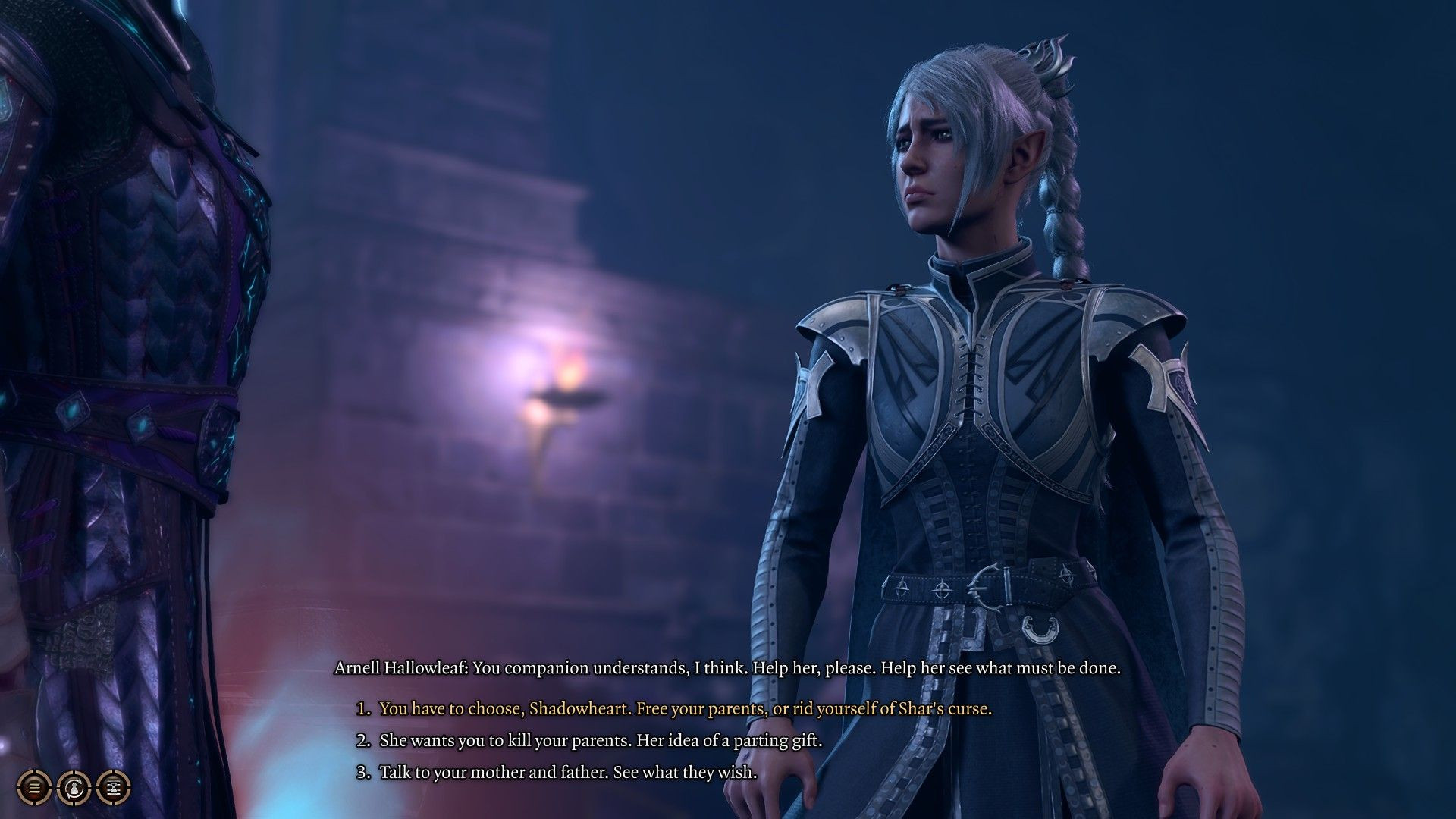

Can you save Shadowheart’s parents in Baldur’s Gate 3? At savewhere.net, we understand the complexities of choices within the game, particularly those that impact characters you’ve grown to care for. We’ll explore the consequences of either decision, offering insights to help you navigate this pivotal moment in the game and make the most informed choice for your playthrough. As you delve deeper into Baldur’s Gate 3, remember that strategic saving is key to enjoying the game’s rich, branching storylines, ensuring you can explore different outcomes and optimize your gameplay experience.

1. Understanding the Stakes: Shadowheart’s Parents in Baldur’s Gate 3

Discovering Shadowheart’s parents in Baldur’s Gate 3 presents a moral quandary, forcing players to confront the character’s past and her devotion to Shar. Whether to save Shadowheart’s parents tests your own values within the game’s narrative. Choosing to save them has significant implications for Shadowheart’s personal quest and your party’s dynamics, so understanding the situation is key.

1.1 Where Are Shadowheart’s Parents Located?

Shadowheart’s parents, Emmeline and Arnell Hallowleaf, are located in the deepest chamber of the House of Grief. This location is significant as it’s heavily tied to Shar, the Goddess of Darkness and Loss, whom Shadowheart serves, adding layers of complexity to the decision of whether or not to save them.

1.2 What Is the Significance of This Decision?

The decision to save or sacrifice Shadowheart’s parents dramatically affects her personal questline, altering her relationship with Shar and potentially changing her alignment. According to Larian Studios, the creators of Baldur’s Gate 3, these choices are designed to deeply impact the character’s development and the overall storyline, providing a rich, branching narrative experience for players.

2. The Dark Justiciar Path: Sacrificing Shadowheart’s Parents

Choosing the path of the Dark Justiciar in Baldur’s Gate 3 has serious ramifications for Shadowheart and her parents. This path is fraught with difficult decisions and moral compromises, particularly when it comes to the fate of her family.

2.1 What Happens When Shadowheart Executes Her Parents?

Allowing Shadowheart to execute her parents solidifies her commitment to Shar but at a terrible cost. They will face eternal torment in Shar’s dark afterlife, forever separated from Selune.

2.2 What Are the Consequences for Shadowheart?

After executing her parents, Shadowheart’s memory is wiped again, deepening her devotion to Shar. She will forget she ever had parents and won’t believe you if you tell her what she’s done. This results in her gaining immense power under Shar, with any remaining Justiciars in the previous room under her control and joining you for the final battle.

Evil Shadowheart in Baldur's Gate 3, having embraced the path of the Dark Justiciar

Evil Shadowheart in Baldur's Gate 3, having embraced the path of the Dark Justiciar

2.3 How Does This Affect the Final Battle?

If you kill all the Justiciars in the other room, there will be no one to join you in the final battle. This makes Shadowheart’s choice more of a story and a moral one without any visible gameplay benefit.

3. The Path of Selune: A Mercy or a Sacrifice?

Choosing the path of Selune offers a contrasting outcome regarding Shadowheart’s parents. This path provides a different perspective on sacrifice and redemption.

3.1 What Happens If Shadowheart Kills Her Parents on the Selune Path?

If Shadowheart walks the path of Selune, Shar will still demand that Shadowheart kill them, but this comes with the added bonus that Shadowheart will be forever relieved of Shar’s burden. Shadowheart’s parents ask for her to go through with it for themselves and for her future, making their death more of a mercy kill than an execution.

3.2 What Is the Fate of Shadowheart’s Parents?

If you decide to go through with this death, Shadowheart’s parents will be delivered to Selune and become “Moonmotes.” These celestial lights are said to always travel with Shadowheart, supporting her forevermore.

Shadowheart Explains Her Parents Have Become Moon Motes To Guide Her as part of her Selune questline in Baldur's Gate 3

Shadowheart Explains Her Parents Have Become Moon Motes To Guide Her as part of her Selune questline in Baldur's Gate 3

3.3 How Does This Impact Shadowheart’s Well-Being?

Shadowheart’s painful curse will be lifted. She’ll be forever free of Shar but will have to live without her parents and the guilt of having killed them. Though their being Moonmotes seems to dampen the hurt ever so slightly.

3.4 Shadowheart’s Reflections on Her Choice

At the end of the game, if you choose to romance Shadowheart, she reveals the depth of her guilt and emotions by stating that she would have given anything, even the curse, to speak with them again. However, Shadowheart appears to accept this loss and offers you a place with her, wherever that may be. She takes the steps to move on despite the regret she carries, giving her ending a bittersweet taste.

4. Defying Shar: Saving Shadowheart’s Parents

Opting to betray Shar and save Shadowheart’s parents is a challenging but potentially rewarding decision. This choice demonstrates loyalty and compassion, shaping Shadowheart’s character arc in a significant way.

4.1 How to Betray Shar and Save Shadowheart’s Parents?

You can choose to save Shadowheart’s parents on either path (Shar or Selune). Both paths will lead to the same outcome with this choice: Shadowheart’s parents will be freed and brought to camp to join you for the remainder of the game.

Player Tells Shadowheart She Should Decide Her Parents fate in Baldur's Gate 3

Player Tells Shadowheart She Should Decide Her Parents fate in Baldur's Gate 3

4.2 What Happens to Shadowheart’s Parents?

Emmeline, Shadowheart’s mother, will continue to suffer from severe memory loss and her steeply declining health, but she’ll give wisdom and comfort to Shadowheart. Arnell will continuously offer his wisdom. Together, the two have a marked improvement in Shadowheart’s mood as they support her for the rest of the story (and likely after).

4.3 What Are the Consequences for Shadowheart?

The drawback of this choice is that Shadowheart’s curse will continue to linger. Although the true nature of the curse is slightly vague, it apparently physically agonizes and tortures Shadowheart nightly and will continue to do so for the rest of her life. According to several sources, the curse also dampens Shadowheart’s ability to feel and express emotions.

Shadowheart Cries As Her Mother Emmeline Wipes Away Her Tears in Baldur's Gate 3

Shadowheart Cries As Her Mother Emmeline Wipes Away Her Tears in Baldur's Gate 3

4.4 Shadowheart’s Future With Her Parents

At the end of the game, if you choose to romance Shadowheart, she states that she’ll settle down near them in a quiet home, spending the rest of their lives with them. She is still deeply afflicted by the pain of Shar’s curse in the end, but she states she can weather it as long as she has both you and her parents. However, Shadowheart’s life promises to be a long one as a half-elf, and the ending leaves some ambiguity about how Shadowheart will endure centuries of torture after her parents’ passing.

5. Shadowheart’s Character Arc: Good or Evil?

Shadowheart’s trajectory in Baldur’s Gate 3 is heavily influenced by the choices you make, especially concerning her parents. Whether she embraces the path of Shar or seeks redemption with Selune, your decisions shape her ultimate destiny.

5.1 The Impact of Choices on Shadowheart’s Development

Your choices define whether Shadowheart leans towards darkness or light, influencing her abilities, relationships, and overall alignment in the game. As noted by game developers at Larian Studios, “The player’s agency is paramount in shaping the narrative and the fates of the characters.”

5.2 Shadowheart’s Alignment: Lawful Good or Chaotic Evil?

The path you choose for Shadowheart can shift her alignment, affecting dialogue options, quest outcomes, and her relationships with other characters in your party.

6. Romancing Shadowheart: How Her Choices Affect Your Relationship

Romancing Shadowheart adds another layer of complexity to the decision of saving her parents. Her emotional state and personal growth significantly impact the dynamics of your relationship.

6.1 The Impact of Saving or Sacrificing Her Parents on Romance

The decision to save or sacrifice Shadowheart’s parents profoundly affects her emotional availability and the depth of your bond. Saving them may lead to a more fulfilling relationship, but it also comes with the burden of her ongoing curse.

6.2 How Shadowheart’s Emotional State Influences the Romance

Shadowheart’s emotional well-being directly influences the romance, with her gratitude and affection deepening if you choose to save her parents.

7. Making the Right Choice: Factors to Consider

Choosing whether to save or sacrifice Shadowheart’s parents requires careful consideration of several factors, including your own moral compass, Shadowheart’s character development, and the overall impact on the game’s narrative.

7.1 Understanding Your Own Moral Compass

Your personal values play a significant role in determining the “right” choice. Do you prioritize compassion and redemption, or do you believe in upholding divine mandates, even at a personal cost?

7.2 Considering Shadowheart’s Character Development

Think about what you want for Shadowheart’s character arc. Do you want her to break free from Shar’s influence and find happiness, or do you believe her destiny lies in embracing her dark side?

7.3 Evaluating the Overall Impact on the Game’s Narrative

Consider how your decision will affect the broader story and the relationships between other characters.

8. Maximizing Your Baldur’s Gate 3 Experience

To make the most of your Baldur’s Gate 3 experience, consider these tips for saving money and optimizing your gameplay:

8.1 Strategic Saving in Baldur’s Gate 3

Utilize the game’s save system to explore different outcomes and make informed decisions. Save before making critical choices, such as the one involving Shadowheart’s parents, so you can see the consequences of each option.

8.2 Budgeting in Baldur’s Gate 3

Manage your resources wisely. Prioritize essential items and equipment upgrades.

8.3 Finding Deals in Baldur’s Gate 3

Explore the game world thoroughly to find hidden treasures and valuable items that can be sold for profit. According to experienced players, certain vendors offer better prices for specific items, so it pays to shop around.

8.4 Utilizing Free Resources

Take advantage of free resources and opportunities to gain experience and level up your characters.

9. Saving Money in Atlanta: Practical Tips

Applying real-world saving strategies can complement your virtual adventures. Here are some practical tips for saving money in Atlanta, tailored to different demographics:

9.1 Tips for Budget-Conscious Individuals (25-55)

- Track Your Spending: Use budgeting apps or spreadsheets to monitor your expenses and identify areas where you can cut back.

- Cook at Home: Reduce dining out by planning meals and cooking at home.

- Utilize Public Transportation: Take advantage of Atlanta’s public transportation system (MARTA) to save on gas and parking.

9.2 Tips for Students and Young Professionals (20-35)

- Take advantage of student discounts at museums, theaters, and other attractions.

- Find Free Activities: Explore Atlanta’s many free attractions, such as parks, hiking trails, and public events.

- Share Housing Costs: Consider living with roommates to split rent and utility expenses.

9.3 Tips for Families with Moderate Income (30-55)

- Create a Family Budget: Involve your family in creating a budget and setting financial goals.

- Look for Family-Friendly Deals: Take advantage of family discounts and promotions at local attractions.

- Plan Affordable Outings: Organize picnics, hikes, and other low-cost activities to spend quality time together as a family.

9.4 Tips for Those Saving for Specific Financial Goals (25-55)

- Set Clear Financial Goals: Define your goals and create a timeline for achieving them.

- Automate Savings: Set up automatic transfers from your checking account to a savings account each month.

- Seek Professional Advice: Consult a financial advisor to develop a personalized savings plan.

10. Tools and Resources for Financial Management

Effective financial management requires the right tools and resources. Here are some recommendations to help you track spending, budget effectively, and find deals:

10.1 Budgeting Apps

- Mint: Mint is a popular budgeting app that allows you to track your spending, create budgets, and set financial goals. According to a survey by NerdWallet, Mint is used by 24% of Americans who use budgeting apps.

- YNAB (You Need a Budget): YNAB is a comprehensive budgeting app that uses the envelope method to help you allocate your income to different categories.

- Personal Capital: Personal Capital offers free financial tools, including budgeting, net worth tracking, and investment analysis.

10.2 Deal-Finding Websites

- Groupon: Groupon offers discounts and deals on a wide range of products and services, including dining, entertainment, and travel.

- LivingSocial: LivingSocial features daily deals on local experiences, restaurants, and activities.

- RetailMeNot: RetailMeNot provides coupon codes and discounts for online and in-store purchases.

10.3 Financial Education Resources

- Consumer Financial Protection Bureau (CFPB): The CFPB offers free resources and tools to help consumers manage their finances.

- Financial Planning Association (FPA): The FPA provides access to certified financial planners and educational resources.

- Investopedia: Investopedia offers a wealth of information on investing, personal finance, and economics.

11. Real-Life Stories of Financial Success

Inspiration can come from hearing how others have successfully saved money and achieved their financial goals. Here are a few real-life stories:

11.1 Overcoming Debt

John, a 32-year-old teacher from Atlanta, was able to pay off $20,000 in student loan debt in just three years by creating a strict budget and automating his savings. According to John, “The key was to stay disciplined and focused on my goals.”

11.2 Saving for a Down Payment

Maria and David, a couple in their late 20s, saved $30,000 for a down payment on a house in Atlanta by cutting back on non-essential expenses and setting up a dedicated savings account. “We made small changes, like cooking at home more often and canceling our gym memberships, which added up over time,” Maria explained.

11.3 Achieving Financial Freedom

Sarah, a 45-year-old entrepreneur, achieved financial freedom by investing wisely and diversifying her income streams. “I started by educating myself about investing and gradually built a portfolio that aligned with my risk tolerance,” Sarah said.

12. Staying Motivated and Disciplined

Maintaining motivation and discipline is crucial for long-term financial success. Here are some tips to help you stay on track:

12.1 Setting Realistic Goals

Set achievable goals that align with your values and priorities. Avoid setting unrealistic targets that can lead to discouragement and burnout.

12.2 Tracking Progress

Monitor your progress regularly and celebrate milestones along the way. Use budgeting apps or spreadsheets to track your spending and savings.

12.3 Seeking Support

Join a support group or online community to connect with others who share your financial goals. Share your successes and challenges with like-minded individuals to stay motivated and accountable.

12.4 Rewarding Yourself

Treat yourself occasionally for reaching financial milestones, but make sure your rewards align with your budget and goals.

13. Navigating Discounts, Promotions, and Special Offers

Knowing how to navigate discounts, promotions, and special offers can help you save money without compromising your lifestyle.

13.1 Evaluating Offers Carefully

Assess whether a discount or promotion is genuinely beneficial before making a purchase. Avoid impulse buying and stick to your budget.

13.2 Reading the Fine Print

Carefully read the terms and conditions of any offer to understand the limitations, restrictions, and expiration dates.

13.3 Comparing Prices

Compare prices from different retailers before making a purchase to ensure you’re getting the best deal.

13.4 Avoiding Scams

Be cautious of offers that seem too good to be true and avoid providing personal or financial information to unverified sources.

14. Community and Support at savewhere.net

At savewhere.net, we are committed to providing you with the resources and support you need to achieve your financial goals.

14.1 Access to Tips and Strategies

Discover a wide range of tips and strategies for saving money in various areas of your life, from shopping and dining to travel and entertainment.

14.2 Tools for Financial Management

Take advantage of our budgeting tools, calculators, and resources to track your spending, create budgets, and set financial goals.

14.3 Community Engagement

Connect with a community of like-minded individuals who are passionate about saving money and achieving financial freedom. Share your experiences, ask questions, and learn from others.

14.4 Latest News and Updates

Stay informed about the latest deals, promotions, and financial news that can help you save money and make informed decisions.

By following these tips and strategies, you can take control of your finances, achieve your goals, and enjoy a more fulfilling life. Visit savewhere.net today to explore our resources and connect with our community.

15. Expert Financial Advice

For personalized financial guidance, consider consulting with a certified financial planner (CFP). A CFP can help you assess your financial situation, set goals, and develop a plan to achieve them. The U.S. Bureau of Labor Statistics projects a 5% growth in employment for personal financial advisors from 2022 to 2032.

15.1 Finding a Qualified Advisor

- Check Credentials: Verify that the advisor is certified and has a clean disciplinary record.

- Ask About Fees: Understand how the advisor is compensated and what fees you will be charged.

- Read Reviews: Look for online reviews and testimonials from other clients to assess the advisor’s reputation.

15.2 Preparing for a Consultation

- Gather Financial Documents: Collect your bank statements, tax returns, investment statements, and other relevant documents.

- Define Your Goals: Identify your financial goals, such as retirement planning, saving for a down payment, or paying off debt.

- Write Down Questions: Prepare a list of questions to ask the advisor to ensure you get the information you need.

16. Embracing a Frugal Lifestyle

Adopting a frugal lifestyle can help you save money, reduce stress, and live more sustainably.

16.1 Reducing Waste

- Buy in Bulk: Purchase non-perishable items in bulk to save money and reduce packaging waste.

- Repurpose and Recycle: Find creative ways to repurpose old items and recycle materials whenever possible.

- Compost Food Scraps: Compost food scraps and yard waste to enrich your garden and reduce landfill waste.

16.2 Mindful Consumption

- Avoid Impulse Buying: Take time to consider purchases before making them and avoid buying things you don’t need.

- Shop Secondhand: Explore thrift stores, consignment shops, and online marketplaces for discounted clothing, furniture, and household goods.

- Borrow or Rent: Borrow or rent items you only need occasionally, such as tools, equipment, and formal wear.

16.3 DIY Projects

- Make Your Own Cleaning Products: Create homemade cleaning products using simple ingredients like vinegar, baking soda, and essential oils.

- Grow Your Own Food: Start a garden and grow your own fruits, vegetables, and herbs.

- Repair and Maintain: Learn basic repair and maintenance skills to fix household items and avoid costly repairs.

Saving money and making sound financial decisions requires a combination of knowledge, discipline, and support. By utilizing the resources and strategies outlined in this guide, you can take control of your finances and achieve your goals. Remember to visit savewhere.net for the latest tips, tools, and community support.

17. The Importance of Financial Literacy

Financial literacy is the foundation for making informed decisions about your money. It includes understanding concepts like budgeting, saving, investing, and debt management. A study by the National Financial Educators Council found that financial illiteracy costs Americans an average of $1,634 per year.

17.1 Assessing Your Financial Knowledge

- Take a Quiz: Take a financial literacy quiz to assess your knowledge and identify areas where you can improve.

- Review Your Finances: Analyze your income, expenses, assets, and liabilities to get a clear picture of your financial situation.

- Seek Feedback: Ask a trusted friend, family member, or financial advisor to review your finances and provide feedback.

17.2 Improving Financial Literacy

- Read Books: Read books on personal finance, investing, and economics to expand your knowledge.

- Take Courses: Enroll in online or in-person courses on financial literacy to learn from experts.

- Follow Blogs and Podcasts: Subscribe to blogs and podcasts on personal finance to stay informed about the latest trends and strategies.

18. Protecting Your Finances

Protecting your finances is essential for maintaining your financial well-being and achieving your goals.

18.1 Identity Theft Protection

- Monitor Your Credit Report: Regularly check your credit report for unauthorized accounts or activity.

- Use Strong Passwords: Create strong, unique passwords for all your online accounts and avoid using the same password for multiple accounts.

- Be Cautious of Phishing Scams: Be wary of suspicious emails, phone calls, or text messages asking for personal or financial information.

18.2 Insurance Coverage

- Health Insurance: Ensure you have adequate health insurance coverage to protect against medical expenses.

- Homeowner’s or Renter’s Insurance: Protect your home and belongings with homeowner’s or renter’s insurance.

- Auto Insurance: Maintain auto insurance coverage to protect against accidents and liability.

18.3 Emergency Fund

- Save 3-6 Months of Expenses: Build an emergency fund with enough money to cover 3-6 months of living expenses in case of job loss, illness, or other unexpected events.

- Keep it Liquid: Keep your emergency fund in a liquid account, such as a savings account or money market account, where you can easily access it when needed.

In the intricate world of Baldur’s Gate 3, the decision to save Shadowheart’s parents is just one of many moral crossroads. Similarly, managing your finances involves making informed choices and taking proactive steps to protect your financial future. By embracing financial literacy, protecting your assets, and seeking expert advice, you can achieve financial security and peace of mind. Remember to visit savewhere.net for ongoing support, tools, and resources to help you navigate your financial journey.

19. Optimizing Savings in Different Sectors

Saving money is about more than cutting back on expenses; it also means optimizing your spending in different sectors.

19.1 Grocery Shopping

- Meal Planning: Plan your meals for the week and create a shopping list to avoid impulse purchases.

- Buy in Season: Purchase fruits and vegetables that are in season for better prices and quality.

- Use Coupons: Utilize coupons and discounts to save money on groceries.

19.2 Transportation

- Carpooling: Share rides with colleagues or neighbors to save on gas and parking.

- Public Transportation: Use public transportation, such as buses, trains, or subways, to save on transportation costs.

- Bike or Walk: Bike or walk for short distances to save money and get exercise.

19.3 Entertainment

- Free Activities: Take advantage of free activities, such as parks, museums, and community events.

- Discounted Tickets: Look for discounted tickets to movies, concerts, and sporting events.

- Home Entertainment: Enjoy home entertainment options, such as streaming services, board games, or books.

Shadowheart standing near Selune Statue as she grieves her parents loss in Baldur's Gate 3

Shadowheart standing near Selune Statue as she grieves her parents loss in Baldur's Gate 3

20. Automating Savings and Investments

Automating your savings and investments can help you stay on track with your financial goals and build wealth over time.

20.1 Setting up Automatic Transfers

- Savings Accounts: Set up automatic transfers from your checking account to a savings account each month.

- Investment Accounts: Automate contributions to your retirement or investment accounts.

- Bill Payments: Automate bill payments to avoid late fees and maintain a good credit score.

20.2 Utilizing Robo-Advisors

- Low-Cost Investment Management: Robo-advisors offer low-cost investment management services based on your risk tolerance and financial goals.

- Diversified Portfolios: Robo-advisors create diversified portfolios using exchange-traded funds (ETFs) to minimize risk.

- Automatic Rebalancing: Robo-advisors automatically rebalance your portfolio to maintain your desired asset allocation.

Saving money and optimizing your finances is an ongoing process that requires knowledge, discipline, and the right tools. By incorporating these tips and strategies into your daily life, you can achieve your financial goals and enjoy a more secure future. Visit savewhere.net for more information and resources to help you on your financial journey. Remember, saving isn’t about deprivation; it’s about making smart choices that align with your values and priorities.

FAQ: Saving Shadowheart’s Parents in Baldur’s Gate 3

Q1: Can you save Shadowheart’s parents in Baldur’s Gate 3?

Yes, you can save Shadowheart’s parents in Baldur’s Gate 3, regardless of whether Shadowheart follows the path of Shar or Selune. Choosing to save them will free them and bring them to your camp for the remainder of the game.

Q2: Where are Shadowheart’s parents located in Baldur’s Gate 3?

Shadowheart’s parents are located in the deepest chamber of the House of Grief. This location is significant as it’s heavily tied to Shar, the Goddess of Darkness and Loss, whom Shadowheart serves, adding layers of complexity to the decision of whether or not to save them.

Q3: What happens if Shadowheart executes her parents?

If Shadowheart executes her parents, it solidifies her commitment to Shar. She will undergo a memory wipe, deepening her devotion to the goddess.

Q4: What happens to Shadowheart’s parents if she kills them on the Selune path?

If Shadowheart walks the path of Selune, Shar will still demand that Shadowheart kill them, but this comes with the added bonus that Shadowheart will be forever relieved of Shar’s burden. Shadowheart’s parents will be delivered to Selune and become “Moonmotes.” These celestial lights are said to always travel with Shadowheart, supporting her forevermore.

Q5: What is the main drawback of saving Shadowheart’s parents?

The main drawback of saving Shadowheart’s parents is that Shadowheart’s curse will continue to linger, causing her nightly agony and dampening her ability to feel and express emotions.

Q6: How does saving Shadowheart’s parents affect her relationship with the player?

Saving Shadowheart’s parents can lead to a more fulfilling romance, but it also comes with the burden of her ongoing curse. Her gratitude and affection may deepen, strengthening your bond.

Q7: Can saving Shadowheart’s parents impact the ending of the game?

Yes, saving Shadowheart’s parents can influence the ending, especially if you choose to romance her. She may express a desire to settle down near them and spend the rest of their lives together.

Q8: What should I consider when deciding whether to save or sacrifice Shadowheart’s parents?

Consider your own moral compass, Shadowheart’s character development, and the overall impact on the game’s narrative. Each choice will have significant consequences, so choose wisely based on your preferred playstyle.

Q9: Where can I find more tips and resources for managing finances?

Visit savewhere.net for the latest tips, tools, and community support to help you navigate your financial journey and achieve your goals.

Q10: Does savewhere.net provide community engagement opportunities?

Yes, savewhere.net allows you to connect with a community of like-minded individuals who are passionate about saving money and achieving financial freedom. You can share experiences, ask questions, and learn from others.