Saving a million dollars in five years might seem like a distant dream, but it’s achievable with the right strategies and dedication. At savewhere.net, we provide the tools and knowledge to help you reach your financial goals faster. Achieving financial freedom starts with smart saving habits, and this guide is designed to show you exactly how to accumulate substantial wealth rapidly.

Financial Independence, Investment Growth, Wealth Accumulation.

1. Understand The Key Factors To Saving A Million Dollars

How can I save a million dollars in 5 years, and what are the critical elements that impact this goal? Saving a million dollars in five years depends on your income, expenses, savings rate, and investment growth. These factors determine how quickly you can accumulate wealth.

- Income: The amount of money you earn is the foundation.

- Expenses: Reducing spending frees up more money to save.

- Savings: The difference between income and expenses is crucial.

- Savings Rate: This is your savings divided by your income, indicating how much of your income you’re saving.

- Investment Growth Rate: How much your investments grow annually significantly impacts your timeline.

“The key to saving a million dollars quickly lies in maximizing your income, minimizing your expenses, and consistently investing the difference,” explains a financial advisor at savewhere.net.

2. Calculate How Long It Will Take

How can I estimate the time it will take to save $1 million based on my current financial situation? To estimate the time, use a financial calculator that considers your income, expenses, current savings, and expected investment growth rate. This tool provides a realistic timeline to reach your goal.

Use savewhere.net’s free financial calculator to determine the time it will take to save $1 million. By inputting your current financial details, you can see how different savings rates and investment returns affect your journey to becoming a millionaire.

3. Strategies For Different Income Levels

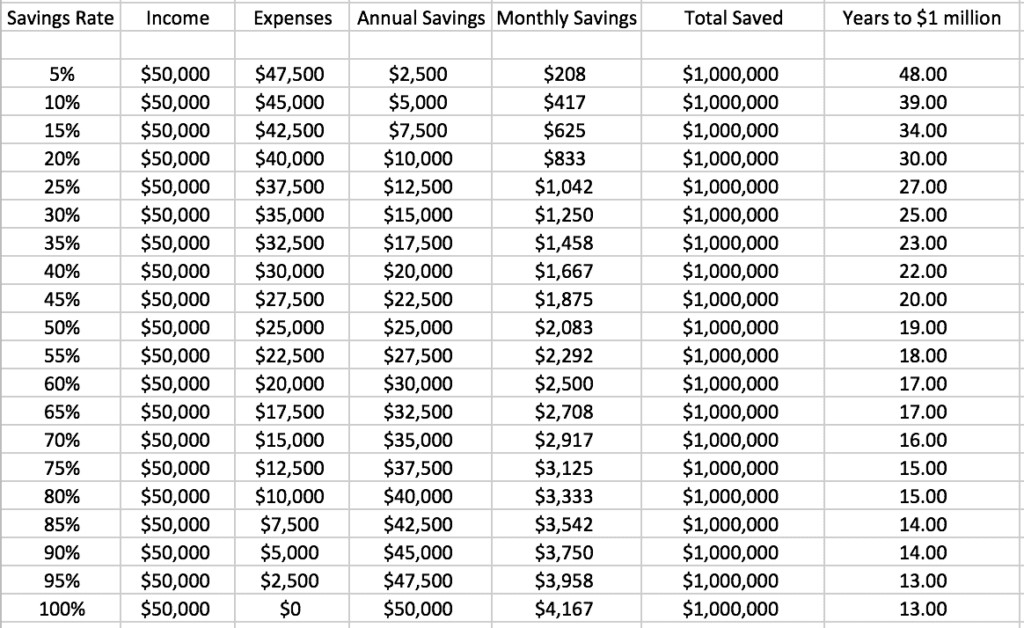

3.1. Saving A Million Dollars With A $50,000 Salary

Is it possible to save a million dollars with a $50,000 salary, and what savings rate is required? Yes, but it requires a very high savings rate and disciplined investing. Saving 50% of your income can significantly shorten the timeline compared to saving only 10%.

A person making $50,000 annually with $40,000 in expenses saves $10,000 yearly, a 20% savings rate. With a 7% annual investment growth, it would take approximately 30 years to reach $1 million. Increasing the savings rate to 50% dramatically reduces this to about 19 years.

chart showing how to save million dollars on ,000 salary

chart showing how to save million dollars on ,000 salary

3.2. Saving A Million Dollars With A $100,000 Salary

How does a $100,000 salary affect the timeline to save a million dollars, and what savings strategies are effective? A higher income allows for faster wealth accumulation. A 50% savings rate can help you reach $1 million in about 13 years.

Earning $100,000 after taxes and saving 10% would take 30 years to reach $1 million. Increasing the savings rate to 50% reduces the time to 13 years. To achieve the goal in less than 10 years, a savings rate of at least 70% is necessary.

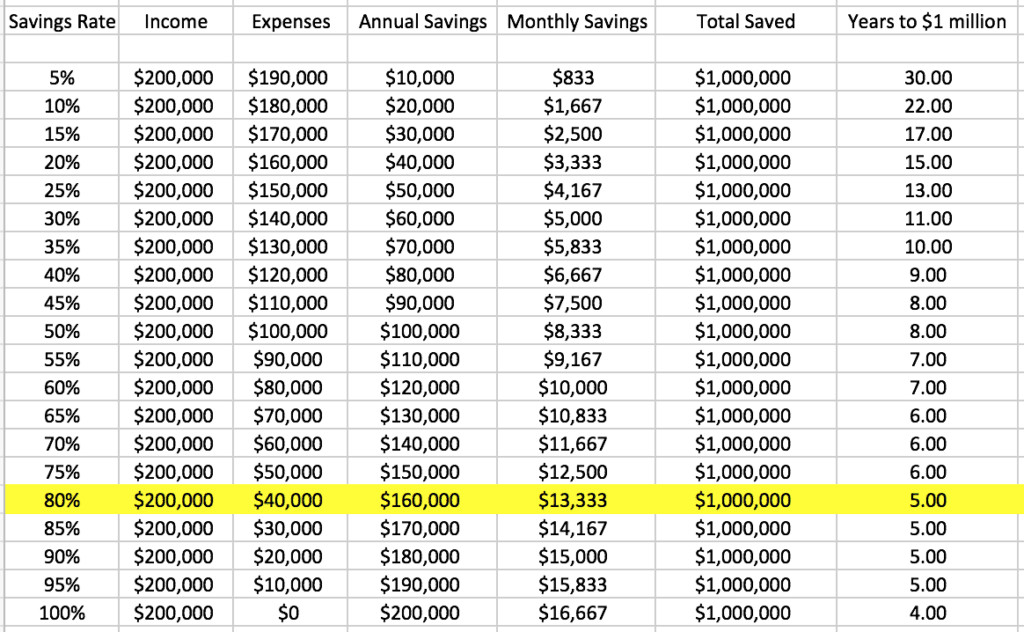

3.3. Saving A Million Dollars With A $200,000 Salary

Can a $200,000 salary make saving a million dollars in 5 years a realistic goal, and what lifestyle adjustments are needed? Yes, with a high savings rate and disciplined spending, it is possible. Living on $40,000 per year and investing the rest can make this goal achievable.

With an after-tax income of $200,000, saving $1 million in 5 years becomes a real possibility if you can live on $40,000 annually and invest the remaining $160,000 each year.

chart showing how to save million dollars on 0,000 salary

chart showing how to save million dollars on 0,000 salary

4. Real-Life Example: Saving $1 Million In 5 Years

How was a million dollars saved in 5 years, and what investment strategies were used to achieve this goal? By combining high income, significant savings, and strategic investments, it’s possible to reach this milestone quickly. A mix of index funds and individual stocks can accelerate wealth accumulation.

Between 2010 and 2015, one individual saved $1.25 million by investing in both index funds and individual companies like Amazon. The key was a high savings rate and benefiting from the stock market’s growth during that period.

5. Investment Strategies

5.1. Index Fund Investing

What are the benefits of index fund investing, and why is it recommended for long-term wealth accumulation? Index funds offer diversification and typically provide steady returns over time, making them a solid choice for long-term investors.

Investing in index funds like the Vanguard Total Stock Market Index Fund can yield significant returns. For example, this fund had returns of 13.53% during the period mentioned above, significantly higher than the average.

5.2. Investing In Individual Stocks

When is it appropriate to invest in individual stocks, and what risks should be considered? Investing in individual stocks can offer high returns but also carries higher risk. It’s best to allocate a smaller portion of your portfolio to individual stocks if you are new to investing.

Investing in companies like Amazon and Facebook during their growth phases can lead to substantial gains. For instance, Amazon’s stock increased by 275% between 2010 and 2015, while Facebook’s stock increased by 293% during a similar period.

Financial expert at savewhere.net advises, “Diversification is key. While individual stocks can boost your returns, a diversified portfolio protects you from significant losses.”

6. Key Tips To Save A Million Dollars Fast

6.1. Track Your Finances

Why is tracking finances essential, and what tools can help monitor income, expenses, and investments? Tracking your finances provides a clear picture of your financial health, allowing you to make informed decisions.

Use tools like the Personal Capital app to track your income, expenses, savings rate, and investment performance regularly. Monitoring your finances daily helps you stay on track and make necessary adjustments.

Empower (formerly Personal Capital) logo

Empower (formerly Personal Capital) logo

6.2. Increase Your Income

How can increasing income accelerate the process of saving a million dollars, and what strategies can be used to boost earnings? Higher income provides more capital to save and invest, significantly speeding up the wealth accumulation process.

Seek opportunities to increase your income, such as asking for a raise, getting a new job, developing valuable skills, launching a consulting company, or starting a side hustle.

According to research from the U.S. Bureau of Economic Analysis (BEA), in July 2025, personal income increased by 0.5%, indicating potential opportunities for individuals to boost their earnings.

6.3. Invest More Money

What is the impact of increasing the savings rate, and how can small, incremental increases lead to substantial savings? Gradually increasing your savings rate can make a significant difference over time without drastically impacting your lifestyle.

Increase your savings rate by 1% every 30 days. Starting with a 10% savings rate and incrementally increasing it can result in saving 46% of your income in just three years.

6.4. Stay Consistent

Why is consistency important in investing, and how can you avoid common pitfalls like day trading? Consistency in investing ensures that you benefit from compounding returns over the long term, regardless of market fluctuations.

Avoid day trading and focus on long-term investments. Stick with your investment plan, even during market downturns, to benefit from the power of compounding.

6.5. Focus On The Big Picture

What is the ultimate goal of saving money, and how can you ensure that financial pursuits align with personal values and well-being? Money is a tool to achieve time and freedom. Prioritize your life and well-being while pursuing financial goals.

Remember that money is not the ultimate goal; time and freedom are. Value your life and well-being while striving for financial success.

“Saving a million dollars is a significant achievement, but it’s essential to remember that financial success is a means to an end, not an end in itself,” emphasizes a financial coach at savewhere.net.

7. Understanding Savings Rate And Its Impact

How does savings rate affect the timeline to save a million dollars, and what strategies can improve it? A higher savings rate dramatically reduces the time required to accumulate wealth. Strategies include budgeting, reducing expenses, and increasing income.

| Savings Rate | Years to $1 Million (at $50k Salary) | Years to $1 Million (at $100k Salary) | Years to $1 Million (at $200k Salary) |

|---|---|---|---|

| 10% | 39 | 30 | 21 |

| 30% | 24 | 17 | 11 |

| 50% | 19 | 13 | 8 |

| 70% | 15 | 9 | 5 |

This table illustrates the dramatic impact of savings rate on the time it takes to reach $1 million at different income levels.

8. The Power Of Compounding

How does compounding work, and why is it crucial for accelerating wealth accumulation? Compounding allows your investments to grow exponentially over time, as earnings generate further earnings.

Compounding is the process where the earnings from an investment generate additional earnings. The earlier you start investing, the more significant the impact of compounding.

Albert Einstein famously said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

9. Common Pitfalls To Avoid

What are the common mistakes that hinder wealth accumulation, and how can they be avoided? Common pitfalls include excessive spending, not tracking finances, and making impulsive investment decisions.

- Excessive Spending: Avoid unnecessary expenses by creating a budget and sticking to it.

- Not Tracking Finances: Regularly monitor your income, expenses, and investments to stay on track.

- Impulsive Investment Decisions: Avoid emotional investing and stick to a well-thought-out investment plan.

10. The Role Of Financial Planning

Why is financial planning important, and how can it help achieve long-term financial goals? Financial planning provides a roadmap to achieve your financial goals, including saving a million dollars.

Financial planning involves setting clear financial goals, creating a budget, developing an investment strategy, and regularly reviewing your progress. A financial plan helps you stay focused and make informed decisions.

According to the Consumer Financial Protection Bureau (CFPB), creating a financial plan can significantly improve your financial well-being and help you achieve your long-term goals.

11. Managing Expenses Effectively

How can expenses be managed effectively, and what strategies can help reduce spending without sacrificing quality of life? Effective expense management involves budgeting, tracking spending, and identifying areas where you can cut back.

- Budgeting: Create a detailed budget that outlines your income and expenses.

- Tracking Spending: Monitor your spending to identify areas where you can reduce costs.

- Reducing Costs: Look for ways to save money on housing, transportation, food, and entertainment.

12. Increasing Income Streams

What are the strategies to increase income streams, and how can multiple income sources accelerate wealth accumulation? Increasing income streams provides more capital to save and invest, accelerating your journey to a million dollars.

- Side Hustles: Start a side business or take on freelance work.

- Investments: Generate income through dividends, interest, and rental properties.

- Career Advancement: Seek opportunities for promotions and higher-paying jobs.

13. The Importance Of Setting Financial Goals

Why is setting financial goals important, and how can clear, specific goals drive financial success? Setting financial goals provides a clear target to aim for, motivating you to save and invest consistently.

- Clarity: Define your financial goals, such as saving a million dollars in five years.

- Motivation: Stay motivated by tracking your progress and celebrating milestones.

- Focus: Keep your focus on your goals by reviewing them regularly and making necessary adjustments.

14. Automating Savings And Investments

How can automating savings and investments simplify the process and ensure consistent progress? Automating your savings and investments ensures that you consistently save and invest without having to manually transfer funds.

- Automated Transfers: Set up automatic transfers from your checking account to your savings and investment accounts.

- Payroll Deductions: Contribute to your retirement accounts through payroll deductions.

- Automatic Reinvestments: Reinvest dividends and capital gains automatically to take advantage of compounding.

15. Leveraging Tax-Advantaged Accounts

What are the benefits of tax-advantaged accounts, and how can they help accelerate wealth accumulation? Tax-advantaged accounts, such as 401(k)s and IRAs, offer tax benefits that can significantly boost your savings.

- 401(k)s: Contribute to your employer-sponsored 401(k) to receive tax deductions and potential employer matching contributions.

- IRAs: Open a traditional or Roth IRA to save for retirement with tax advantages.

- HSAs: If eligible, use a Health Savings Account (HSA) for healthcare expenses and long-term savings.

16. Developing A Budgeting Strategy

How can a budgeting strategy help manage finances effectively, and what methods are most effective for different lifestyles? A budgeting strategy provides a framework for managing your income and expenses, helping you save more money.

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Allocate every dollar of your income to a specific purpose, ensuring that your income equals your expenses.

- Envelope System: Use cash for variable expenses, such as groceries and entertainment, to stay within your budget.

17. The Role Of Emergency Funds

Why is an emergency fund essential, and how does it protect against financial setbacks? An emergency fund provides a financial cushion to cover unexpected expenses, preventing you from derailing your savings and investment plans.

- Unexpected Expenses: Cover unexpected medical bills, car repairs, or job loss.

- Financial Security: Provide peace of mind knowing you have funds available for emergencies.

- Avoid Debt: Prevent relying on credit cards or loans for emergencies, which can lead to high-interest debt.

18. Debt Management Strategies

How can debt be managed effectively, and what strategies can help reduce or eliminate high-interest debt? Effective debt management involves creating a plan to pay off your debts as quickly as possible.

- Debt Snowball Method: Pay off your smallest debts first to build momentum and motivation.

- Debt Avalanche Method: Pay off your highest-interest debts first to save money on interest payments.

- Balance Transfers: Transfer high-interest credit card balances to a lower-interest card to save money.

19. Negotiating Lower Bills

How can negotiating lower bills save money, and what strategies are most effective for different types of expenses? Negotiating lower bills can significantly reduce your expenses, freeing up more money to save and invest.

- Insurance: Shop around for lower insurance rates on car, home, and life insurance.

- Utilities: Negotiate lower rates with your utility providers or switch to a cheaper provider.

- Subscriptions: Cancel unused subscriptions and negotiate lower rates on the ones you keep.

20. Utilizing Rewards Programs And Cashback Offers

How can rewards programs and cashback offers save money, and what are the best programs to utilize? Rewards programs and cashback offers can provide significant savings on everyday purchases, boosting your savings rate.

- Credit Card Rewards: Use credit cards that offer cashback, points, or miles on your purchases.

- Store Loyalty Programs: Sign up for loyalty programs at your favorite stores to receive discounts and exclusive offers.

- Cashback Websites: Use cashback websites like Rakuten and Swagbucks to earn cashback on online purchases.

21. The Importance Of Continuous Learning

Why is continuous learning important for financial success, and what resources can help improve financial literacy? Continuous learning keeps you informed about the latest financial strategies and helps you make informed decisions.

- Books: Read books on personal finance, investing, and wealth building.

- Websites: Follow personal finance websites and blogs for tips and advice.

- Courses: Take online courses and workshops to improve your financial literacy.

22. Staying Motivated And Avoiding Burnout

How can you stay motivated on your financial journey, and what strategies can prevent burnout? Staying motivated and avoiding burnout is crucial for long-term financial success.

- Celebrate Milestones: Celebrate your progress and reward yourself for reaching your financial goals.

- Set Realistic Goals: Set achievable goals that align with your values and priorities.

- Take Breaks: Take regular breaks from focusing on your finances to avoid burnout.

23. Community Support And Accountability

How can community support and accountability enhance your financial journey, and where can you find these resources? Community support and accountability can provide motivation, encouragement, and valuable insights.

- Financial Communities: Join online or in-person financial communities to connect with like-minded individuals.

- Accountability Partners: Find an accountability partner to share your goals and track your progress.

- Financial Advisors: Work with a financial advisor to receive personalized guidance and support.

24. Adapting To Changing Circumstances

How can you adapt your financial plan to changing circumstances, and what factors should be considered? Adapting to changing circumstances is crucial for maintaining financial stability and achieving your long-term goals.

- Regular Reviews: Review your financial plan regularly and make necessary adjustments.

- Flexibility: Be flexible and willing to adapt your plan to changing circumstances.

- Contingency Plans: Develop contingency plans to address potential financial setbacks.

25. Seeking Professional Financial Advice

When should you seek professional financial advice, and what benefits can it provide? Seeking professional financial advice can provide personalized guidance and support, helping you make informed decisions and achieve your financial goals.

- Complex Situations: Seek advice if you have complex financial situations, such as significant debt, investments, or estate planning needs.

- Uncertainty: Seek advice if you are unsure about your financial decisions or need help developing a plan.

- Personalized Guidance: Receive personalized guidance and support from a qualified financial advisor.

FAQ: Frequently Asked Questions About Saving A Million Dollars In 5 Years

FAQ 1: Is it really possible to save a million dollars in 5 years?

Yes, it is possible, but it requires a high income, a significant savings rate, and strategic investments.

FAQ 2: What income level is needed to save a million dollars in 5 years?

Generally, an after-tax income of $200,000 or more is needed, with the ability to save and invest a substantial portion of it.

FAQ 3: What savings rate is necessary to achieve this goal?

A savings rate of 70% or higher is typically required to save a million dollars in 5 years.

FAQ 4: What investment strategies are most effective?

A combination of index funds and strategic investments in individual stocks with high growth potential can be effective.

FAQ 5: How important is tracking my finances?

Tracking your finances is crucial for monitoring your progress and making informed decisions.

FAQ 6: Can increasing my income help?

Yes, increasing your income provides more capital to save and invest, significantly speeding up the process.

FAQ 7: What are the common pitfalls to avoid?

Common pitfalls include excessive spending, not tracking finances, and making impulsive investment decisions.

FAQ 8: How can I stay motivated on this challenging journey?

Set clear financial goals, celebrate milestones, and seek support from financial communities.

FAQ 9: What role does financial planning play?

Financial planning provides a roadmap to achieve your financial goals and helps you stay focused and disciplined.

FAQ 10: Is it necessary to seek professional financial advice?

Seeking professional advice can provide personalized guidance and support, especially if you have complex financial situations.

Conclusion: Your Path To Financial Freedom

Saving a million dollars in 5 years is an ambitious goal, but with the right strategies, discipline, and resources, it is achievable. By understanding the key factors, implementing effective savings and investment strategies, and staying motivated, you can pave your path to financial freedom. Visit savewhere.net today to explore more tips, tools, and resources to help you on your journey to financial success. Start making your financial dreams a reality with savewhere.net.

Address: 100 Peachtree St NW, Atlanta, GA 30303, United States

Phone: +1 (404) 656-2000

Website: savewhere.net

Take control of your financial future now and visit savewhere.net to discover more tips, resources, and tools to help you save a million dollars faster. Don’t wait; start building your wealth today!