle: Using tools and technology to solve problems.

- Financial Application: Employing financial software, apps, and online resources to manage budgets, track expenses, and invest.

- Example: Using budgeting apps like Mint or YNAB (You Need a Budget) to track spending and identify areas for savings. Savewhere.net recommends several financial tools for effective money management.

4.3 Engineering: Designing Financial Strategies

- STEM Principle: Designing and building solutions to meet specific needs.

- Financial Application: Creating personalized financial plans tailored to individual goals and circumstances.

- Example: Developing a retirement savings plan that includes diversified investments and considers risk tolerance. Financial advisors often use engineering principles to design optimal investment portfolios.

4.4 Mathematics: Calculating Savings and Returns

- STEM Principle: Using mathematical principles to analyze and solve problems.

- Financial Application: Calculating savings rates, investment returns, and interest payments to make informed financial decisions.

- Example: Calculating the compound interest on a savings account to project future growth. The Rule of 72 is a simple mathematical tool to estimate how long it takes for an investment to double.

5. How to Make Saving Money Fun and Engaging

Saving money doesn’t have to be a chore. By incorporating elements of fun and engagement, you can make the process more enjoyable and sustainable.

5.1 Gamify Your Savings

- Concept: Turn saving money into a game with rewards and challenges.

- Application: Use apps like Qapital or Digit that automate savings and offer rewards for reaching savings goals. Create a family savings challenge with prizes for the winner.

- Example: Setting a goal to save $100 each month and rewarding yourself with a small treat or activity once the goal is achieved.

5.2 Set Achievable Goals

- Concept: Break down large savings goals into smaller, more manageable steps.

- Application: Focus on short-term goals that are easier to achieve and provide a sense of accomplishment.

- Example: Instead of aiming to save $10,000 in a year, focus on saving $833 per month or $208 per week.

5.3 Visualize Your Progress

- Concept: Use visual aids to track your savings progress and stay motivated.

- Application: Create a savings chart or use a budgeting app that shows your progress over time.

- Example: A simple chart on the fridge showing how much you’ve saved each month or a graph in your budgeting app illustrating your savings growth.

5.4 Celebrate Milestones

- Concept: Acknowledge and celebrate your savings milestones to stay motivated.

- Application: Treat yourself to a small reward when you reach a savings goal, such as a dinner out or a new book.

- Example: Celebrating the first $1,000 saved with a special activity or purchase.

5.5 Make it Social

- Concept: Involve friends and family in your savings efforts for support and accountability.

- Application: Start a savings group with friends, share tips and ideas, and celebrate each other’s successes.

- Example: Joining a financial literacy group or participating in a savings challenge with friends or family.

6. Leveraging Savewhere.net for Financial Success

Savewhere.net is a valuable resource for anyone looking to improve their financial literacy and save money. It offers a variety of tools, tips, and resources to help you manage your finances effectively.

6.1 Exploring Money-Saving Tips

Savewhere.net offers a wealth of articles and guides on various money-saving topics, from grocery shopping to travel.

6.2 Discovering Deals and Discounts

Savewhere.net provides a comprehensive list of deals, discounts, and promotional offers from local and national retailers.

6.3 Connecting with a Community

Savewhere.net also fosters a community of like-minded individuals who share their savings tips and experiences.

7. Success Stories: Real People, Real Savings

Hearing about others who have successfully saved money can be inspiring and motivating. Here are a few success stories from individuals who have used creative strategies to achieve their financial goals:

7.1 The College Graduate Who Paid Off Debt

- Challenge: $30,000 in student loan debt.

- Strategy: Lived frugally, worked extra hours, and used the snowball method to pay off debt.

- Result: Debt-free in three years.

7.2 The Family That Cut Expenses

- Challenge: High monthly expenses and difficulty saving.

- Strategy: Created a detailed budget, cut unnecessary expenses, and found free entertainment options.

- Result: Saved $500 per month and built an emergency fund.

7.3 The Retiree Who Maximized Savings

- Challenge: Insufficient retirement savings.

- Strategy: Downsized their home, reduced expenses, and invested in low-risk assets.

- Result: Increased their retirement savings by 50% and secured their financial future.

8. Addressing Common Challenges in Saving Money

Saving money can be challenging, but understanding common obstacles and developing strategies to overcome them can make the process easier.

8.1 Lack of Motivation

- Challenge: Feeling unmotivated to save money.

- Solution: Set clear and achievable goals, visualize your progress, and reward yourself for reaching milestones.

8.2 Overspending

- Challenge: Spending more than you earn.

- Solution: Track your expenses, create a budget, and identify areas where you can cut back.

8.3 Unexpected Expenses

- Challenge: Unexpected expenses derailing your savings efforts.

- Solution: Build an emergency fund to cover unexpected costs without dipping into your savings.

8.4 Peer Pressure

- Challenge: Feeling pressured to spend money to keep up with friends or family.

- Solution: Communicate your financial goals to your peers and find alternative ways to socialize that don’t involve spending money.

8.5 Lack of Financial Literacy

- Challenge: Not understanding basic financial concepts.

- Solution: Educate yourself about personal finance through books, articles, and online resources like Savewhere.net.

9. Practical Tools and Apps for Money Management

Utilizing the right tools and apps can significantly simplify the process of managing your finances and saving money.

9.1 Budgeting Apps

- Mint: A free budgeting app that tracks your income, expenses, and savings goals.

- YNAB (You Need a Budget): A budgeting app that helps you allocate every dollar to a specific purpose.

- Personal Capital: A financial management tool that tracks your net worth, investments, and spending.

9.2 Savings Apps

- Qapital: A savings app that automates savings based on your spending habits and goals.

- Digit: A savings app that analyzes your income and spending to automatically save small amounts of money.

- Acorns: An investment app that rounds up your purchases and invests the spare change.

9.3 Coupon and Deal Apps

- Ibotta: A cashback app that offers rebates on groceries and other purchases.

- Rakuten: A cashback app that offers rebates on online purchases.

- Honey: A browser extension that automatically finds and applies coupon codes when you shop online.

9.4 Investment Apps

- Robinhood: A commission-free investment app that allows you to buy and sell stocks, ETFs, and cryptocurrencies.

- Fidelity: A full-service brokerage that offers a wide range of investment options and research tools.

- Charles Schwab: A brokerage firm that offers investment management, retirement planning, and banking services.

10. Actionable Steps to Start Saving Today

Ready to start saving money? Here are some actionable steps you can take today:

- Track Your Expenses: Use a budgeting app or spreadsheet to track your income and expenses for one month.

- Create a Budget: Based on your expense tracking, create a budget that allocates your income to different categories, including savings.

- Set Savings Goals: Set clear and achievable savings goals, such as building an emergency fund or saving for a down payment on a home.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month.

- Find Deals and Discounts: Use coupon apps and websites like Savewhere.net to find deals and discounts on your everyday purchases.

- Reduce Unnecessary Expenses: Identify areas where you can cut back on spending, such as eating out less or canceling subscriptions you don’t use.

- Increase Your Income: Look for ways to increase your income, such as taking on a side hustle or negotiating a raise at work.

- Invest Your Savings: Once you have built an emergency fund, start investing your savings in low-cost index funds or ETFs.

- Review and Adjust Your Plan: Regularly review your budget and savings goals and adjust your plan as needed.

- Stay Informed: Stay up-to-date on personal finance topics by reading books, articles, and following financial experts on social media.

Saving money is a journey, not a destination. By incorporating the lessons from the “Can You Save Fred” activity and leveraging resources like Savewhere.net, you can develop the skills and strategies needed to achieve your financial goals and build a more secure future.

FAQ: Frequently Asked Questions About Saving Money

1. What is the first step to saving money?

The first step to saving money is tracking your expenses to understand where your money is going.

2. How much of my income should I save each month?

A general rule is to save at least 15% of your income each month, but this can vary depending on your financial goals and circumstances.

3. What is an emergency fund and why is it important?

An emergency fund is a savings account set aside to cover unexpected expenses, such as medical bills or job loss. It is important to have an emergency fund to avoid going into debt when unexpected costs arise.

4. What are some easy ways to cut expenses?

Some easy ways to cut expenses include eating out less, canceling unused subscriptions, and finding free entertainment options.

5. How can I create a budget that works for me?

To create a budget that works for you, track your expenses, set financial goals, and allocate your income to different categories, including savings.

6. What is the difference between saving and investing?

Saving is setting aside money for short-term goals, while investing is using your money to purchase assets with the expectation of generating future income or appreciation.

7. How can I stay motivated to save money?

To stay motivated to save money, set clear and achievable goals, visualize your progress, and reward yourself for reaching milestones.

8. What are some common mistakes to avoid when saving money?

Some common mistakes to avoid when saving money include not tracking your expenses, not creating a budget, and not setting financial goals.

9. How can Savewhere.net help me save money?

Savewhere.net offers a variety of tools, tips, and resources to help you manage your finances effectively, including articles on money-saving topics and a comprehensive list of deals and discounts.

10. Where can I find more information about personal finance?

You can find more information about personal finance through books, articles, online resources like Savewhere.net, and by consulting with a financial advisor.

Address: 100 Peachtree St NW, Atlanta, GA 30303, United States.

Phone: +1 (404) 656-2000.

Website: savewhere.net.

Ready to take control of your finances and start saving money today? Visit Savewhere.net to discover more tips, tricks, and resources to help you achieve your financial goals. Explore our articles, find exclusive deals, and connect with a community of like-minded savers. Don’t wait – start your journey to financial freedom with savewhere.net today!

Paperclips used to solve the Fred problem

Paperclips used to solve the Fred problem

Alt text: Solutions for using paperclips to get Fred to the gummy saver ring