Are you looking for practical methods to save money and manage your finances better? Pages can be a helpful tool. At savewhere.net, we provide you with innovative savings strategies and resources to improve your financial wellness. Learn how to use Pages to track your spending, create budgets, and achieve your savings goals.

1. Understanding How to Save in Pages: The Basics

Saving documents in Pages is simple, but utilizing its features to manage your finances can be a game-changer for budget-conscious individuals, students, young professionals, and families alike. Whether you’re aiming to cut daily expenses, save for a specific goal, or simply improve your financial habits, mastering Pages can offer practical solutions.

1.1. What Is Pages and Why Use It for Saving?

Pages is a versatile word processing application developed by Apple, ideal for creating documents, reports, and more. Its user-friendly interface and powerful features make it perfect for personal finance management.

- Budget Creation: Pages helps you create detailed budgets, track income and expenses, and visualize your financial status.

- Goal Setting: You can set clear financial goals, track progress, and stay motivated.

- Template Availability: Utilize pre-designed templates for budgets, financial reports, and savings plans.

1.2. Identifying Your Financial Goals

Before you start using Pages, clarify your financial objectives. Having well-defined goals helps you stay focused and motivated.

- Short-Term Goals: Saving for a vacation, paying off credit card debt, or creating an emergency fund.

- Mid-Term Goals: Buying a car, saving for a down payment on a house, or funding a home renovation.

- Long-Term Goals: Retirement planning, children’s education, or investment portfolios.

1.3. Setting Up Pages for Financial Tracking

To begin, set up your Pages document for effective financial tracking.

- Open Pages: Launch the Pages app on your Mac or iOS device.

- Choose a Template: Select a suitable template or start with a blank document. Templates like “Budget” or “Financial Report” can be very useful.

- Customize the Template: Modify the template to fit your specific needs. Add or remove categories to match your income and expense streams.

2. Creating a Budget in Pages

Budgeting is a foundational element of financial management. Pages offers several tools to help you create and maintain an effective budget.

2.1. Designing Your Budget Template

Start by designing a budget template that suits your needs. Include sections for income, expenses, and savings.

- Income Section: List all sources of income, such as salary, freelance work, investments, etc.

- Expense Section: Categorize your expenses (e.g., housing, transportation, food, entertainment).

- Savings Section: Allocate a portion of your income to savings and investments.

2.2. Inputting Your Income and Expenses

Regularly update your budget with your actual income and expenses. Accuracy is key to effective financial tracking.

- Track Income: Record all income as soon as you receive it.

- Monitor Expenses: Keep track of your spending daily or weekly. Use banking apps, receipts, and other tools to ensure accuracy.

- Categorize Transactions: Assign each transaction to a specific expense category.

2.3. Utilizing Formulas for Automatic Calculations

Pages allows you to use formulas to automate calculations, making budgeting easier and more efficient.

- Total Income: Use the SUM formula to calculate total income. For example,

=SUM(B2:B10)to add up income from cells B2 to B10. - Total Expenses: Calculate total expenses using the SUM formula.

- Savings Rate: Calculate your savings rate with the formula

=(Savings/Income)*100. This shows the percentage of your income you are saving. - Net Income: Determine your net income (Income – Expenses) to see how much money you have left after expenses.

2.4. Visualizing Your Budget with Charts

Charts can help you visualize your budget, making it easier to understand your spending habits and financial health.

- Pie Charts: Show the proportion of each expense category relative to your total expenses.

- Bar Graphs: Compare income and expenses over time.

- Line Graphs: Track your savings progress and identify trends.

Pie chart visualizing budget expenses in Pages

Pie chart visualizing budget expenses in Pages

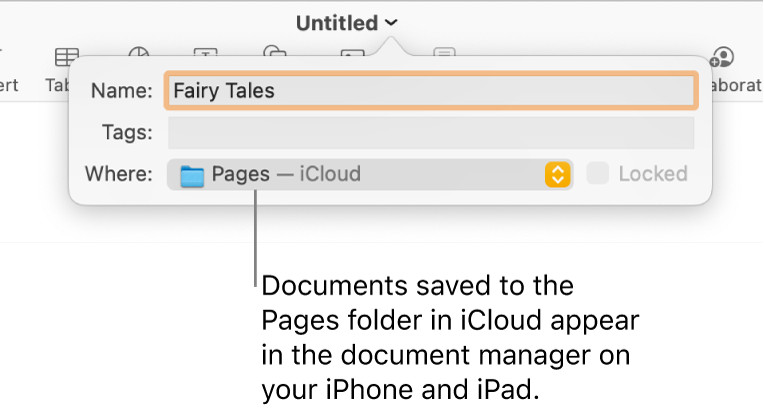

Alt text: The Save dialog for a document with Pages—iCloud in the Where pop-up menu.

3. Tracking Your Spending in Pages

Effective spending tracking is essential for identifying areas where you can save money.

3.1. Setting Up a Spending Tracker

Create a separate section in your Pages document to track your daily, weekly, or monthly spending.

- Date: Record the date of each transaction.

- Description: Provide a brief description of the transaction (e.g., “Grocery shopping at Kroger”).

- Category: Assign the transaction to a specific category (e.g., “Food,” “Transportation,” “Entertainment”).

- Amount: Enter the amount spent.

3.2. Categorizing Expenses Effectively

Categorizing your expenses helps you understand where your money is going. Common categories include:

- Housing: Rent, mortgage payments, property taxes, insurance.

- Transportation: Car payments, gas, public transport, maintenance.

- Food: Groceries, dining out, coffee.

- Utilities: Electricity, water, gas, internet, phone.

- Healthcare: Insurance premiums, doctor visits, prescriptions.

- Entertainment: Movies, concerts, hobbies.

- Personal Care: Haircuts, toiletries, clothing.

- Debt Payments: Credit card bills, student loans, personal loans.

- Savings: Contributions to savings accounts, investments.

3.3. Analyzing Spending Patterns

Regularly analyze your spending patterns to identify areas where you can cut back.

- Review Spending: Go through your spending tracker at the end of each week or month.

- Identify Trends: Look for patterns in your spending. Are you spending too much on dining out or entertainment?

- Adjust Budget: Based on your spending analysis, adjust your budget to allocate more money to savings and less to unnecessary expenses.

3.4. Using Conditional Formatting to Highlight Overspending

Conditional formatting in Pages can help you quickly identify areas where you are overspending.

- Select Cells: Select the cells in your spending tracker that you want to monitor.

- Add Rule: Choose “Format” > “Conditional Formatting” from the menu.

- Set Conditions: Set rules to highlight cells that exceed a certain amount. For example, highlight expenses in red if they exceed your budgeted amount for that category.

4. Setting Savings Goals in Pages

Having clear savings goals is crucial for staying motivated and achieving financial success.

4.1. Defining Specific, Measurable, Achievable, Relevant, and Time-Bound (SMART) Goals

Set SMART goals to ensure they are effective and attainable.

- Specific: Clearly define what you want to achieve (e.g., “Save $5,000 for a down payment on a car”).

- Measurable: Set a measurable target (e.g., “$5,000”).

- Achievable: Ensure your goal is realistic and attainable given your income and expenses.

- Relevant: Make sure your goal aligns with your overall financial objectives.

- Time-Bound: Set a deadline for achieving your goal (e.g., “Save $5,000 in 12 months”).

4.2. Creating a Savings Plan

Develop a detailed savings plan that outlines how you will achieve your savings goals.

- Calculate Monthly Savings: Determine how much you need to save each month to reach your goal.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month.

- Track Progress: Monitor your progress regularly and make adjustments as needed.

4.3. Tracking Progress Towards Goals

Use Pages to track your progress toward your savings goals.

- Create a Table: Set up a table with columns for “Month,” “Target Savings,” “Actual Savings,” and “Difference.”

- Update Regularly: Update the table each month with your actual savings.

- Analyze Results: Compare your actual savings to your target savings and identify any shortfalls.

4.4. Visualizing Savings Progress with Charts

Charts can help you visualize your savings progress, making it easier to stay motivated.

- Line Graph: Track your savings over time and see how you are progressing towards your goal.

- Bar Graph: Compare your actual savings to your target savings each month.

Alt text: Go to the Pages app on your Mac.

5. Advanced Tips for Saving Money with Pages

Take your savings efforts to the next level with these advanced tips.

5.1. Creating Multiple Budgets for Different Scenarios

Create multiple budgets to plan for different scenarios, such as job loss or unexpected expenses.

- Normal Budget: Your regular budget with your current income and expenses.

- Emergency Budget: A budget with reduced expenses in case of job loss or unexpected events.

- Savings Budget: A budget focused on maximizing savings for specific goals.

5.2. Using Pages with Other Financial Tools and Apps

Integrate Pages with other financial tools and apps to streamline your financial management.

- Export Data: Export data from your banking apps and import it into Pages for analysis.

- Link Documents: Link your Pages budget to other financial documents, such as investment reports or tax returns.

5.3. Automating Data Entry with Scripts (if applicable)

If you are comfortable with scripting, you can automate data entry in Pages.

- AppleScript: Use AppleScript to automate tasks such as importing data from spreadsheets or updating charts.

5.4. Sharing and Collaborating on Budgets with Family Members

Share your Pages budget with family members to collaborate on financial planning.

- iCloud Sharing: Use iCloud to share your Pages document with family members.

- Collaboration: Allow family members to view and edit the document in real-time.

6. Real-Life Examples of Saving Money with Pages

See how others are using Pages to save money effectively.

6.1. Case Study 1: Saving for a Down Payment on a House

- Goal: Save $20,000 for a down payment on a house in 2 years.

- Strategy: Created a detailed budget in Pages, tracked expenses meticulously, and automated savings transfers.

- Results: Successfully saved $20,000 in 2 years and purchased a house.

6.2. Case Study 2: Paying Off Credit Card Debt

- Goal: Pay off $5,000 in credit card debt in 1 year.

- Strategy: Used Pages to create a debt repayment plan, cut unnecessary expenses, and allocate extra income to debt payments.

- Results: Paid off $5,000 in credit card debt in 1 year and improved credit score.

6.3. Case Study 3: Building an Emergency Fund

- Goal: Save $10,000 for an emergency fund in 18 months.

- Strategy: Developed a savings plan in Pages, automated savings contributions, and tracked progress regularly.

- Results: Built a $10,000 emergency fund in 18 months and gained financial security.

7. Common Mistakes to Avoid When Saving Money with Pages

Avoid these common mistakes to maximize your savings potential.

7.1. Not Tracking Expenses Regularly

Inconsistent expense tracking can lead to inaccurate budgeting and missed savings opportunities.

- Solution: Set a reminder to track expenses daily or weekly.

- Tip: Use a mobile app to track expenses on the go.

7.2. Setting Unrealistic Savings Goals

Setting unrealistic savings goals can lead to discouragement and failure.

- Solution: Set SMART goals that are achievable and relevant.

- Tip: Start with smaller, more manageable goals and gradually increase them.

7.3. Ignoring Budget Variances

Ignoring budget variances can prevent you from identifying and addressing overspending.

- Solution: Review your budget regularly and analyze any variances.

- Tip: Use conditional formatting to highlight variances in your Pages document.

7.4. Failing to Adjust Budget as Needed

Failing to adjust your budget as your income and expenses change can make it ineffective.

- Solution: Review and adjust your budget regularly to reflect changes in your financial situation.

- Tip: Create multiple budgets for different scenarios.

8. Expert Advice on Saving Money and Using Pages

Get expert insights on saving money and maximizing the use of Pages.

8.1. Quotes from Financial Experts

- Suze Orman: “A budget is telling your money where to go instead of wondering where it went.”

- Dave Ramsey: “You must gain control over your money or the lack of it will forever control you.”

- Robert Kiyosaki: “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

8.2. Tips from Certified Financial Planners (CFPs)

- Create a Detailed Budget: “A well-structured budget is the foundation of financial success. Use Pages to track every dollar coming in and going out,” advises CFP John Smith.

- Automate Savings: “Set up automatic transfers to your savings account to ensure you are consistently saving,” recommends CFP Jane Doe.

- Review Regularly: “Review your budget and financial goals at least once a month to stay on track and make necessary adjustments,” suggests CFP David Lee.

8.3. Recommendations from Personal Finance Bloggers

- Use Templates: “Utilize Pages templates to create professional-looking budgets and financial reports quickly,” suggests personal finance blogger Sarah Jones.

- Track Progress: “Track your progress towards your savings goals and celebrate milestones to stay motivated,” recommends blogger Mike Brown.

- Share and Collaborate: “Share your budget with your partner or family members to collaborate on financial planning,” advises blogger Emily Green.

9. Savewhere.net: Your Partner in Saving Money

Discover how savewhere.net can help you achieve your financial goals.

9.1. Overview of Savewhere.net

Savewhere.net is dedicated to providing you with innovative savings strategies and resources to improve your financial wellness.

9.2. Resources and Tools Available on Savewhere.net

- Budgeting Templates: Download free budgeting templates for Pages and other applications.

- Financial Calculators: Use our financial calculators to estimate savings, calculate debt repayment, and plan for retirement.

- Savings Tips: Access a library of articles and guides on saving money in various areas of your life.

- Community Forum: Connect with other savers and share tips and advice in our community forum.

9.3. How Savewhere.net Can Help You Save More Effectively

Savewhere.net offers personalized savings recommendations based on your financial situation and goals.

- Personalized Advice: Get tailored savings advice based on your income, expenses, and savings goals.

- Exclusive Deals: Access exclusive deals and discounts on products and services that can help you save money.

- Expert Support: Get support from our team of financial experts to answer your questions and guide you on your savings journey.

9.4. Success Stories from Savewhere.net Users

- John from Atlanta: “Thanks to Savewhere.net, I was able to create a budget in Pages and save $5,000 in 6 months for an emergency fund.”

- Emily from New York: “Savewhere.net helped me pay off my credit card debt by providing a debt repayment plan and budgeting tips.”

- Michael from Los Angeles: “I used Savewhere.net’s budgeting templates to save for a down payment on a house and achieved my goal in 2 years.”

10. Frequently Asked Questions (FAQs) About Saving Money with Pages

10.1. Can I use Pages on my iPhone or iPad to track my finances?

Yes, Pages is available on iOS devices, allowing you to track your finances on the go. Ensure your documents are synced via iCloud for seamless access.

10.2. Is there a free budget template available for Pages?

Yes, numerous free budget templates are available online. Savewhere.net also offers free templates designed specifically for Pages.

10.3. How can I protect my financial data in Pages?

Protect your financial data by using a strong password for your Apple ID and enabling two-factor authentication. Additionally, consider encrypting your Pages documents.

10.4. Can I export my Pages budget to other formats like Excel?

Yes, you can export your Pages document to various formats, including Microsoft Excel, for compatibility and sharing.

10.5. How often should I update my budget in Pages?

Update your budget regularly, ideally weekly or monthly, to ensure accuracy and to track your progress towards your savings goals.

10.6. What if my income changes during the month?

Adjust your budget accordingly by updating the income section in your Pages document to reflect the new income amount.

10.7. How can I track my investments in Pages?

Create a separate section in your Pages document to track your investments, including the type of investment, initial investment amount, and current value.

10.8. What are some creative ways to cut expenses and save more money?

Consider reducing dining out, canceling unused subscriptions, negotiating bills, and finding free or low-cost entertainment options.

10.9. Can I use Pages to plan for retirement?

Yes, Pages can be used to create a retirement plan by estimating future expenses, calculating savings needed, and tracking progress towards your retirement goals.

10.10. Where can I find more resources and support for saving money?

Savewhere.net offers a variety of resources and support, including budgeting templates, financial calculators, savings tips, and a community forum.

Start saving money effectively today by leveraging the power of Pages and the resources available at savewhere.net!

Ready to take control of your finances and start saving money like never before? Visit savewhere.net now to explore our comprehensive resources, discover exclusive deals, and connect with a community of like-minded savers in the USA. Don’t wait—achieve your financial goals with savewhere.net today! Address: 100 Peachtree St NW, Atlanta, GA 30303, United States. Phone: +1 (404) 656-2000.