Saving a million dollars can seem like a distant dream, but it’s achievable with the right strategies and a clear plan. Are you ready to learn how to reach this financial milestone? Savewhere.net is here to provide you with expert guidance and practical tips to help you accumulate wealth efficiently. With effective money management and strategic financial planning, you can turn your dream of becoming a millionaire into a reality. Discover the power of compound interest, smart budgeting, and savvy investment decisions today!

1. Understanding the Million-Dollar Goal

Saving a million dollars is a significant financial milestone that many people aspire to achieve. How long it takes and how you get there depends on your income, expenses, savings rate, and investment growth. Let’s explore these variables and see how they affect your journey to a million dollars.

1.1. Key Variables in Saving a Million Dollars

Several factors determine how quickly you can save a million dollars. Understanding these variables is crucial for creating a personalized savings plan.

- Income: The amount of money you earn plays a fundamental role. Higher income generally allows for more savings.

- Expenses: Managing your spending is vital. Lower expenses mean more money can be saved.

- Savings: The amount you save regularly directly impacts your timeline.

- Savings Rate: Calculated as savings divided by income, a higher savings rate accelerates your progress.

- Investment Growth Rate: The annual return on your investments significantly boosts your savings through compounding.

1.2. The Impact of Compounding

Compounding is the process where the earnings from an investment generate further earnings. This exponential growth can dramatically accelerate your journey to a million dollars. The higher your compounding rate, the faster you’ll reach your goal.

According to research from the U.S. Bureau of Economic Analysis (BEA), consistent investment in assets with steady growth rates leads to significant wealth accumulation over time.

Close up of a calculator calculating numbers

Close up of a calculator calculating numbers

1.3. Why $1 Million?

While everyone’s financial goals may differ, $1 million is often used as a benchmark for financial security. It’s a substantial sum that can provide a comfortable retirement or fund other significant life goals.

- Psychological Milestone: Reaching a million dollars provides a sense of accomplishment and security.

- Retirement Planning: It’s often used as a baseline for estimating retirement needs.

- Financial Freedom: It can open up opportunities for early retirement or pursuing passions.

2. Strategies for Saving a Million Dollars

Saving a million dollars requires a strategic approach. Here are some effective strategies to help you reach your goal faster.

2.1. Start Early

Starting early is one of the most impactful strategies. The earlier you begin saving, the more time your investments have to grow through compounding.

- Time is Your Ally: Early investments benefit from years of compounded growth.

- Smaller Contributions: Starting early allows you to reach your goal with smaller, more manageable contributions.

- Habit Formation: Early saving habits set the foundation for lifelong financial discipline.

2.2. Increase Your Income

Boosting your income can significantly accelerate your savings timeline. Explore opportunities to earn more through promotions, side hustles, or new ventures.

- Negotiate Salary: Regularly negotiate your salary to ensure you’re being compensated fairly.

- Side Hustles: Start a side business or freelance to generate additional income.

- Skill Development: Acquire valuable skills that increase your marketability and earning potential.

2.3. Reduce Your Expenses

Lowering your expenses frees up more money to save and invest. Identify areas where you can cut back without sacrificing your quality of life.

- Budgeting: Create a detailed budget to track your income and expenses.

- Eliminate Debt: Pay off high-interest debt to reduce your monthly obligations.

- Smart Spending: Make conscious spending decisions and avoid impulse purchases.

2.4. Automate Your Savings

Automating your savings ensures consistency and discipline. Set up automatic transfers from your checking account to your savings and investment accounts.

- Set It and Forget It: Automate transfers to ensure savings happen regularly.

- Consistency: Consistent saving habits build wealth over time.

- Peace of Mind: Knowing your savings are automated reduces financial stress.

2.5. Invest Wisely

Smart investing is crucial for growing your savings. Diversify your portfolio and consider low-cost index funds or ETFs to maximize returns.

- Diversification: Spread your investments across different asset classes to reduce risk.

- Low-Cost Funds: Opt for low-cost index funds or ETFs to minimize expenses.

- Long-Term Perspective: Invest for the long term and avoid trying to time the market.

Investment chart showing different stocks

Investment chart showing different stocks

3. Real-Life Examples and Scenarios

Let’s examine different scenarios to illustrate how income, savings rate, and investment growth impact the time it takes to save a million dollars.

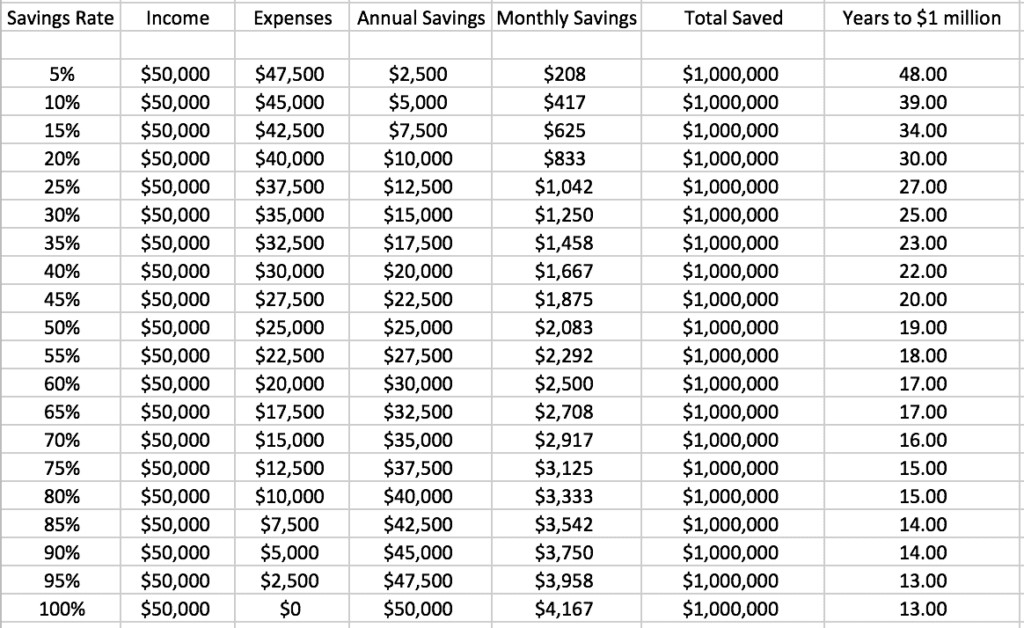

3.1. Scenario 1: Saving with a $50,000 Salary

Imagine Trevor earns $50,000 per year after taxes and spends $40,000, saving $10,000 annually. With a 20% savings rate and a 7% investment growth rate, it would take Trevor approximately 30 years to save a million dollars.

- Savings Rate Impact: Increasing his savings rate to 50% would reduce the time to 19 years.

- Investment Growth: A higher investment growth rate could further shorten the timeline.

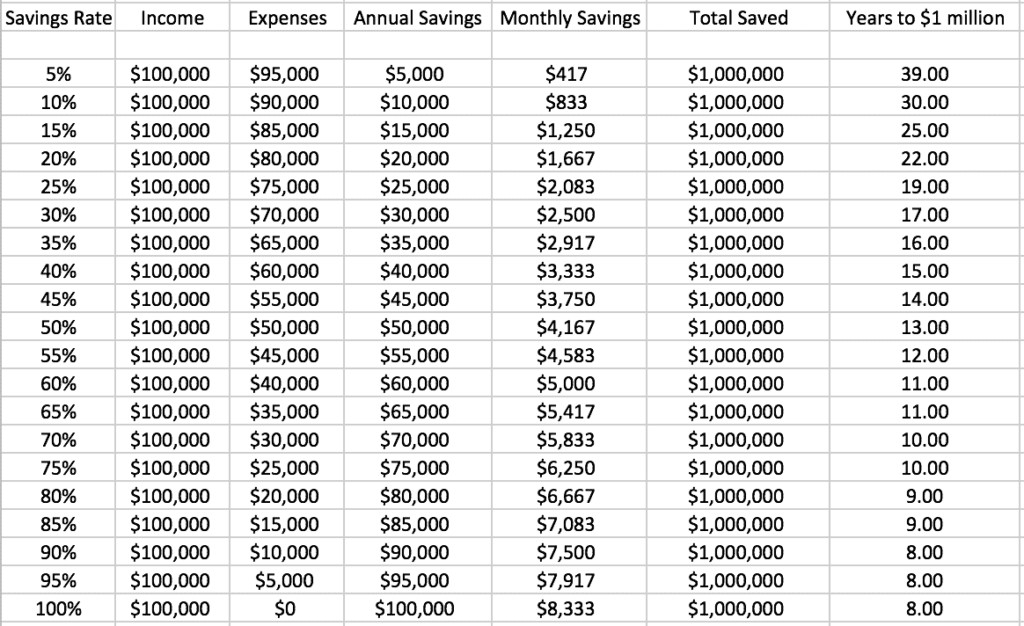

3.2. Scenario 2: Saving with a $100,000 Salary

If Trevor earned $100,000 after taxes and maintained a 10% savings rate, it would take him 30 years to reach $1 million. However, increasing his savings rate to 50% would reduce the time to 13 years.

- Expense Management: Living on a smaller portion of his income can significantly accelerate his savings.

- Strategic Investments: Investing in high-growth potential assets could further shorten the timeline.

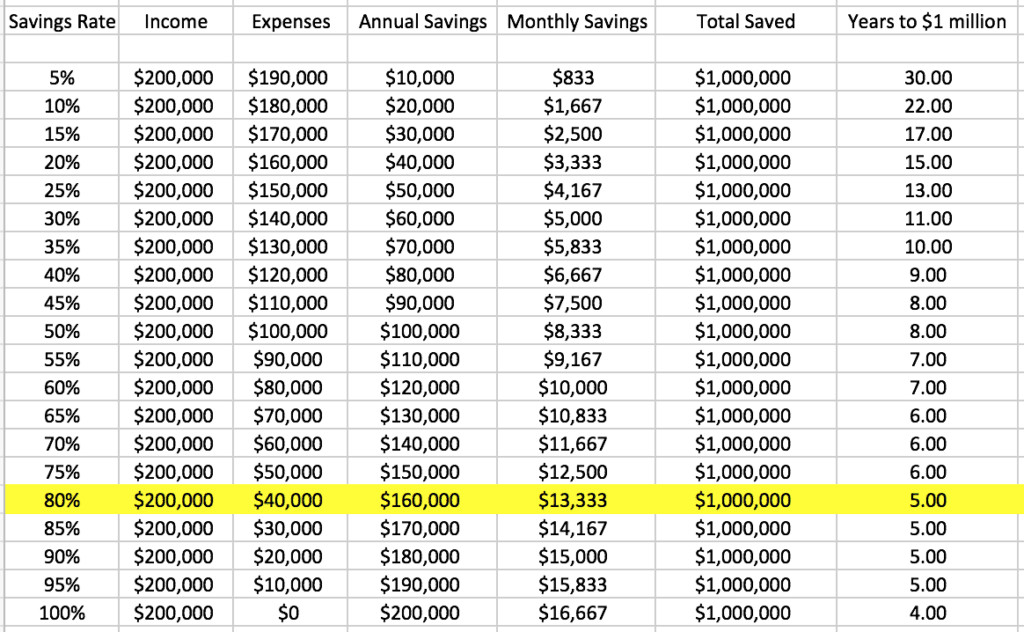

3.3. Scenario 3: Saving with a $200,000 Salary

With an after-tax income of $200,000, saving $1 million in 5 years becomes a realistic possibility. This requires a high savings rate and disciplined spending habits.

- Aggressive Saving: Living on $40,000 per year while investing the rest can lead to rapid wealth accumulation.

- High Investment Returns: Achieving high investment returns through strategic investments is crucial.

3.4. Case Study: Saving $1 Million in 5 Years

Achieving a million dollars in just 5 years requires a combination of high income, aggressive savings, and strategic investments. Here’s how one individual did it.

- High Income: Earning a substantial income provides the necessary capital to invest.

- Aggressive Savings: Saving a significant portion of income is essential for rapid wealth accumulation.

- Strategic Investments: Investing in high-growth potential assets can accelerate wealth creation.

4. Key Investments That Can Help You Reach $1 Million

Investing wisely is crucial for reaching your million-dollar goal. Here are some key investments to consider.

4.1. Index Funds

Index funds are a popular choice for long-term investors. They offer diversification and typically have low expense ratios.

- Diversification: Index funds track a specific market index, providing broad market exposure.

- Low Costs: They generally have lower expense ratios compared to actively managed funds.

- Long-Term Growth: They offer the potential for long-term growth in line with the market.

4.2. Stocks

Investing in individual stocks can offer the potential for high returns, but it also comes with higher risk.

- Growth Potential: Individual stocks can experience significant growth in value.

- Risk Management: Diversify your stock portfolio to mitigate risk.

- Research: Thoroughly research companies before investing in their stocks.

4.3. Bonds

Bonds are generally considered a safer investment than stocks. They provide a fixed income stream and can help balance your portfolio.

- Fixed Income: Bonds offer a fixed interest rate, providing a predictable income stream.

- Lower Risk: They are generally less volatile than stocks, making them a safer investment.

- Portfolio Balance: Bonds can help balance your portfolio and reduce overall risk.

4.4. Real Estate

Investing in real estate can provide both income and appreciation potential.

- Rental Income: Rental properties can generate a steady stream of income.

- Appreciation: Real estate can appreciate in value over time.

- Tax Benefits: Real estate investments often come with tax benefits.

Investment portfolio consisting of stocks, bonds, and real estate

Investment portfolio consisting of stocks, bonds, and real estate

4.5. Cryptocurrency

Cryptocurrency is a high-risk, high-reward investment. While it can offer the potential for significant returns, it’s also highly volatile.

- High Potential Returns: Some cryptocurrencies have experienced significant growth in value.

- High Volatility: Cryptocurrency values can fluctuate dramatically.

- Risk Management: Only invest what you can afford to lose in cryptocurrency.

5. How I Saved a Million Dollars in 5 Years: A Personal Story

Between 2010 and 2015, one individual achieved financial independence by saving $1.25 million. This journey involved strategic investments and a high savings rate.

5.1. Investment Strategy

A combination of index funds and individual stocks fueled this rapid wealth accumulation.

- Index Funds: Investing in broad market index funds provided diversification and steady growth.

- Individual Stocks: Strategic investments in companies like Amazon and Facebook yielded significant returns.

- Diversification: Maintaining a diversified portfolio helped mitigate risk.

5.2. Savings Rate

A high savings rate was crucial for accelerating the journey to a million dollars.

- Aggressive Saving: Saving and investing an average of $144,500 per year.

- Income Maximization: Maximizing income through side hustles and career advancements.

- Expense Management: Keeping expenses low to free up more money for saving and investing.

5.3. Portfolio Growth

Strategic investments and consistent contributions led to substantial portfolio growth.

- Investment Gains: Achieving significant investment gains over a 5-year period.

- Compounding: Benefiting from the power of compounding to grow investments exponentially.

- Long-Term Perspective: Maintaining a long-term perspective and staying invested through market fluctuations.

6. Practical Tips to Accelerate Your Savings

Accelerating your savings requires consistent effort and smart financial decisions. Here are some practical tips to help you reach your million-dollar goal faster.

6.1. Track Your Finances

Tracking your income, expenses, and investments is essential for understanding your financial situation and identifying areas for improvement.

- Budgeting Apps: Use budgeting apps to track your spending and manage your budget.

- Net Worth Trackers: Monitor your net worth to track your progress towards your financial goals.

- Regular Review: Regularly review your financial statements to identify trends and make adjustments.

6.2. Increase Your Savings Rate

Gradually increase your savings rate over time to accelerate your wealth accumulation.

- Small Increments: Increase your savings rate by 1% every 30 days to make it more manageable.

- Automatic Adjustments: Set up automatic adjustments to your savings contributions to ensure consistency.

- Financial Discipline: Stay committed to increasing your savings rate and reaching your financial goals.

6.3. Make More Money

Explore opportunities to increase your income through career advancements, side hustles, or new ventures.

- Negotiate Raises: Regularly negotiate your salary to ensure you’re being compensated fairly.

- Side Hustles: Start a side business or freelance to generate additional income.

- Skill Development: Acquire valuable skills that increase your marketability and earning potential.

6.4. Invest Early and Often

Investing early and often allows you to take advantage of the power of compounding and grow your wealth exponentially.

- Start Now: Begin investing as soon as possible to maximize the benefits of compounding.

- Consistent Contributions: Make consistent contributions to your investment accounts to build wealth over time.

- Long-Term Perspective: Invest for the long term and avoid trying to time the market.

6.5. Minimize Taxes

Minimizing your tax burden can help you keep more of your money and accelerate your savings.

- Tax-Advantaged Accounts: Utilize tax-advantaged accounts such as 401(k)s and IRAs to reduce your tax liability.

- Tax-Efficient Investments: Choose tax-efficient investments to minimize taxes on your investment gains.

- Tax Planning: Consult with a tax professional to develop a tax-efficient investment strategy.

An example of Personal Capital app showing the user's net worth

An example of Personal Capital app showing the user's net worth

7. Common Pitfalls to Avoid

Saving a million dollars requires discipline and awareness of potential pitfalls. Here are some common mistakes to avoid.

7.1. Lifestyle Inflation

Lifestyle inflation occurs when your spending increases as your income rises. Avoid this by maintaining a disciplined approach to spending.

- Budgeting: Create a budget and stick to it, even as your income increases.

- Prioritize Savings: Prioritize saving and investing over increasing your spending.

- Conscious Spending: Make conscious spending decisions and avoid impulse purchases.

7.2. High-Interest Debt

High-interest debt can derail your savings efforts. Pay off high-interest debt as quickly as possible.

- Debt Snowball: Use the debt snowball method to pay off your debts one by one.

- Debt Avalanche: Use the debt avalanche method to pay off your debts based on interest rate.

- Balance Transfers: Consider balance transfers to lower the interest rate on your debt.

7.3. Market Timing

Trying to time the market is a risky strategy that can lead to significant losses. Invest for the long term and avoid trying to predict market movements.

- Long-Term Perspective: Invest for the long term and ignore short-term market fluctuations.

- Dollar-Cost Averaging: Use dollar-cost averaging to invest a fixed amount of money at regular intervals.

- Avoid Emotional Decisions: Avoid making investment decisions based on emotions.

7.4. Lack of Diversification

Failing to diversify your investments can increase your risk and reduce your potential returns.

- Asset Allocation: Allocate your investments across different asset classes to reduce risk.

- Index Funds: Invest in index funds to gain broad market exposure.

- Regular Review: Regularly review your portfolio and rebalance as needed.

7.5. Neglecting Financial Planning

Failing to create a financial plan can lead to missed opportunities and poor financial decisions.

- Set Goals: Set clear financial goals and create a plan to achieve them.

- Consult a Professional: Consult with a financial advisor to develop a comprehensive financial plan.

- Regular Review: Regularly review your financial plan and make adjustments as needed.

8. Tools and Resources for Saving a Million Dollars

Several tools and resources can help you save a million dollars. Here are some of the most useful.

8.1. Budgeting Apps

Budgeting apps can help you track your spending, manage your budget, and identify areas for improvement.

- Mint: Mint is a popular budgeting app that tracks your spending and helps you create a budget.

- YNAB (You Need a Budget): YNAB is a budgeting app that helps you allocate every dollar to a specific purpose.

- Personal Capital: Personal Capital is a budgeting app that also tracks your net worth and investment performance.

8.2. Investment Platforms

Investment platforms provide access to a wide range of investment options, including stocks, bonds, and mutual funds.

- Vanguard: Vanguard is a popular investment platform known for its low-cost index funds.

- Fidelity: Fidelity is a full-service investment platform that offers a wide range of investment options.

- Charles Schwab: Charles Schwab is a full-service investment platform that offers banking and brokerage services.

8.3. Financial Calculators

Financial calculators can help you estimate your savings needs, calculate your investment returns, and plan for retirement.

- Retirement Calculators: Retirement calculators can help you estimate how much you need to save for retirement.

- Investment Calculators: Investment calculators can help you calculate your investment returns and project your future wealth.

- Savings Calculators: Savings calculators can help you estimate how much you need to save to reach your financial goals.

8.4. Financial Advisors

Financial advisors can provide personalized advice and guidance to help you reach your financial goals.

- Certified Financial Planner (CFP): CFPs are financial advisors who have met rigorous education and experience requirements.

- Registered Investment Advisor (RIA): RIAs are financial advisors who are registered with the Securities and Exchange Commission (SEC).

- Fee-Only Advisors: Fee-only advisors are financial advisors who are compensated solely by fees paid by their clients.

8.5. Online Courses and Books

Online courses and books can provide valuable knowledge and insights to help you improve your financial literacy and reach your financial goals.

- Financial Freedom: A Proven Path to All the Money You Will Ever Need by Grant Sabatier: Offers actionable steps to achieve financial independence.

- The Total Money Makeover by Dave Ramsey: Provides a step-by-step plan for getting out of debt and building wealth.

- The Intelligent Investor by Benjamin Graham: A classic guide to value investing.

9. Maintaining Motivation and Discipline

Staying motivated and disciplined is essential for long-term success in saving a million dollars. Here are some strategies to help you stay on track.

9.1. Set Clear Goals

Setting clear financial goals can help you stay motivated and focused on your objectives.

- SMART Goals: Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals to make them more effective.

- Visualize Success: Visualize yourself achieving your financial goals to stay motivated.

- Regular Review: Regularly review your goals to ensure they are still relevant and adjust them as needed.

9.2. Track Your Progress

Tracking your progress can help you stay motivated and see how far you’ve come.

- Net Worth Tracking: Track your net worth to see your overall financial progress.

- Savings Rate Tracking: Track your savings rate to see how much of your income you’re saving.

- Investment Performance Tracking: Track your investment performance to see how your investments are growing.

9.3. Celebrate Milestones

Celebrating milestones can help you stay motivated and reward yourself for your hard work.

- Small Rewards: Reward yourself with small treats when you reach significant milestones.

- Acknowledge Progress: Acknowledge your progress and celebrate your achievements.

- Stay Focused: Stay focused on your long-term goals and continue to work towards them.

9.4. Join a Community

Joining a community of like-minded individuals can provide support and encouragement.

- Online Forums: Participate in online forums to connect with other savers and investors.

- Financial Groups: Join financial groups to share ideas and learn from others.

- Support System: Build a support system of friends and family who can encourage you on your journey.

9.5. Stay Informed

Staying informed about personal finance and investing can help you make better decisions and stay motivated.

- Read Books and Articles: Read books and articles about personal finance and investing to improve your knowledge.

- Attend Seminars and Webinars: Attend seminars and webinars to learn from experts in the field.

- Follow Financial News: Follow financial news to stay informed about market trends and economic developments.

10. Frequently Asked Questions (FAQ) about Saving a Million Dollars

Here are some frequently asked questions about saving a million dollars.

10.1. How Long Does It Really Take to Save a Million Dollars?

It varies based on income, savings rate, and investment returns. With a moderate income and savings rate, it could take 20-30 years.

10.2. What Is the First Step to Saving a Million Dollars?

Start by setting clear financial goals and creating a budget to track your income and expenses.

10.3. Is It Possible to Save a Million Dollars on a Low Income?

Yes, but it requires a high savings rate, disciplined spending, and strategic investments.

10.4. What Are the Best Investments for Saving a Million Dollars?

Low-cost index funds, stocks, bonds, and real estate are all viable options. Diversification is key.

10.5. How Can I Increase My Savings Rate?

Reduce expenses, increase income, and automate your savings contributions.

10.6. What Should I Do If I Fall Behind on My Savings Goals?

Re-evaluate your budget, adjust your savings strategy, and seek advice from a financial advisor.

10.7. Is It Necessary to Work with a Financial Advisor?

While not required, a financial advisor can provide personalized advice and guidance to help you reach your goals.

10.8. How Important Is It to Start Saving Early?

Starting early is crucial because it allows your investments to grow through compounding over a longer period.

10.9. What Are Some Common Mistakes to Avoid When Saving for a Million Dollars?

Lifestyle inflation, high-interest debt, market timing, and lack of diversification are common pitfalls.

10.10. How Can I Stay Motivated While Saving for a Million Dollars?

Set clear goals, track your progress, celebrate milestones, and join a community of like-minded individuals.

Conclusion: Your Journey to a Million Dollars Starts Now

Saving a million dollars is an ambitious but achievable goal. By understanding the key variables, implementing effective strategies, and staying disciplined, you can turn your dream into reality. Visit savewhere.net for more tips, resources, and tools to help you on your journey to financial independence. Start today, and take the first step towards a brighter financial future!

Address: 100 Peachtree St NW, Atlanta, GA 30303, United States.

Phone: +1 (404) 656-2000.

Website: savewhere.net.

Ready to take control of your financial future? Visit savewhere.net today to discover more tips, find exclusive deals, and connect with a community of like-minded individuals in the USA! Explore practical advice, inspiring success stories, and the latest resources to help you save money efficiently and achieve your financial goals faster.