Hogwarts Legacy is an immersive open-world action RPG set in the 1800s wizarding world. You will want to preserve your progress as you unravel mysteries and explore Hogwarts. Savewhere.net offers a simple guide on saving your progress with the in-game features of Hogwarts Legacy. This article is your comprehensive guide to mastering the art of saving, securing your magical journey, and mastering personal finance.

1. Understanding the Importance of Saving in Hogwarts Legacy

Why is saving your progress crucial in Hogwarts Legacy? Because it protects your time, effort, and digital assets.

- Preventing Lost Progress: A manual save ensures that your character’s progress, acquired items, and narrative decisions are always secured in case of unforeseen game crashes or interruptions.

- Experimentation and Freedom: Manual saves allow players to experiment with various choices and gameplay tactics without worrying about long-term consequences. Players can easily revert to an earlier state and try different options.

- Boss Battles: Hogwarts Legacy features intense encounters and boss battles. Saving before each battle ensures you can quickly retry without losing progress.

- Long Quests: Manual save points during long quests will prevent you from replaying long stretches of gameplay when you die.

By actively managing your save data, you ensure your adventure through Hogwarts is as seamless and rewarding as possible.

2. Automatic Saving Explained

The game has an autosave feature, but understanding it is crucial.

2.1 How Autosave Works

The autosave feature runs in the background, logging your progress at specific intervals or key moments. Here’s what to expect:

- Triggers: Autosaves commonly occur after major events, such as completing quests, finishing cutscenes, or reaching certain milestones in the storyline.

- Frequency: The time between autosaves varies but is generally designed to minimize potential progress loss.

- Indicator: Look for a waving wand icon at the bottom of your screen to show an active autosave.

2.2 How to Enable Autosave

Here’s how to make sure autosave is enabled.

- Open the Main Menu.

- Go to Settings.

- Choose Gameplay.

- Look for Save.

- Check that the AutoSave option is turned on.

2.3 Limitations of Autosave

While convenient, autosave has limitations:

- Infrequent saves: Autosaves might not occur as frequently as you’d like.

- Lack of control: You can’t control when autosaves occur.

- Overwriting: Autosaves can overwrite previous states.

Understanding these limitations will lead to using manual saves more effectively.

3. Mastering Manual Saves

Using manual saves gives you the most control.

3.1 Step-by-Step Guide to Manual Saving

Here’s how to perform a manual save.

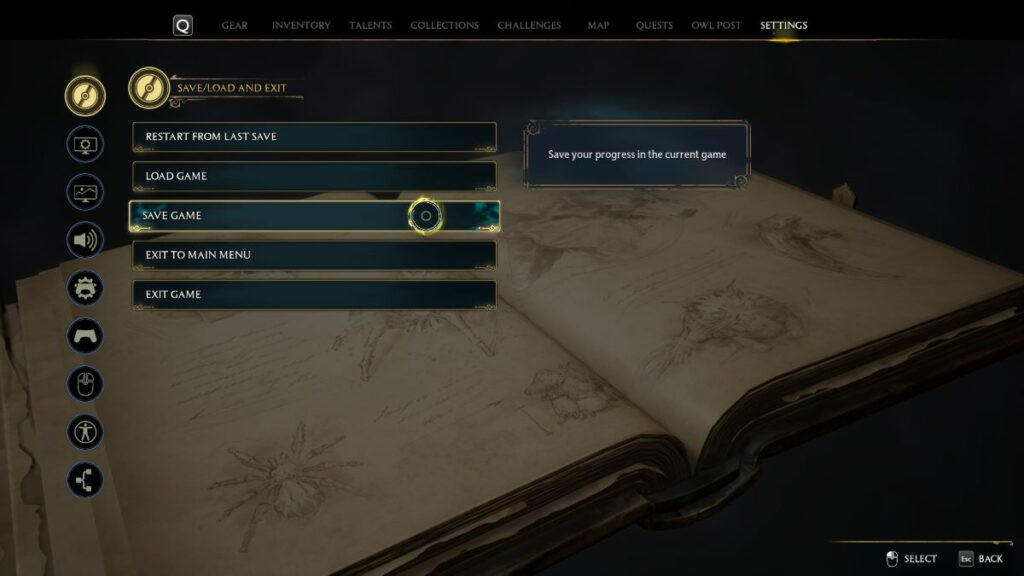

- Open the Main Menu.

- Go to Settings at the bottom-right of the action wheel.

- Choose the Save Game directive.

- Select the save slot you’d like to use. To overwrite a current save, choose the top slot. To create a separate save to switch between slots later on, choose an empty slot.

- Saving requires a long press, depending on your platform. Wait for the white ring to make a complete circle to fully log your progress. Your save will fail if you release the control before the ring is complete.

Choose Save Game in Hogwarts Legacy

Choose Save Game in Hogwarts Legacy

3.2 Save Slots Management

Effective management of save slots is essential. Here are some tips:

- Multiple Saves: Use multiple save slots to keep various points in the game.

- Naming Saves: Though Hogwarts Legacy doesn’t allow custom names, remember key points.

- Regular Cleaning: Delete old or unnecessary saves to keep things organized.

3.3 Best Practices for Manual Saving

Here’s when to manually save.

- Before Tough Battles: Before entering challenging battles or duels, save your progress.

- After Completing Quests: Save after completing significant quests or missions.

- Before Making Choices: Many quests in Hogwarts Legacy involve critical decisions.

- Before Exploring Risky Areas: Save before entering dangerous or unknown areas.

4. Troubleshooting Save Issues

Sometimes, saving can be problematic.

4.1 Common Save Errors and Solutions

Here are some common issues and fixes:

- “Save Failed” Error: Check storage space. If space is low, delete unnecessary files.

- Game Freezes During Save: Close unnecessary applications. If the issue persists, restart your system.

- Corrupted Save Files: Unfortunately, corrupted files are often unrecoverable.

4.2 Preventing Save Data Loss

Taking preventive measures can minimize the risk of data loss.

- Regular Backups: Regularly back up your save data to an external drive or cloud service.

- Avoid Interrupting Saves: Never turn off your console or PC during a save.

- Monitor Storage: Keep an eye on your storage space.

4.3 Contacting Support

If problems continue, contact technical support for your platform.

5. The Connection Between Saving In-Game and Saving in Real Life

Saving in Hogwarts Legacy and saving money share the principles of planning, consistency, and security.

5.1 Planning and Strategy

- In-Game: Before a risky quest, players often create a manual save to revert to that point if things go wrong.

- Real Life: Creating a budget outlines income and expenses, helping individuals allocate funds effectively, like saving before a “risky quest.” According to the U.S. Bureau of Economic Analysis (BEA), personal saving as a percentage of disposable personal income was 3.6% in July 2024.

5.2 Consistency and Discipline

- In-Game: Regular saving prevents significant progress loss from unexpected game crashes.

- Real Life: Setting aside a fixed amount of money each month builds a substantial emergency fund. According to a 2023 survey by Bankrate, only 39% of Americans would be able to cover a $1,000 emergency expense with savings.

5.3 Security and Risk Management

- In-Game: Backing up save files prevents data loss.

- Real Life: Diversifying investments mitigates the risk of losing all your money if one investment performs poorly. The Securities and Exchange Commission (SEC) emphasizes diversification as a key strategy for managing investment risk.

5.4 Adapting to Change

- In-Game: Adjusting your strategy if a particular quest is too challenging.

- Real Life: Reviewing and adjusting your budget regularly to adapt to changes in income or expenses.

6. Saving Money Like Saving Your Game: Practical Strategies

Saving money effectively involves similar strategies to saving your game progress: planning, regular action, and security.

6.1 Budgeting as a Saving Strategy

Budgeting is the financial equivalent of planning your in-game saves. It involves tracking your income and expenses to manage your money effectively.

- Track Your Income: List all sources of income, including salary, investments, and any side hustles.

- List Expenses: Categorize spending into fixed (rent, utilities) and variable (groceries, entertainment) expenses.

- Use Budgeting Tools: Apps like Mint, YNAB (You Need a Budget), and Personal Capital can automate tracking and provide insights.

- Set Financial Goals: Define what you’re saving for, such as a down payment on a house, retirement, or an emergency fund.

- Review Regularly: Check your budget regularly.

6.2 Automate Savings

Automating savings is like setting up autosave in Hogwarts Legacy. You set it and forget it, ensuring consistent progress without manual effort.

- Set Up Direct Deposit: Have a portion of your paycheck automatically deposited into a savings account.

- Use Bank Transfers: Schedule regular transfers from your checking to your savings account.

- Round-Up Savings: Some banks offer programs that round up purchases to the nearest dollar and transfer the difference to savings.

- Employer Retirement Plans: Maximize contributions to 401(k) or other retirement plans, especially if your employer offers matching contributions.

6.3 Reduce Daily Expenses

Reducing daily expenses is akin to finding hidden treasures and resources in Hogwarts Legacy. Small savings add up over time.

- Meal Planning: Plan your meals for the week, shop with a list, and cook at home.

- Cut Unnecessary Subscriptions: Review subscriptions and cancel those you don’t use.

- Energy Efficiency: Use energy-efficient appliances, turn off lights when you leave a room, and adjust your thermostat.

- Transportation Costs: Walk, bike, or use public transport instead of driving whenever possible.

- Negotiate Bills: Negotiate with service providers for lower rates on internet, cable, and insurance.

6.4 Emergency Fund

Just as you save your game before a tough battle, an emergency fund protects you from unexpected financial setbacks.

- Set a Goal: Aim to save three to six months’ worth of living expenses.

- Start Small: Begin with a smaller goal, like $1,000, and gradually increase it.

- Separate Account: Keep your emergency fund in a separate, easily accessible savings account.

- Avoid Dipping In: Only use the emergency fund for true emergencies, like medical bills or job loss.

6.5 Use Savings Apps

Savings apps use technology to help you save more efficiently, much like game guides help you navigate Hogwarts Legacy.

- Acorns: Invests spare change from purchases.

- Digit: Analyzes spending habits and automatically saves small amounts.

- Qapital: Sets savings goals and automates savings based on triggers and rules.

- Personal Capital: Offers financial planning and investment tracking tools.

6.6 Financial Education

Improving your financial literacy is like mastering new spells in Hogwarts Legacy. The Consumer Financial Protection Bureau (CFPB) offers resources for financial education.

- Read Books: “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki are great options.

- Take Online Courses: Platforms like Coursera and Udemy offer courses on personal finance.

- Follow Financial Blogs: Blogs like The Penny Hoarder and Mr. Money Mustache provide practical tips.

- Attend Workshops: Local community centers and libraries often host free financial workshops.

6.7 Savewhere.net Resources

Websites like savewhere.net offer tips, tricks, and strategies to save money effectively.

- Read Articles: Look for articles on budgeting, saving, and investing.

- Use Calculators: Use financial calculators to plan savings and investments.

- Sign Up for Newsletters: Get regular updates on deals, discounts, and money-saving tips.

- Join Communities: Connect with others to share advice and support.

7. Finding Real-World “Save Points”: Financial Resources in Atlanta

Discovering financial resources is like finding hidden passages in Hogwarts.

7.1 Local Banks and Credit Unions

Local financial institutions often offer personalized services and community support.

- SunTrust Bank (now Truist): Offers various savings accounts, financial planning services, and community support programs.

- Address: 303 Peachtree St NE, Atlanta, GA 30308

- Phone: +1 (404) 588-7711

- Delta Community Credit Union: Provides competitive rates on savings accounts, loans, and financial education resources.

- Address: 3250 Riverwood Pkwy SE, Atlanta, GA 30339

- Phone: +1 (800) 541-3328

- Fifth Third Bank: Offers financial literacy programs, savings tools, and personalized banking services.

- Address: 25 Park Place NE, Atlanta, GA 30303

- Phone: +1 (800) 972-3030

7.2 Non-Profit Financial Counseling Services

Non-profit organizations offer free or low-cost financial counseling.

- Credit Counseling of Atlanta: Provides credit counseling, debt management plans, and financial education.

- Address: 235 Peachtree St NE Suite 400, Atlanta, GA 30303

- Phone: +1 (800) 251-2227

- United Way of Greater Atlanta: Connects individuals with resources for financial stability, including job training and income support.

- Address: 100 Peachtree St NW, Atlanta, GA 30303

- Phone: +1 (404) 527-7200

- Website: savewhere.net

- Georgia Resource Center: Offers financial literacy programs and assistance with housing and employment.

- Address: 150 E Ponce de Leon Ave Suite 250, Decatur, GA 30030

- Phone: +1 (404) 371-2010

7.3 Government Resources

Government programs provide a safety net for those in need.

- Georgia Department of Human Services: Administers programs like SNAP (Supplemental Nutrition Assistance Program) and TANF (Temporary Assistance for Needy Families).

- Address: 2 Peachtree St NW, Atlanta, GA 30303

- Phone: +1 (404) 657-5274

- Internal Revenue Service (IRS): Offers free tax preparation services and resources for low-income individuals through the Volunteer Income Tax Assistance (VITA) program.

- Address: 401 W Peachtree St NW, Atlanta, GA 30308

- Phone: +1 (800) 829-1040

- U.S. Department of Housing and Urban Development (HUD): Provides resources for affordable housing and rental assistance.

- Address: 40 Marietta St NW, Atlanta, GA 30303

- Phone: +1 (404) 331-5142

7.4 Community Centers and Libraries

Community centers and libraries offer free workshops and resources.

- Atlanta-Fulton Public Library System: Hosts workshops on budgeting, credit management, and investing.

- Address: 1 Margaret Mitchell Square NW, Atlanta, GA 30303

- Phone: +1 (404) 730-1700

- YMCA of Metro Atlanta: Offers programs focused on financial literacy, job readiness, and community development.

- Address: 100 Edgewood Ave NE Suite 1200, Atlanta, GA 30303

- Phone: +1 (404) 688-9622

- Boys & Girls Clubs of Metro Atlanta: Provides programs for youth focused on financial literacy, career exploration, and leadership development.

- Address: 1331 Greene Ave NW, Atlanta, GA 30318

- Phone: +1 (404) 527-7100

8. Maximizing Your Savings: Advanced Tips and Tricks

Like discovering advanced spells, these techniques can significantly enhance your savings.

8.1 High-Yield Savings Accounts

High-yield savings accounts offer higher interest rates than traditional savings accounts.

- Shop Around: Compare rates from different banks and credit unions. Online banks often offer the best rates.

- Consider FDIC Insurance: Ensure your account is FDIC-insured for up to $250,000 per depositor, per insured bank.

- Read the Fine Print: Check for fees, minimum balance requirements, and any restrictions on withdrawals.

8.2 Investing Basics

Investing can grow your money faster than savings accounts.

- Start Early: The earlier you start, the more time your investments have to grow.

- Diversify: Spread your investments across different asset classes, like stocks, bonds, and real estate.

- Use Tax-Advantaged Accounts: Utilize 401(k)s, IRAs, and other tax-advantaged accounts to reduce your tax burden.

8.3 Refinancing Debt

Refinancing can lower your interest rates and monthly payments.

- Credit Score: Check your credit score and improve it before applying for refinancing.

- Shop Around: Compare offers from different lenders to find the best rates and terms.

- Consider Closing Costs: Factor in any fees or closing costs associated with refinancing.

8.4 Side Hustles

Increasing your income through side hustles can accelerate your savings goals.

- Freelancing: Offer your skills on platforms like Upwork and Fiverr.

- Delivery Services: Drive for Uber Eats or DoorDash.

- Online Tutoring: Tutor students online in subjects you excel in.

- Selling Crafts: Sell handmade items on Etsy.

9. Common Financial Pitfalls and How to Avoid Them

Avoiding financial traps is crucial for long-term financial health.

9.1 High-Interest Debt

Avoid credit card debt and payday loans.

- Pay Off Balances: Pay off credit card balances in full each month.

- Avoid Payday Loans: Steer clear of payday loans, which have high interest rates and fees.

- Debt Snowball or Avalanche: Use the debt snowball or avalanche method to pay off debt.

9.2 Lifestyle Inflation

Resist the urge to increase spending as income rises.

- Budget Consciously: Stick to your budget even as your income increases.

- Save Windfalls: Save unexpected income, like bonuses or tax refunds.

- Set Financial Goals: Focus on long-term financial goals rather than short-term gratification.

9.3 Impulse Purchases

Avoid making unplanned purchases.

- Wait 24 Hours: Wait 24 hours before making non-essential purchases.

- Unsubscribe from Emails: Unsubscribe from marketing emails that tempt you to spend.

- Shop with a List: Always shop with a list and stick to it.

9.4 Neglecting Emergency Savings

Always prioritize building an emergency fund.

- Automate Savings: Set up automated transfers to your emergency fund.

- Treat it Like a Bill: Consider your emergency fund contribution as a non-negotiable expense.

- Start Small: Begin with a smaller goal and gradually increase it.

10. Hogwarts Legacy Meets Personal Finance: A Recap

By applying the principles of saving in Hogwarts Legacy to your financial life, you can achieve financial stability.

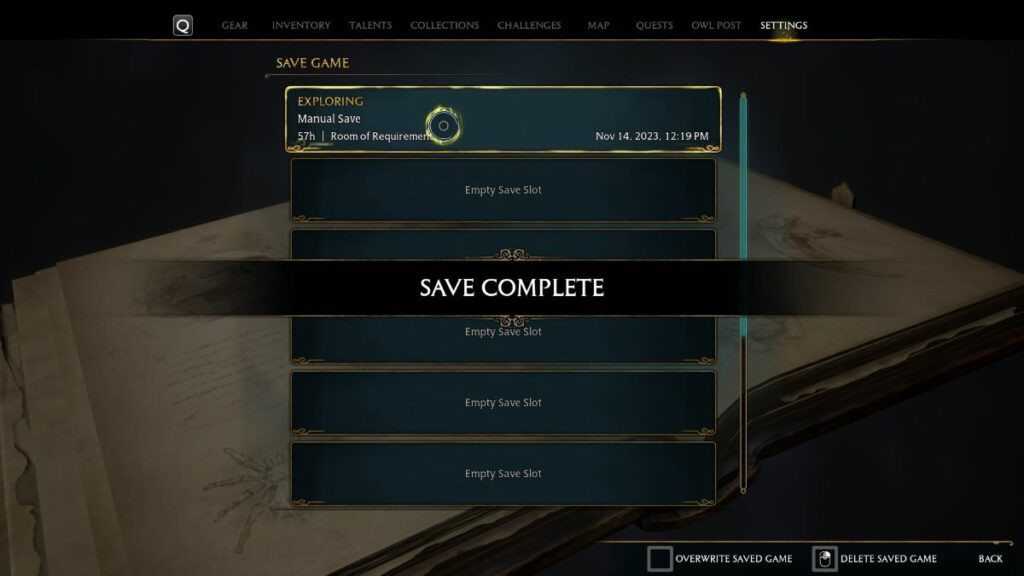

Wait for progress to save in Hogwarts Legacy

Wait for progress to save in Hogwarts Legacy

- Planning: Budgeting is planning your financial journey.

- Consistency: Automating savings is regular in-game saving.

- Security: Emergency funds are your financial shield.

- Education: Financial literacy is mastering new spells.

Ready to master your financial magic? Visit savewhere.net for more tips, deals, and resources to help you save money, find financial resources in Atlanta, and connect with a community of like-minded savers. Start your journey to financial freedom today Address: 100 Peachtree St NW, Atlanta, GA 30303, United States. Phone: +1 (404) 656-2000. Website: savewhere.net.

Frequently Asked Questions (FAQs)

- How often should I manually save in Hogwarts Legacy?

- Manually save before and after major quests, tough battles, and any significant decision.

- What happens if I lose my save data?

- If you’ve backed up your saves, you can restore them. If not, you may have to restart from your last autosave.

- Can I have too many save files?

- Having too many save files can take up storage space.

- Is autosave enough to protect my progress?

- Autosave is helpful but not as reliable as manual saves.

- How do I back up my save data on PC?

- Locate the save folder and copy it to an external drive or cloud service.

- How do I back up my save data on PlayStation or Xbox?

- Use PlayStation Plus or Xbox Live cloud storage.

- What are some common signs of a corrupted save file?

- Game crashes, errors, or inability to load the save.

- Can I recover a corrupted save file?

- Sometimes, but it’s rare. Prevention through regular backups is best.

- How do I manage my finances effectively?

- Create a budget, automate savings, reduce daily expenses, and build an emergency fund.

- Where can I find financial resources in Atlanta?

- Local banks, credit unions, non-profit counseling services, and government resources are available.