Were you aware of the incredible number of soldiers rescued during the Dunkirk evacuation? How many soldiers were saved from the clutches of war? This article, brought to you by savewhere.net, dives deep into the numbers and reveals the heroic efforts behind this pivotal event, offering financial wisdom relevant even today. Discover how understanding history can inform your financial decisions and unlock resources for greater savings.

1. What Was the Total Number of Soldiers Saved During the Dunkirk Evacuation?

Over 338,000 Allied soldiers were rescued from Dunkirk between May 26 and June 4, 1940. This astonishing achievement, known as Operation Dynamo, involved a diverse fleet of naval vessels and civilian boats braving treacherous conditions to rescue British, French, and other Allied troops trapped by the German advance.

The Dunkirk evacuation stands as a testament to human resilience and ingenuity. The sheer scale of the operation, the variety of vessels involved, and the unwavering determination of those involved all contributed to its success. Let’s break down the numbers and explore the key factors that made this “miracle of Dunkirk” possible.

2. How Many British Soldiers Were Saved at Dunkirk?

Approximately 225,000 British Expeditionary Force (BEF) soldiers were successfully evacuated from Dunkirk. The British military recognized the dire situation early on and prioritized the extraction of its troops to preserve its fighting force.

The BEF’s evacuation was crucial for Britain’s survival. Losing such a significant portion of its army would have had devastating consequences. The successful rescue allowed Britain to continue the fight against Nazi Germany.

3. What Was The Total Number Of French Soldiers Evacuated From Dunkirk?

More than 112,000 French soldiers and other allied personnel were rescued by the Royal Navy during the operation Dynamo. Despite the initial plan that British troops would be evacuated in Royal Navy ships, while French soldiers would be evacuated in French ships, this number highlights the significant contribution of the Royal Navy in rescuing the French.

French and British escapees from Dunkirk debarking at a British port during the Evacuation, June 1940.

French and British escapees from Dunkirk debarking at a British port during the Evacuation, June 1940.

This act of solidarity strengthened the alliance between Britain and France. Although the French faced defeat shortly after, the shared experience of Dunkirk fostered a sense of camaraderie and mutual support.

4. What Role Did Civilian Vessels Play in the Dunkirk Evacuation?

Hundreds of civilian boats, often referred to as the “Little Ships of Dunkirk,” played a crucial role in the evacuation. These vessels, ranging from fishing boats and pleasure crafts to lifeboats and commercial ships, were instrumental in ferrying troops from the beaches to larger ships waiting offshore.

The “Little Ships” embody the spirit of ordinary citizens rising to meet extraordinary challenges. Their contribution was essential in navigating the shallow waters and reaching soldiers stranded along the coastline. The diversity of these vessels and the willingness of their owners to risk their lives underscore the collective effort that defined the Dunkirk evacuation.

5. How Did The British War Cabinet Ensure Fair Evacuation Numbers?

On May 31, the British War Cabinet mandated that French soldiers should be evacuated alongside BEF troops in equal numbers. This decision underscores the commitment to supporting their French allies, even amidst the chaos of war.

This policy shift demonstrates the importance of political decisions in shaping military operations. The War Cabinet’s directive ensured that the evacuation was not solely focused on British troops but also prioritized the rescue of French soldiers. This decision, while logistically challenging, reinforced the alliance and demonstrated a commitment to shared responsibility.

6. Why Was There a Perception That The French Were Abandoned at Dunkirk?

Despite the significant number of French soldiers rescued, the perception of abandonment stemmed from several factors, including communication breakdowns, conflicting priorities, and the subsequent defeat of France. The speed of the German advance and the chaotic nature of the evacuation contributed to misunderstandings and resentment.

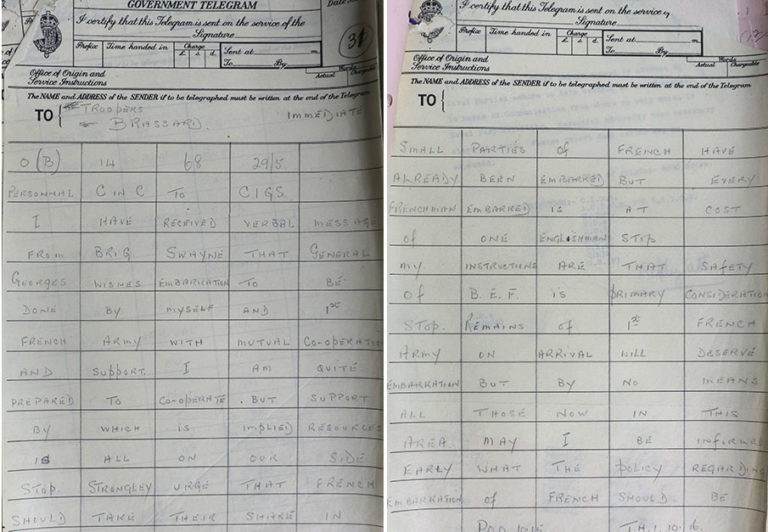

Telegram from Commander-in-Chief, BEF, Lord Gort to C.I.G.S., Field Marshal Sir John Dill: Evacuation of the French, 29 May 1940.

Telegram from Commander-in-Chief, BEF, Lord Gort to C.I.G.S., Field Marshal Sir John Dill: Evacuation of the French, 29 May 1940.

The perception of abandonment highlights the complexities of wartime alliances and the challenges of coordinating multinational operations. Communication failures and differing priorities can lead to misunderstandings and erode trust, even when significant efforts are made to support one another. The Dunkirk evacuation serves as a reminder of the importance of clear communication, shared objectives, and mutual respect in maintaining effective alliances.

7. What Impact Did Lord Gort’s Actions Have on Anglo-French Relations During The Evacuation?

Lord Gort, the commander of the BEF, made several undiplomatic remarks and demonstrated a dismissive attitude towards the French, which strained Anglo-French relations. His primary focus on the safety of the BEF, while understandable, created friction with French commanders who expected greater commitment to the joint defense of the Dunkirk perimeter.

Gort’s actions serve as a cautionary tale about the importance of diplomacy and cultural sensitivity in military leadership. His remarks, while perhaps reflecting the pressures of the situation, damaged trust and hindered cooperation between the allied forces. The Dunkirk evacuation underscores the need for leaders to foster strong relationships and maintain open communication channels, especially in times of crisis.

8. How Did The Royal Navy Demonstrate Their Commitment to Saving French Soldiers?

Despite the challenges and initial misunderstandings, the Royal Navy demonstrated a strong commitment to rescuing French soldiers. They altered evacuation plans, dispatched ships to the beaches, and worked closely with French naval officers to coordinate the rescue efforts.

The Royal Navy’s efforts highlight the importance of adaptability and collaboration in achieving common goals. Despite facing immense pressure and logistical challenges, they adjusted their strategies and worked tirelessly to rescue as many soldiers as possible. Their actions exemplify the spirit of solidarity and the willingness to go the extra mile to support their allies.

9. What Were Admiral Ramsay’s Instructions Regarding The Evacuation of French Troops?

Admiral Ramsay, who was in charge of Operation Dynamo, issued clear instructions to prioritize the evacuation of French troops alongside British forces. He emphasized the importance of not abandoning their allies and called on his officers and men to do everything possible to save them.

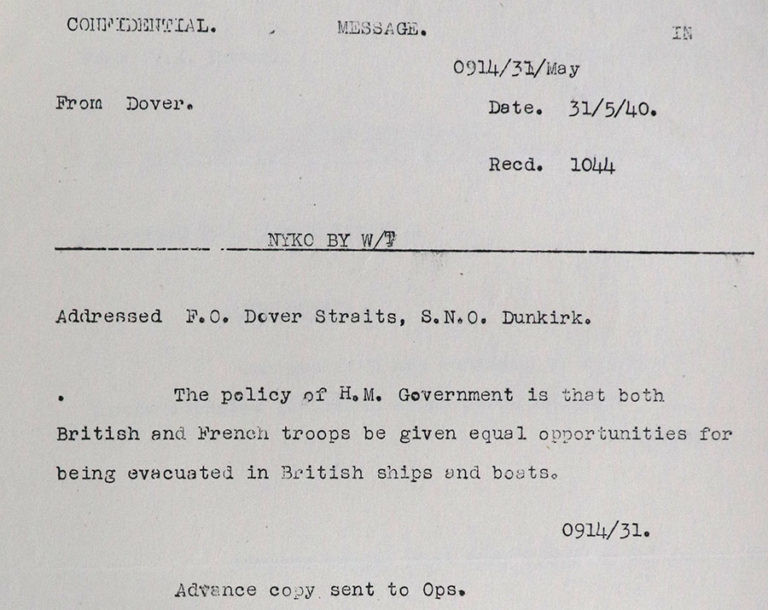

Message from Vice-Admiral Dover to Flag Officer Dover Straits and S.N.O. Dunkirk: Evacuation of French on equal basis, 31 May 1940.

Message from Vice-Admiral Dover to Flag Officer Dover Straits and S.N.O. Dunkirk: Evacuation of French on equal basis, 31 May 1940.

Ramsay’s leadership underscores the importance of clear communication and unwavering commitment in achieving complex objectives. His instructions set the tone for the operation and ensured that the rescue efforts were guided by a sense of duty and solidarity. The Dunkirk evacuation demonstrates the power of effective leadership in inspiring and motivating individuals to overcome seemingly insurmountable challenges.

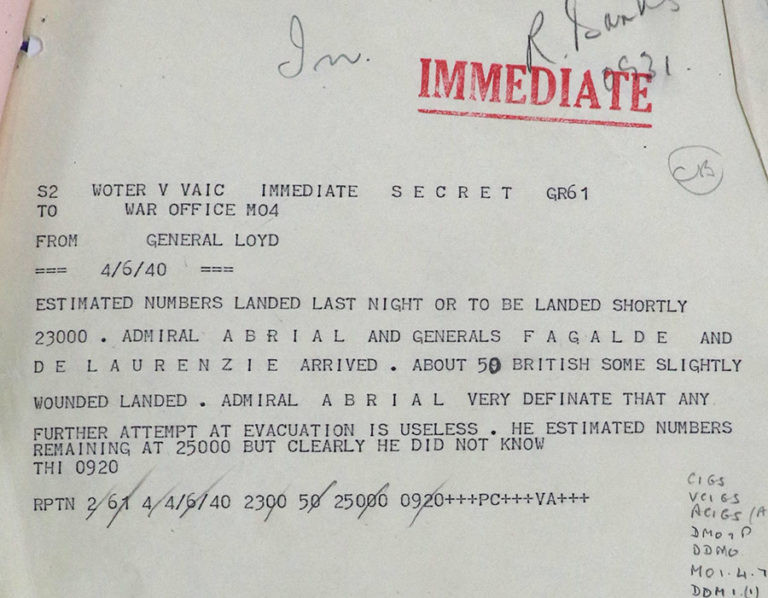

10. What Factors Led to The Termination of Operation Dynamo?

Operation Dynamo was terminated on June 4, 1940, primarily because the senior French naval officer at Dunkirk, Admiral Abrial, determined that any further evacuation attempts would be futile. By this point, German forces had advanced, and the remaining French troops were running out of ammunition.

The termination of Operation Dynamo highlights the difficult decisions that must be made in wartime. Factors such as enemy advances, dwindling resources, and the assessment of senior commanders all play a role in determining when to end an operation. The Dunkirk evacuation serves as a reminder of the complex calculations and sacrifices involved in military strategy.

11. What Financial Lessons Can Be Learned From The Dunkirk Evacuation?

While seemingly unrelated, the Dunkirk evacuation offers valuable lessons applicable to personal finance. These include:

- Importance of Planning: Just as the military planned Operation Dynamo, creating a financial plan is essential for achieving your goals.

- Adaptability: The evacuation required adapting to changing circumstances. Similarly, your financial plan should be flexible enough to adjust to unexpected events.

- Resourcefulness: The “Little Ships” demonstrated resourcefulness. Finding creative ways to save and invest can help you maximize your financial resources.

- Collaboration: The Allied forces worked together. Seeking advice from financial professionals can provide valuable support and guidance.

By understanding these parallels, you can apply the lessons of Dunkirk to your financial life and increase your chances of success. Visit savewhere.net for more tips and strategies on how to manage your finances effectively.

12. How Does Understanding History Help with Financial Planning?

History provides context and perspective. Understanding past events, including both successes and failures, can help you make more informed decisions about your financial future. For example, studying economic cycles can help you anticipate market fluctuations and adjust your investment strategy accordingly.

Furthermore, history teaches us about the importance of resilience and perseverance. Just as the people of Dunkirk faced adversity with courage and determination, you can overcome financial challenges by staying focused on your goals and adapting to changing circumstances.

13. What Resources Are Available on Savewhere.net to Help Me Save Money?

Savewhere.net offers a wide range of resources to help you save money, including:

- Budgeting tools: Create a budget and track your spending.

- Savings tips: Discover practical ways to cut expenses and increase your savings.

- Investment guides: Learn how to invest your money wisely.

- Deals and discounts: Find exclusive offers from retailers and service providers.

- Community forum: Connect with other savers and share tips and advice.

General Lloyd to War Office: Evacuation of French and closure of Dynamo, 4 June 1940.

General Lloyd to War Office: Evacuation of French and closure of Dynamo, 4 June 1940.

By utilizing these resources, you can take control of your finances and achieve your savings goals. Whether you’re saving for a down payment on a house, retirement, or simply want to build a financial cushion, savewhere.net has the tools and information you need to succeed.

14. How Can I Apply The “Never Give Up” Mentality of Dunkirk to My Financial Goals?

The Dunkirk evacuation is a story of resilience and determination in the face of overwhelming odds. To apply this “never give up” mentality to your financial goals, consider the following:

- Set clear goals: Define what you want to achieve and why it’s important to you.

- Develop a plan: Create a detailed roadmap outlining the steps you need to take to reach your goals.

- Stay disciplined: Stick to your plan, even when faced with setbacks or temptations.

- Learn from mistakes: Don’t be discouraged by failures. Use them as opportunities to learn and improve.

- Seek support: Surround yourself with people who encourage and motivate you.

By adopting this mindset, you can overcome obstacles and achieve your financial dreams. Just as the soldiers at Dunkirk never lost hope, you can maintain a positive attitude and persevere through any challenges that come your way.

15. What Are Some Practical Tips for Saving Money in My Daily Life?

Saving money doesn’t have to be difficult or time-consuming. Here are some practical tips you can implement in your daily life:

- Track your spending: Use a budgeting app or spreadsheet to monitor where your money is going.

- Create a budget: Set spending limits for different categories and stick to them.

- Cook at home: Eating out can be expensive. Prepare your own meals whenever possible.

- Shop around for the best deals: Compare prices before making a purchase.

- Cut unnecessary expenses: Identify areas where you can reduce spending, such as entertainment or subscriptions.

- Automate your savings: Set up automatic transfers to your savings account.

- Take advantage of discounts and rewards programs: Use coupons, cashback apps, and loyalty programs to save money on purchases.

By incorporating these tips into your daily routine, you can gradually increase your savings and achieve your financial goals. Remember, every little bit counts.

16. How Can I Find Exclusive Deals and Discounts on Savewhere.net?

Savewhere.net partners with various retailers and service providers to offer exclusive deals and discounts to its users. To find these offers:

- Visit the “Deals” section: Browse the latest deals and discounts available on the website.

- Sign up for the newsletter: Receive regular updates on new offers and promotions.

- Follow Savewhere.net on social media: Stay informed about exclusive deals and contests.

- Use the search function: Search for specific products or services to find relevant offers.

By taking advantage of these resources, you can save money on everyday purchases and reach your savings goals faster.

17. How Can Savewhere.Net Help Me With Budgeting and Expense Tracking?

Savewhere.net provides a user-friendly platform for budgeting and expense tracking. Here’s how you can leverage it:

- Budget Creation: Use the platform to create a detailed budget, allocating funds for various categories like housing, food, transportation, and entertainment.

- Expense Tracking: Log your daily expenses to monitor where your money is going. The platform categorizes your spending, providing insights into your spending habits.

- Financial Goal Setting: Set financial goals, like saving for a vacation or paying off debt, and track your progress.

- Budget Analysis: Analyze your budget and spending patterns to identify areas where you can cut back and save more.

- Customized Reports: Generate reports to visualize your financial data, helping you make informed decisions.

With these tools, you can gain control over your finances and work towards a more secure financial future.

18. What Investment Guides Does Savewhere.Net Offer?

Savewhere.net offers various investment guides tailored for different levels of experience. These resources provide essential knowledge for informed investment decisions:

- Beginner’s Guide to Investing: Covers the basics of investing, including different asset classes, risk tolerance, and investment strategies.

- Retirement Planning Guide: Helps you plan for retirement by providing information on retirement accounts, investment options, and strategies for maximizing your retirement savings.

- Investing in Stocks: Explains how to research and select stocks, understand market trends, and manage risk.

- Investing in Bonds: Details the benefits of investing in bonds, how they work, and how to incorporate them into your investment portfolio.

- Mutual Funds and ETFs: Explores the advantages of investing in mutual funds and exchange-traded funds, including diversification and professional management.

By using these guides, you can enhance your investment knowledge and make strategic decisions to grow your wealth.

19. How Can The Community Forum on Savewhere.net Support My Financial Goals?

The community forum on Savewhere.net provides a supportive environment where you can connect with other individuals working towards similar financial goals. Here’s how it can help:

- Share Tips and Advice: Exchange saving tips, budgeting strategies, and investment ideas with other members.

- Seek Advice: Ask questions and get personalized advice from experienced savers and investors.

- Stay Motivated: Find encouragement and inspiration from others who are on the same financial journey.

- Discuss Financial Challenges: Share your challenges and receive support from a community that understands your struggles.

- Stay Updated: Keep up with the latest financial news, trends, and saving opportunities.

By participating in the community forum, you can gain valuable insights and build a strong support network to help you achieve your financial goals.

20. What Are Some Common Financial Pitfalls to Avoid?

To protect your financial health, it’s essential to be aware of common financial pitfalls and take steps to avoid them:

- Overspending: Spending more than you earn can lead to debt and financial stress.

- Ignoring Your Budget: Not tracking your spending and sticking to a budget can result in uncontrolled expenses.

- High-Interest Debt: Carrying high-interest debt, like credit card debt, can quickly deplete your resources.

- Not Saving for Retirement: Failing to save for retirement can leave you financially insecure in your later years.

- Impulse Buying: Making unplanned purchases can disrupt your budget and lead to unnecessary spending.

- Not Having an Emergency Fund: Lacking an emergency fund can force you to take on debt when unexpected expenses arise.

- Neglecting Financial Planning: Not having a financial plan can lead to poor decisions and missed opportunities.

By being mindful of these pitfalls and taking proactive steps to avoid them, you can safeguard your financial well-being and achieve your long-term goals.

21. How Can I Create an Emergency Fund?

An emergency fund is a vital component of financial security. Here’s how to build one:

- Set a Goal: Determine how much you want to save in your emergency fund. A common recommendation is to aim for three to six months’ worth of living expenses.

- Start Small: Begin by saving small amounts regularly. Even saving $50 or $100 per month can add up over time.

- Automate Savings: Set up automatic transfers from your checking account to your savings account to make saving effortless.

- Reduce Expenses: Identify areas where you can cut back on spending and allocate those funds to your emergency fund.

- Use Windfalls: Direct any unexpected income, like tax refunds or bonuses, towards your emergency fund.

- Keep It Accessible: Store your emergency fund in a high-yield savings account where it’s easily accessible when needed.

Building an emergency fund provides a financial cushion, giving you peace of mind and the ability to handle unexpected expenses without incurring debt.

22. What Are The Benefits of Automating My Savings?

Automating your savings is a powerful way to ensure consistent progress towards your financial goals. Here are some of the key benefits:

- Consistency: Automating savings ensures you save regularly, regardless of your motivation levels.

- Convenience: Setting up automatic transfers eliminates the need to manually transfer funds, making saving effortless.

- Out of Sight, Out of Mind: Automating savings makes it less tempting to spend the money since it’s automatically transferred before you can access it.

- Goal Achievement: Consistent saving helps you reach your financial goals faster and more effectively.

- Reduced Stress: Knowing that your savings are being taken care of automatically reduces financial stress.

- Compounding Growth: Automated savings allows your money to grow through compounding interest, maximizing your returns over time.

By automating your savings, you can create a sustainable saving habit and build a more secure financial future.

23. How Can Savewhere.Net Help Me Save on Groceries?

Groceries are a significant expense for most households, but Savewhere.net offers several resources to help you save on your grocery bills:

- Coupon Database: Access a comprehensive database of coupons for various grocery items.

- Weekly Ads: Browse weekly ads from local grocery stores to find the best deals.

- Price Comparison Tool: Compare prices of grocery items at different stores to find the lowest prices.

- Meal Planning: Create a meal plan based on available deals and coupons to reduce food waste and save money.

- Cashback Offers: Take advantage of cashback offers on grocery purchases through various apps and programs.

- Loyalty Programs: Join loyalty programs at your favorite grocery stores to earn rewards and discounts.

By using these resources, you can significantly reduce your grocery expenses and free up more money for your savings goals.

24. What Strategies Can I Use to Pay off Debt Faster?

Paying off debt faster can save you money on interest and improve your financial health. Here are some effective strategies:

- Debt Snowball Method: List your debts from smallest to largest and focus on paying off the smallest debt first, while making minimum payments on the others.

- Debt Avalanche Method: List your debts from highest interest rate to lowest and focus on paying off the debt with the highest interest rate first, while making minimum payments on the others.

- Balance Transfers: Transfer high-interest debt to a credit card with a lower interest rate to save on interest charges.

- Debt Consolidation: Consolidate multiple debts into a single loan with a lower interest rate and a fixed monthly payment.

- Increase Payments: Make extra payments on your debts whenever possible to reduce the principal and pay them off faster.

- Negotiate with Creditors: Contact your creditors to negotiate lower interest rates or payment plans.

By implementing these strategies, you can accelerate your debt repayment and achieve financial freedom sooner.

25. How Can I Improve My Credit Score?

A good credit score is essential for accessing credit and securing favorable interest rates. Here are some steps you can take to improve your credit score:

- Pay Bills on Time: Make all your payments on time, as payment history is a significant factor in your credit score.

- Reduce Credit Card Balances: Keep your credit card balances low, ideally below 30% of your credit limit.

- Don’t Close Old Accounts: Keep old credit card accounts open, even if you don’t use them, to increase your available credit.

- Monitor Your Credit Report: Check your credit report regularly for errors and dispute any inaccuracies.

- Become an Authorized User: Ask a family member or friend with good credit to add you as an authorized user on their credit card.

- Apply for New Credit Sparingly: Avoid applying for too many new credit accounts at once, as this can lower your credit score.

By following these tips, you can gradually improve your credit score and gain access to better financial opportunities.

26. What Are Some Long-Term Financial Goals I Should Consider?

Setting long-term financial goals provides direction and motivation for your financial planning. Here are some common long-term goals to consider:

- Retirement Savings: Saving enough money to cover your expenses during retirement.

- Homeownership: Buying a home and paying off your mortgage.

- Education Funding: Saving for your children’s college education.

- Investment Portfolio Growth: Building a diversified investment portfolio to generate wealth over time.

- Financial Independence: Achieving a level of wealth where you no longer need to work for a living.

- Estate Planning: Planning for the transfer of your assets to your heirs.

By defining your long-term financial goals, you can create a comprehensive plan to achieve them and secure your financial future.

27. How Can I Stay Motivated to Save Money?

Staying motivated to save money can be challenging, but here are some strategies to help you stay on track:

- Visualize Your Goals: Create a vision board or use visual reminders to stay focused on your savings goals.

- Celebrate Milestones: Reward yourself for reaching savings milestones to stay motivated.

- Track Your Progress: Monitor your savings progress regularly to see how far you’ve come.

- Join a Savings Challenge: Participate in savings challenges with friends or online communities to stay accountable.

- Automate Your Savings: Set up automatic transfers to your savings account to make saving effortless.

- Find a Savings Buddy: Partner with a friend or family member to support each other’s savings goals.

By implementing these strategies, you can maintain your motivation and make saving a rewarding and sustainable habit.

28. What Role Does Financial Education Play in Achieving Financial Security?

Financial education is crucial for making informed decisions and achieving financial security. Here’s how it helps:

- Understanding Financial Concepts: Learning about budgeting, saving, investing, and debt management.

- Making Informed Decisions: Being able to evaluate financial products and services and make choices that align with your goals.

- Avoiding Financial Pitfalls: Recognizing and avoiding common financial mistakes.

- Building Wealth: Developing strategies to grow your wealth over time.

- Achieving Financial Goals: Being able to plan and execute a strategy to achieve your financial goals.

- Improving Financial Well-being: Reducing financial stress and improving your overall quality of life.

By prioritizing financial education, you can empower yourself to take control of your finances and build a more secure future.

29. How Can I Access Financial Advice on Savewhere.Net?

Savewhere.net provides various resources to access financial advice:

- Informative Articles: Access a library of articles covering various financial topics.

- Financial Calculators: Use calculators to estimate savings, loan payments, and retirement needs.

- Expert Interviews: Watch interviews with financial experts providing insights and advice.

- Community Forum: Ask questions and get advice from experienced savers and investors in the community forum.

- Recommended Resources: Find links to trusted financial resources and tools.

While Savewhere.net offers valuable information, it’s essential to consult with a qualified financial advisor for personalized advice tailored to your specific situation.

30. What Is The Importance of Diversification in Investments?

Diversification is a key strategy for managing risk in investments. Here’s why it’s important:

- Reducing Risk: Spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment performing poorly.

- Maximizing Returns: Increasing your potential for returns by participating in different markets and asset classes.

- Protecting Capital: Shielding your capital from significant losses by diversifying your portfolio.

- Long-Term Growth: Creating a portfolio that can grow steadily over the long term.

- Balancing Risk and Return: Finding the right balance between risk and potential returns to achieve your financial goals.

By diversifying your investments, you can create a more resilient portfolio that can weather market fluctuations and help you achieve your financial goals.

The Dunkirk evacuation reminds us of the power of planning, adaptability, and collaboration. Just as those involved in Operation Dynamo overcame immense challenges to achieve their goals, you can apply these lessons to your financial life and build a more secure future. Visit savewhere.net today to discover more tips, tools, and resources to help you save money and achieve your financial dreams. Start exploring your path to financial freedom now.

Contact Us:

Address: 100 Peachtree St NW, Atlanta, GA 30303, United States

Phone: +1 (404) 656-2000

Website: savewhere.net