Saving $2500 in 2 months is achievable with a strategic approach. At Savewhere.net, we provide you with the tools and knowledge to make smart financial decisions and reach your savings goals faster. Discover actionable strategies and resources to manage your money effectively and accelerate your savings journey.

1. What Is The Fastest Way To Save $2500 In 2 Months?

The fastest way to save $2500 in 2 months involves a combination of cutting expenses, increasing income, and diligent budgeting. To save this amount, you’ll need to save approximately $312.50 per week, or $1250 per month. This requires a focused and disciplined approach to your finances. Let’s explore effective ways to achieve this goal.

1.1. Create a Detailed Budget

The first step is to understand where your money is currently going. Create a detailed budget by tracking your income and expenses for a month. Use budgeting apps, spreadsheets, or even a simple notebook. Once you have a clear picture of your spending habits, you can identify areas where you can cut back.

1.2. Cut Unnecessary Expenses

Look for expenses you can eliminate or reduce. This could include dining out, entertainment, subscriptions, or other non-essential items. Consider these strategies:

- Reduce Dining Out: Cook more meals at home. According to the U.S. Bureau of Labor Statistics, the average household spends a significant portion of their budget on food away from home. Reducing this can lead to substantial savings.

- Cancel Unused Subscriptions: Review all your subscriptions (streaming services, gym memberships, etc.) and cancel the ones you don’t use.

- Lower Energy Consumption: Turn off lights when you leave a room, use energy-efficient appliances, and adjust your thermostat.

- Shop Around for Insurance: Compare rates from different insurance providers to find the best deals on car, home, and life insurance.

- Negotiate Bills: Contact your service providers (internet, phone, cable) and negotiate lower rates. Many companies are willing to offer discounts to retain customers.

1.3. Increase Your Income

Finding ways to increase your income can significantly accelerate your savings. Consider these options:

- Freelance Work: Offer your skills on platforms like Upwork or Fiverr. Whether it’s writing, graphic design, or data entry, there are numerous opportunities to earn extra money.

- Part-Time Job: Take on a part-time job in the evenings or on weekends. Retail stores, restaurants, and delivery services are often hiring.

- Sell Unwanted Items: Declutter your home and sell items you no longer need on platforms like eBay, Craigslist, or Facebook Marketplace.

- Rent Out a Spare Room: If you have a spare room, consider renting it out on Airbnb.

- Participate in Paid Surveys: Take online surveys for cash or gift cards. While the pay per survey is typically small, it can add up over time.

1.4. Automate Your Savings

Set up automatic transfers from your checking account to a savings account each payday. Automating your savings ensures that you consistently save money without having to think about it.

1.5. Utilize Cashback and Rewards Programs

Take advantage of cashback and rewards programs offered by credit cards and retailers. These programs can help you earn money back on purchases you would make anyway. According to a study by the Consumer Financial Protection Bureau (CFPB), consumers can save a significant amount of money each year by using these programs wisely.

1.6. Set Specific and Realistic Goals

Break down your $2500 savings goal into smaller, manageable targets. This makes the overall goal less daunting and helps you stay motivated. For example, aim to save $625 every two weeks.

1.7. Track Your Progress

Regularly monitor your progress to stay on track. Use a spreadsheet or budgeting app to track your income, expenses, and savings. This will help you identify any areas where you need to adjust your strategy.

By implementing these strategies, you can effectively save $2500 in 2 months and build a solid foundation for your financial future. Savewhere.net is here to support you with more tips, resources, and tools to help you achieve your financial goals.

2. What Are Some Practical Tips To Save $2500 In 60 Days?

Saving $2500 in just 60 days requires a focused and strategic approach. Here are some practical tips to help you achieve this goal:

2.1. Evaluate Your Current Spending

Start by evaluating your current spending habits. Track every dollar you spend for a week or two to identify where your money is going. Use budgeting apps like Mint or Personal Capital to automate this process.

2.2. Create a Realistic Budget

Based on your spending analysis, create a realistic budget. Allocate funds for essential expenses like rent, utilities, and groceries. Then, identify areas where you can cut back.

2.3. Reduce Housing Costs

Housing is often one of the biggest expenses. Consider these options:

- Downsize: If possible, move to a smaller apartment or house.

- Find a Roommate: Sharing your living space can significantly reduce your rent or mortgage payments.

- Refinance Your Mortgage: If you own a home, consider refinancing your mortgage to a lower interest rate.

2.4. Lower Transportation Costs

Transportation expenses can also add up quickly. Try these strategies:

- Use Public Transportation: Take the bus, train, or subway instead of driving.

- Carpool: Share rides with coworkers or neighbors.

- Bike or Walk: When possible, bike or walk to your destination.

- Maintain Your Car: Regular maintenance can prevent costly repairs and improve fuel efficiency.

2.5. Minimize Food Expenses

Food is another significant expense. Here’s how to minimize it:

- Plan Your Meals: Create a weekly meal plan and stick to it.

- Shop with a List: Avoid impulse purchases by shopping with a list.

- Cook at Home: Prepare meals at home instead of eating out.

- Buy in Bulk: Purchase non-perishable items in bulk to save money.

- Use Coupons and Discounts: Look for coupons and discounts on groceries.

2.6. Limit Entertainment Spending

Entertainment can be a major drain on your budget. Consider these alternatives:

- Free Activities: Look for free events and activities in your community.

- Home Entertainment: Host movie nights or game nights at home.

- Library: Borrow books, movies, and music from the library.

2.7. Negotiate Your Bills

Contact your service providers and negotiate lower rates on your bills. This can include your internet, phone, cable, and insurance bills.

2.8. Sell Unused Items

Declutter your home and sell items you no longer need. Use online platforms like eBay, Craigslist, or Facebook Marketplace.

2.9. Take on a Side Hustle

Increase your income by taking on a side hustle. This could include freelancing, driving for a ride-sharing service, or delivering food.

2.10. Use Cashback and Rewards Programs

Take advantage of cashback and rewards programs offered by credit cards and retailers. This can help you earn money back on purchases you would make anyway.

2.11. Cut Down on Energy Consumption

Lower your utility bills by cutting down on energy consumption. Turn off lights when you leave a room, use energy-efficient appliances, and adjust your thermostat.

2.12. Avoid Impulse Purchases

Resist the urge to make impulse purchases. Before buying something, ask yourself if you really need it.

2.13. Set Specific and Realistic Goals

Break down your $2500 savings goal into smaller, manageable targets. This makes the overall goal less daunting and helps you stay motivated.

2.14. Track Your Progress

Regularly monitor your progress to stay on track. Use a spreadsheet or budgeting app to track your income, expenses, and savings. This will help you identify any areas where you need to adjust your strategy.

2.15. Stay Motivated

Saving money can be challenging, so it’s important to stay motivated. Remind yourself of your goals and celebrate your successes along the way.

By following these practical tips, you can save $2500 in 60 days and achieve your financial goals. Visit Savewhere.net for more resources and tools to help you manage your money effectively.

3. What Are The Best Budgeting Methods To Save $2500 In Two Months?

To save $2500 in two months, you need an effective budgeting method. Here are some of the best methods to help you achieve your goal:

3.1. The 50/30/20 Rule

The 50/30/20 rule is a simple and popular budgeting method. It involves allocating your after-tax income as follows:

- 50% for Needs: This includes essential expenses like rent, utilities, groceries, and transportation.

- 30% for Wants: This covers non-essential expenses like dining out, entertainment, and hobbies.

- 20% for Savings and Debt Repayment: This is where you allocate money towards your savings goals and paying off debt.

To save $2500 in two months using this method, you would need to ensure that 20% of your income is sufficient to cover the $1250 monthly savings target. If not, you may need to adjust the percentages or find ways to increase your income.

3.2. Zero-Based Budgeting

Zero-based budgeting involves allocating every dollar of your income to a specific category. The goal is to have your income minus your expenses equal zero. This method requires you to plan where every dollar will go each month.

To use zero-based budgeting to save $2500 in two months, follow these steps:

- Calculate your monthly income.

- List all your expenses, including essential expenses, debts, and savings goals.

- Allocate funds to each category until your income minus your expenses equals zero.

- Adjust your budget as needed to ensure you are saving $1250 per month.

3.3. Envelope Budgeting

Envelope budgeting is a cash-based method where you allocate cash to different spending categories and place the cash in envelopes. Once the cash in an envelope is gone, you cannot spend any more money in that category.

To use envelope budgeting to save $2500 in two months, follow these steps:

- Determine your monthly income.

- Create envelopes for different spending categories, such as groceries, transportation, and entertainment.

- Allocate cash to each envelope based on your budget.

- Track your spending by only using the cash in the envelopes.

- Allocate any leftover cash to your savings goal.

3.4. The Pay Yourself First Method

The pay yourself first method involves setting aside money for savings before you pay any other bills or expenses. This ensures that you prioritize your savings goals.

To use the pay yourself first method to save $2500 in two months, follow these steps:

- Determine how much you need to save each month ($1250).

- Set up automatic transfers from your checking account to your savings account each payday.

- Pay your bills and expenses with the remaining money.

- Adjust your spending as needed to ensure you are meeting your savings goal.

3.5. The High-Income, High-Savings Method

This method focuses on increasing your income and maximizing your savings rate. It involves taking on side hustles, freelancing, or working overtime to earn more money, and then allocating a significant portion of that extra income to savings.

To use the high-income, high-savings method to save $2500 in two months, follow these steps:

- Identify ways to increase your income, such as taking on a part-time job or freelancing.

- Allocate a significant portion of your extra income to your savings goal.

- Track your progress and adjust your strategy as needed to ensure you are meeting your savings goal.

3.6. The Automated Savings Method

The automated savings method involves setting up automatic transfers to various savings accounts for different goals. This ensures that you consistently save money without having to think about it.

To use the automated savings method to save $2500 in two months, follow these steps:

- Determine how much you need to save each month ($1250).

- Set up automatic transfers from your checking account to your savings account each payday.

- Adjust your spending as needed to ensure you are meeting your savings goal.

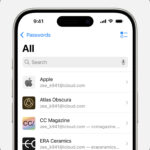

3.7. Mint App

Mint is a popular budgeting app that helps you track your spending, create a budget, and set financial goals. It links to your bank accounts and credit cards to automatically track your transactions.

To use Mint to save $2500 in two months, follow these steps:

- Download the Mint app and link your bank accounts and credit cards.

- Create a budget and set a savings goal of $1250 per month.

- Track your spending and make adjustments to your budget as needed.

- Monitor your progress and celebrate your successes.

By choosing the budgeting method that works best for you and consistently following your budget, you can save $2500 in two months and achieve your financial goals. Savewhere.net provides additional resources and tools to help you manage your money effectively and reach your savings goals.

4. How Can I Cut My Expenses To Save $2500 In 2 Months?

Cutting expenses is a crucial part of saving $2500 in just two months. Here are several strategies to help you reduce your spending and reach your savings goal:

4.1. Housing Costs

Housing is often the largest expense for most people. Here’s how to reduce it:

- Downsize: Consider moving to a smaller apartment or house.

- Find a Roommate: Sharing your living space can significantly reduce your rent or mortgage payments.

- Refinance Your Mortgage: If you own a home, consider refinancing your mortgage to a lower interest rate.

4.2. Transportation Costs

Transportation expenses can add up quickly. Try these strategies:

- Use Public Transportation: Take the bus, train, or subway instead of driving.

- Carpool: Share rides with coworkers or neighbors.

- Bike or Walk: When possible, bike or walk to your destination.

- Maintain Your Car: Regular maintenance can prevent costly repairs and improve fuel efficiency.

4.3. Food Expenses

Food is another significant expense. Here’s how to minimize it:

- Plan Your Meals: Create a weekly meal plan and stick to it.

- Shop with a List: Avoid impulse purchases by shopping with a list.

- Cook at Home: Prepare meals at home instead of eating out.

- Buy in Bulk: Purchase non-perishable items in bulk to save money.

- Use Coupons and Discounts: Look for coupons and discounts on groceries.

- Reduce Food Waste: Store food properly and use leftovers to avoid wasting food.

4.4. Entertainment Spending

Entertainment can be a major drain on your budget. Consider these alternatives:

- Free Activities: Look for free events and activities in your community.

- Home Entertainment: Host movie nights or game nights at home.

- Library: Borrow books, movies, and music from the library.

- Limit Eating Out: Reduce the frequency of dining out and opt for more affordable options.

4.5. Utility Bills

Lower your utility bills by cutting down on energy consumption:

- Turn Off Lights: Turn off lights when you leave a room.

- Use Energy-Efficient Appliances: Replace old appliances with energy-efficient models.

- Adjust Your Thermostat: Lower your thermostat in the winter and raise it in the summer.

- Unplug Electronics: Unplug electronics when they are not in use.

4.6. Subscription Services

Review your subscription services and cancel the ones you don’t use:

- Streaming Services: Cancel streaming services that you rarely watch.

- Gym Memberships: If you don’t use your gym membership, cancel it and find alternative ways to exercise.

- Magazines and Newspapers: Cancel subscriptions to magazines and newspapers and read articles online.

4.7. Banking Fees

Avoid banking fees by using a bank that doesn’t charge monthly fees and by avoiding overdrafts.

4.8. Credit Card Interest

Pay off your credit card balances in full each month to avoid paying interest.

4.9. Insurance Costs

Shop around for insurance to find the best rates on car, home, and life insurance.

4.10. Clothing Expenses

Reduce your clothing expenses by buying clothes on sale, shopping at thrift stores, and taking care of your clothes to make them last longer.

4.11. Personal Care

Cut back on personal care expenses by doing your own hair and nails, and by using coupons and discounts on personal care products.

4.12. Transportation

Reduce your transportation expenses by walking, biking, carpooling, or using public transportation.

4.13. Communication

Reduce your communication expenses by bundling your phone, internet, and cable services, and by using free communication apps like WhatsApp or Skype.

4.14. Negotiate Bills

Contact your service providers and negotiate lower rates on your bills. This can include your internet, phone, cable, and insurance bills.

4.15. Track Your Spending

Track your spending to identify areas where you can cut back. Use budgeting apps like Mint or Personal Capital to automate this process.

By implementing these strategies, you can significantly cut your expenses and save $2500 in two months. Savewhere.net provides additional resources and tools to help you manage your money effectively and reach your savings goals.

5. How Can I Increase My Income To Save $2500 In 60 Days?

Increasing your income is an effective way to accelerate your savings and reach your goal of saving $2500 in 60 days. Here are several strategies to help you boost your income:

5.1. Take on a Side Hustle

A side hustle is a great way to earn extra money outside of your regular job. Here are some popular side hustle ideas:

- Freelancing: Offer your skills on platforms like Upwork or Fiverr. Whether it’s writing, graphic design, or data entry, there are numerous opportunities to earn extra money.

- Driving for a Ride-Sharing Service: Drive for Uber or Lyft in your spare time.

- Delivering Food: Deliver food for companies like DoorDash or Uber Eats.

- Selling Crafts: If you enjoy making crafts, sell them on Etsy or at local craft fairs.

- Tutoring: Offer tutoring services to students in your area.

- Virtual Assistant: Provide administrative, technical, or creative assistance to clients from a remote location.

5.2. Get a Part-Time Job

Taking on a part-time job is another way to increase your income. Retail stores, restaurants, and delivery services are often hiring.

5.3. Sell Unwanted Items

Declutter your home and sell items you no longer need on platforms like eBay, Craigslist, or Facebook Marketplace.

5.4. Rent Out a Spare Room

If you have a spare room, consider renting it out on Airbnb.

5.5. Participate in Paid Surveys

Take online surveys for cash or gift cards. While the pay per survey is typically small, it can add up over time.

5.6. Get a Raise

Ask for a raise at your current job. Prepare a strong case by highlighting your accomplishments and contributions to the company.

5.7. Work Overtime

If your employer offers overtime, take advantage of it to earn extra money.

5.8. Invest in Stocks

Investing in the stock market can provide an additional income stream.

5.9. Create and Sell Online Courses

Share your expertise by creating and selling online courses on platforms like Teachable or Udemy.

5.10. Write and Sell an Ebook

If you enjoy writing, consider writing and selling an ebook on Amazon Kindle Direct Publishing.

5.11. Start a Blog or YouTube Channel

Share your passions by starting a blog or YouTube channel and monetize it through advertising, affiliate marketing, or selling products and services.

5.12. Become a Consultant

If you have expertise in a particular field, offer your services as a consultant.

5.13. Teach English Online

Teach English online to students around the world through platforms like VIPKid or EF Education First.

5.14. Become a Notary Public

Become a notary public and offer your services to individuals and businesses in your area.

5.15. Freelance Writing

Freelance writing involves writing articles, blog posts, or website content for clients on a contract basis.

By implementing these strategies, you can significantly increase your income and save $2500 in two months. Savewhere.net provides additional resources and tools to help you manage your money effectively and reach your savings goals.

6. What Are The Best Saving Challenges To Save $2500 Quickly?

Saving challenges can be a fun and effective way to reach your financial goals. Here are some of the best saving challenges to help you save $2500 quickly:

6.1. The 52-Week Savings Challenge

The 52-week savings challenge involves saving a small amount of money each week, gradually increasing the amount over the course of a year. While the traditional challenge is for a year, you can adapt it to fit your 2-month goal. To save $2500 in 8 weeks (approximately 2 months), you would need to adjust the weekly savings amounts accordingly.

Here’s a modified version:

- Week 1: $250

- Week 2: $275

- Week 3: $300

- Week 4: $325

- Week 5: $350

- Week 6: $375

- Week 7: $400

- Week 8: $425

This totals $2700, exceeding your $2500 goal.

6.2. The No-Spend Challenge

The no-spend challenge involves going for a set period without spending any money on non-essential items. This can help you break bad spending habits and save a significant amount of money.

To use the no-spend challenge to save $2500 in two months, follow these steps:

- Define what you consider to be essential and non-essential expenses.

- Set a goal for how many days or weeks you will go without spending money on non-essential items.

- Track your spending and avoid making impulse purchases.

- Allocate the money you save to your savings goal.

6.3. The Spare Change Challenge

The spare change challenge involves saving all your spare change. This can be a fun and easy way to save money without feeling like you are making a big sacrifice.

To use the spare change challenge to save $2500 in two months, follow these steps:

- Collect all your spare change and deposit it into a savings account or jar.

- Set a goal for how much you want to save each week.

- Track your progress and celebrate your successes.

- Deposit the accumulated change frequently to earn interest.

6.4. The $5 Challenge

The $5 challenge involves saving every $5 bill you receive. This can be a simple and effective way to save money without much effort.

To use the $5 challenge to save $2500 in two months, follow these steps:

- Save every $5 bill you receive in a jar or savings account.

- Track your progress and set a goal for how much you want to save each week.

- Deposit the accumulated $5 bills frequently to earn interest.

6.5. The Automatic Savings Challenge

The automatic savings challenge involves setting up automatic transfers from your checking account to your savings account each payday. This ensures that you consistently save money without having to think about it.

To use the automatic savings challenge to save $2500 in two months, follow these steps:

- Determine how much you need to save each month ($1250).

- Set up automatic transfers from your checking account to your savings account each payday.

- Adjust your spending as needed to ensure you are meeting your savings goal.

6.6. The Round-Up Challenge

The round-up challenge involves rounding up your purchases to the nearest dollar and saving the difference. This can be a simple and effective way to save money without much effort.

To use the round-up challenge to save $2500 in two months, follow these steps:

- Round up your purchases to the nearest dollar and track the difference.

- Transfer the accumulated round-up amounts to your savings account regularly.

- Monitor your progress and adjust your spending as needed.

6.7. The 30-Day Savings Challenge

The 30-day savings challenge involves setting a specific savings goal and working towards it over the course of 30 days. This can be a great way to kickstart your savings efforts.

To use the 30-day savings challenge to save $2500 in two months, follow these steps:

- Set a savings goal of $1250 for each 30-day period.

- Create a plan for how you will achieve your savings goal, such as cutting expenses or increasing your income.

- Track your progress and make adjustments to your plan as needed.

By choosing the saving challenge that works best for you and consistently following your plan, you can save $2500 in two months and achieve your financial goals. Savewhere.net provides additional resources and tools to help you manage your money effectively and reach your savings goals.

7. How Can I Use Coupons And Discounts To Save $2500 In Two Months?

Using coupons and discounts is a smart and practical way to save money and reach your goal of saving $2500 in two months. Here’s how to maximize your savings with coupons and discounts:

7.1. Grocery Shopping

Grocery shopping is a significant expense for most households. Here’s how to save money with coupons and discounts:

- Clip Coupons: Clip coupons from newspapers, magazines, and online sources.

- Use Digital Coupons: Sign up for digital coupon programs offered by grocery stores and retailers.

- Download Coupon Apps: Use coupon apps like Ibotta, Coupons.com, and SavingStar to find deals and earn cashback.

- Compare Prices: Compare prices at different stores to find the best deals.

- Buy in Bulk: Purchase non-perishable items in bulk when they are on sale.

- Plan Your Meals: Create a weekly meal plan and shop with a list to avoid impulse purchases.

- Use Store Loyalty Cards: Sign up for store loyalty cards to earn discounts and rewards.

7.2. Retail Shopping

Retail shopping can also be a major expense. Here’s how to save money with coupons and discounts:

- Sign Up for Email Newsletters: Sign up for email newsletters from your favorite retailers to receive exclusive coupons and discounts.

- Follow Retailers on Social Media: Follow retailers on social media to stay informed about sales and promotions.

- Use Coupon Codes: Search for coupon codes online before making a purchase.

- Shop During Sales: Take advantage of sales events like Black Friday, Cyber Monday, and seasonal sales.

- Use Cashback Websites: Use cashback websites like Rakuten or Honey to earn money back on your purchases.

- Shop at Outlet Stores: Visit outlet stores to find discounted merchandise.

7.3. Travel

Travel expenses can add up quickly. Here’s how to save money with coupons and discounts:

- Search for Travel Deals: Use websites like Expedia, Booking.com, and Kayak to find travel deals and discounts.

- Use Coupon Codes: Search for coupon codes for hotels, flights, and rental cars.

- Travel During Off-Peak Seasons: Travel during off-peak seasons to take advantage of lower prices.

- Use Hotel Loyalty Programs: Sign up for hotel loyalty programs to earn discounts and rewards.

- Use Credit Card Rewards: Use credit card rewards to pay for travel expenses.

7.4. Entertainment

Entertainment expenses can also be reduced with coupons and discounts:

- Search for Entertainment Deals: Use websites like Groupon and LivingSocial to find deals on entertainment activities.

- Use Coupon Codes: Search for coupon codes for movie tickets, concerts, and sporting events.

- Take Advantage of Free Activities: Look for free events and activities in your community.

7.5. Dining Out

Dining out can be a significant expense. Here’s how to save money with coupons and discounts:

- Search for Restaurant Deals: Use websites like Restaurant.com to find deals on dining out.

- Use Coupon Codes: Search for coupon codes for restaurants.

- Dine During Off-Peak Hours: Dine during off-peak hours to take advantage of lower prices.

- Use Restaurant Loyalty Programs: Sign up for restaurant loyalty programs to earn discounts and rewards.

7.6. Utilities

Utility expenses can also be reduced with coupons and discounts:

- Search for Energy-Efficient Appliances: Look for energy-efficient appliances when they are on sale or with rebates.

- Use Energy-Saving Tips: Implement energy-saving tips to lower your utility bills.

- Take Advantage of Government Rebates: Look for government rebates on energy-efficient appliances and home improvements.

7.7. Insurance

Insurance expenses can be reduced by shopping around for the best rates and using discounts:

- Shop Around for Insurance: Compare rates from different insurance providers to find the best deals.

- Use Discount Codes: Search for discount codes for insurance.

- Bundle Your Insurance: Bundle your car, home, and life insurance to save money.

7.8. Healthcare

Healthcare expenses can be reduced by using coupons and discounts:

- Search for Discounted Prescriptions: Use websites like GoodRx to find discounted prescriptions.

- Use Coupon Codes: Search for coupon codes for healthcare products and services.

- Take Advantage of Preventative Care: Take advantage of preventative care services to avoid costly medical expenses.

7.9. Education

Education expenses can be reduced by using coupons and discounts:

- Search for Discounted Textbooks: Use websites like Chegg to find discounted textbooks.

- Use Coupon Codes: Search for coupon codes for educational products and services.

- Take Advantage of Free Online Courses: Take advantage of free online courses to save money on education.

7.10. Childcare

Childcare expenses can be reduced by using coupons and discounts:

- Search for Discounted Childcare Services: Use websites like Care.com to find discounted childcare services.

- Use Coupon Codes: Search for coupon codes for childcare products and services.

- Take Advantage of Government Subsidies: Look for government subsidies on childcare.

By implementing these strategies and consistently using coupons and discounts, you can save a significant amount of money and reach your goal of saving $2500 in two months. savewhere.net provides additional resources and tools to help you manage your money effectively and reach your savings goals.

8. What Digital Tools Can Help Me Save $2500 In 2 Months?

Digital tools can be incredibly helpful in managing your finances and reaching your savings goal of $2500 in two months. Here are some of the best digital tools to help you save:

8.1. Budgeting Apps

Budgeting apps help you track your spending, create a budget, and set financial goals. Here are some popular options:

- Mint: Mint is a free budgeting app that links to your bank accounts and credit cards to automatically track your transactions.

- Personal Capital: Personal Capital is a free budgeting app that also offers investment management services.

- YNAB (You Need a Budget): YNAB is a paid budgeting app that helps you allocate every dollar of your income to a specific category.

- PocketGuard: PocketGuard is a budgeting app that helps you track your spending and set savings goals.

8.2. Coupon Apps

Coupon apps help you find deals and discounts on groceries, retail shopping, and more. Here are some popular options:

- Ibotta: Ibotta is a coupon app that offers cashback on groceries and other purchases.

- Coupons.com: Coupons.com is a coupon app that offers digital coupons for groceries and household items.

- SavingStar: SavingStar is a coupon app that offers cashback on groceries and other purchases.

8.3. Cashback Websites

Cashback websites allow you to earn money back on your purchases. Here are some popular options:

- Rakuten: Rakuten is a cashback website that offers cashback on purchases from a wide range of retailers.

- Honey: Honey is a browser extension that automatically finds and applies coupon codes and cashback offers when you shop online.

- Swagbucks: Swagbucks is a cashback website that offers cashback on purchases, surveys, and other activities.

8.4. Investment Apps

Investment apps allow you to invest in stocks, bonds, and other assets. Here are some popular options:

- Robinhood: Robinhood is a commission-free investment app that allows you to trade stocks, ETFs, and cryptocurrencies.

- Acorns: Acorns is an investment app that automatically invests your spare change.

- Betterment: Betterment is a robo-advisor that helps you invest in a diversified portfolio based on your risk tolerance and financial goals.

8.5. Bill Negotiation Apps

Bill negotiation apps help you negotiate lower rates on your bills. Here are some popular options:

- Trim: Trim is a bill negotiation app that negotiates lower rates on your bills and cancels unwanted subscriptions.

- Billshark: Billshark is a bill negotiation app that negotiates lower rates on your bills and finds better deals.

8.6. Debt Management Apps

Debt management apps help you manage your debt and create a plan to pay it off. Here are some popular options:

- Tally: Tally is a debt management app that consolidates your credit card debt into a single, lower-interest loan.

- Undebt.it: Undebt.it is a debt management app that helps you create a debt repayment plan.

8.7. Financial Calculators

Financial calculators help you estimate your savings, debt payments, and other financial metrics. Here are some useful calculators:

- Savings Calculator: Use a savings calculator to estimate how much you need to save each month to reach your savings goal.

- Debt Payoff Calculator: Use a debt payoff calculator to estimate how long it will take to pay off your debt.

- Mortgage Calculator: Use a mortgage calculator to estimate your mortgage payments.

8.8. Budgeting Spreadsheets

Budgeting spreadsheets can be a simple and effective way to track your spending and create a budget. You can create your own spreadsheet using Microsoft Excel or Google Sheets, or download a free template online.

8.9. Mobile Banking Apps

Mobile banking apps allow you to manage your bank accounts, transfer funds, and track your spending from your smartphone.

8.10. Payment Apps

Payment apps like Venmo, PayPal, and Cash App allow you