Are you looking for effective strategies on How To Save Money In Business and improve your bottom line? Savewhere.net provides actionable tips and creative ideas to help businesses like yours cut costs, boost efficiency, and achieve financial stability. Discover how to optimize expenses, improve cash flow, and invest in your company’s future with financial planning, cost reduction strategies, and cash flow management.

1. Why Is Saving Money Important for Businesses?

Saving money is crucial for businesses for several reasons. Businesses improve financial stability, which leads to better decision-making. According to the U.S. Bureau of Economic Analysis (BEA), effective financial management can significantly increase a company’s profitability by optimizing resource allocation.

- Financial Stability: Saving money builds a financial cushion, enabling businesses to weather economic downturns and unexpected expenses.

- Growth Opportunities: Conserved funds can be reinvested into business growth, such as expanding operations, launching new products, or improving marketing efforts.

- Improved Profitability: Reducing expenses directly increases profits, making the business more attractive to investors and lenders.

- Competitive Advantage: Businesses that manage their finances well can offer competitive pricing, invest in innovation, and respond quickly to market changes.

- Better Decision-Making: Financial stability allows business owners to make strategic decisions without the pressure of immediate financial concerns.

Businesses save money to enhance their long-term sustainability and success.

2. What Are Some Basic Strategies for Saving Money in Business?

Basic strategies for saving money in business include cutting unnecessary costs and improving operational efficiency. Here are some key approaches:

- Budgeting: Create a detailed budget to track income and expenses, identifying areas where you can cut back.

- Negotiate with Suppliers: Negotiate better deals with suppliers to reduce procurement costs.

- Energy Efficiency: Implement energy-saving measures to lower utility bills.

- Reduce Waste: Minimize waste in all areas of your business, from office supplies to inventory.

- Technology Adoption: Utilize technology to automate tasks, improve productivity, and reduce labor costs.

- Outsourcing: Consider outsourcing non-core functions to reduce overhead expenses.

- Monitor Cash Flow: Regularly monitor your cash flow to identify potential financial problems early.

These basic strategies provide a solid foundation for effective cost management and long-term financial health for any business.

3. How Can I Reduce Office-Related Expenses?

Reducing office-related expenses involves several strategies. A business saves money and promotes environmentally friendly practices.

- Go Paperless: Reduce paper consumption by using digital documents and online collaboration tools.

- Energy-Efficient Equipment: Invest in energy-efficient office equipment and appliances.

- Remote Work: Allow employees to work remotely to reduce office space and utility costs.

- Negotiate Rent: Negotiate a lower rent or consider moving to a smaller, more affordable office space.

- Reduce Printing Costs: Implement strict printing policies and use double-sided printing.

- Buy in Bulk: Purchase office supplies in bulk to take advantage of discounts.

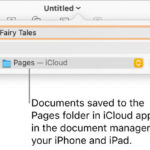

- Use Cloud Services: Utilize cloud-based services to reduce IT infrastructure costs.

By implementing these strategies, you can significantly lower your office-related expenses and improve your bottom line.

4. What Are Some Creative Ways to Save Money on Marketing?

Creative ways to save money on marketing include leveraging digital channels and focusing on cost-effective strategies. A business saves money while maintaining a strong market presence.

- Social Media Marketing: Utilize free social media platforms to engage with customers and promote your brand.

- Email Marketing: Build an email list and send targeted newsletters and promotions to reduce advertising costs.

- Content Marketing: Create valuable content to attract and retain customers, reducing the need for paid advertising.

- SEO Optimization: Optimize your website for search engines to increase organic traffic.

- Partnerships: Collaborate with other businesses for cross-promotional opportunities.

- Customer Referrals: Implement a customer referral program to acquire new customers at a lower cost.

- DIY Marketing Materials: Create your marketing materials using free design tools.

By implementing these creative marketing strategies, you can achieve significant cost savings and enhance your marketing effectiveness.

5. How Can Technology Help Save Money in Business?

Technology can significantly help save money in business by automating processes, improving efficiency, and reducing operational costs.

- Automation Software: Use software to automate repetitive tasks, reducing the need for manual labor.

- Cloud Computing: Migrate to cloud-based services to reduce IT infrastructure and maintenance costs.

- Communication Tools: Utilize video conferencing and VoIP systems to reduce travel and communication expenses.

- Data Analytics: Implement data analytics tools to identify areas for cost optimization and efficiency improvements.

- Project Management Software: Use project management software to improve collaboration and ensure projects are completed on time and within budget.

- CRM Systems: Implement a customer relationship management (CRM) system to improve customer retention and reduce marketing costs.

- Energy Management Systems: Use smart energy management systems to reduce energy consumption and lower utility bills.

By leveraging technology, businesses can streamline operations, reduce costs, and improve overall efficiency.

6. What Are Some Strategies for Managing Employee Costs Effectively?

Strategies for managing employee costs effectively include optimizing staffing levels, improving productivity, and offering competitive benefits.

- Performance Management: Implement a robust performance management system to ensure employees are productive and contributing to business goals.

- Flexible Work Arrangements: Offer flexible work arrangements, such as remote work and flexible hours, to reduce overhead costs and improve employee satisfaction.

- Training and Development: Invest in training and development to improve employee skills and productivity.

- Health and Wellness Programs: Implement health and wellness programs to reduce healthcare costs and improve employee morale.

- Competitive Salaries and Benefits: Offer competitive salaries and benefits to attract and retain top talent.

- Employee Retention Strategies: Focus on employee retention to reduce turnover costs.

- Outsourcing and Freelancing: Consider outsourcing or hiring freelancers for specific tasks to reduce labor costs.

By implementing these strategies, businesses can effectively manage employee costs while maintaining a motivated and productive workforce.

7. How Can I Improve Cash Flow to Save Money?

Improving cash flow is essential for saving money and maintaining financial stability in your business.

- Invoice Promptly: Send invoices promptly to ensure timely payments from customers.

- Offer Payment Incentives: Offer discounts for early payments to encourage customers to pay quickly.

- Manage Inventory: Optimize inventory levels to reduce storage costs and minimize waste.

- Negotiate Payment Terms: Negotiate longer payment terms with suppliers to improve cash flow.

- Collect Overdue Payments: Implement a system for collecting overdue payments promptly.

- Monitor Expenses: Regularly monitor and analyze expenses to identify areas where you can cut back.

- Use Factoring: Consider using invoice factoring to get immediate cash for your invoices.

By implementing these strategies, you can improve your cash flow and save money, providing your business with greater financial flexibility.

8. What Are the Benefits of Leasing Equipment Instead of Buying?

Leasing equipment instead of buying offers several benefits that can help businesses save money.

- Lower Upfront Costs: Leasing requires lower upfront costs compared to purchasing, freeing up capital for other investments.

- Tax Benefits: Lease payments are often tax-deductible, providing additional savings.

- Access to Latest Technology: Leasing allows you to upgrade to the latest equipment without the cost of purchasing new assets.

- Maintenance and Repairs: Many lease agreements include maintenance and repair services, reducing additional expenses.

- Predictable Costs: Lease payments are fixed, making it easier to budget and manage cash flow.

- Avoid Obsolescence: Leasing avoids the risk of equipment becoming obsolete, as you can upgrade to newer models when the lease expires.

- Improved Cash Flow: Leasing conserves your company’s cash, allowing you to allocate funds to other critical areas of your business.

By leasing equipment, businesses can save money, improve cash flow, and stay competitive with the latest technology.

9. How Can I Reduce Travel and Transportation Costs?

Reducing travel and transportation costs involves implementing several strategies to minimize expenses while maintaining business operations.

- Virtual Meetings: Utilize video conferencing and online collaboration tools to reduce the need for in-person meetings.

- Travel Policy: Implement a clear travel policy that outlines acceptable expenses and guidelines for booking travel.

- Negotiate with Hotels and Airlines: Negotiate corporate rates with hotels and airlines to reduce travel costs.

- Carpooling: Encourage carpooling among employees to reduce fuel costs and parking expenses.

- Public Transportation: Promote the use of public transportation for commuting and business travel.

- Optimize Delivery Routes: Use route optimization software to plan efficient delivery routes and reduce fuel consumption.

- Telecommuting: Allow employees to telecommute to reduce commuting costs and office space requirements.

By implementing these strategies, businesses can significantly reduce travel and transportation costs, improving their bottom line.

10. What Role Does Budgeting Play in Saving Money?

Budgeting plays a crucial role in saving money by providing a clear framework for managing income and expenses. A well-structured budget enables businesses to track their financial performance, identify areas of overspending, and allocate resources effectively. According to the Consumer Financial Protection Bureau (CFPB), budgeting is the cornerstone of financial stability.

- Tracking Expenses: A budget allows you to track all income and expenses, providing a clear picture of where your money is going.

- Identifying Areas for Savings: By analyzing your budget, you can identify areas where you are overspending and find opportunities to cut costs.

- Setting Financial Goals: A budget helps you set realistic financial goals and track your progress towards achieving them.

- Prioritizing Spending: A budget helps you prioritize spending, ensuring that you allocate resources to the most important areas of your business.

- Improving Financial Control: Budgeting gives you greater control over your finances, allowing you to make informed decisions and avoid unnecessary expenses.

- Enhancing Financial Stability: By managing your income and expenses effectively, a budget helps you build a solid financial foundation for your business.

- Informed Decision-Making: Budgeting provides the data needed for making informed financial decisions.

By implementing a comprehensive budgeting process, businesses can save money, improve financial stability, and achieve their financial goals.

11. How Can Savewhere.net Help My Business Save Money?

Savewhere.net offers a variety of resources and tools to help your business save money effectively. Our platform provides expert advice, practical tips, and up-to-date information on various cost-saving strategies.

- Expert Articles: Access a library of articles written by financial experts, covering topics such as budgeting, cost reduction, and cash flow management.

- Financial Tools: Utilize our budgeting templates, expense trackers, and financial calculators to manage your finances effectively.

- Community Forum: Connect with other business owners in our community forum to share ideas, ask questions, and get support.

- Exclusive Deals: Discover exclusive deals and discounts on products and services that can help your business save money.

- Personalized Advice: Get personalized advice from our team of financial experts to address your specific business needs.

- Success Stories: Read success stories from other businesses that have successfully implemented our cost-saving strategies.

- Up-to-Date Information: Stay informed about the latest financial trends, regulations, and opportunities to save money.

Visit Savewhere.net today to explore our resources and start saving money for your business.

12. What Are the Best Practices for Negotiating with Suppliers?

Negotiating effectively with suppliers is a critical skill for businesses looking to save money.

- Research: Before entering negotiations, research current market prices and alternative suppliers.

- Build Relationships: Establish strong relationships with your suppliers to foster trust and cooperation.

- Be Clear About Your Needs: Clearly communicate your requirements and expectations to your suppliers.

- Ask for Discounts: Don’t be afraid to ask for discounts, such as volume discounts or early payment discounts.

- Compare Quotes: Obtain quotes from multiple suppliers and compare them to leverage better deals.

- Be Willing to Walk Away: Be prepared to walk away from the negotiation if the terms are not favorable.

- Negotiate Payment Terms: Negotiate favorable payment terms, such as longer payment periods or installment options.

By following these best practices, businesses can negotiate better deals with suppliers and save money on procurement costs.

13. How Can I Motivate Employees to Participate in Cost-Saving Initiatives?

Motivating employees to participate in cost-saving initiatives is essential for creating a culture of financial responsibility within your business.

- Communicate the Importance: Clearly communicate the importance of cost-saving initiatives and how they benefit the company and its employees.

- Involve Employees: Involve employees in the process of identifying and implementing cost-saving ideas.

- Offer Incentives: Offer incentives, such as bonuses or rewards, for employees who contribute to cost-saving initiatives.

- Provide Feedback: Provide regular feedback to employees on their progress and contributions to cost-saving efforts.

- Recognize and Reward Success: Recognize and reward employees who achieve significant cost savings.

- Create a Culture of Accountability: Create a culture of accountability where employees are responsible for managing costs within their areas of responsibility.

- Lead by Example: Lead by example by demonstrating your commitment to cost-saving initiatives.

By motivating employees to participate in cost-saving initiatives, businesses can achieve significant cost reductions and improve their financial performance.

14. What Are the Legal and Ethical Considerations When Cutting Costs?

Cutting costs in business requires careful consideration of legal and ethical implications to avoid potential liabilities and maintain a positive reputation.

- Labor Laws: Ensure compliance with labor laws when reducing employee costs, such as providing proper notice and severance pay.

- Contractual Obligations: Honor contractual obligations with suppliers and customers when making cost-cutting decisions.

- Environmental Regulations: Comply with environmental regulations when reducing waste and energy consumption.

- Transparency: Be transparent with employees, customers, and suppliers about cost-cutting measures.

- Fairness: Treat all stakeholders fairly when making cost-cutting decisions.

- Ethical Sourcing: Maintain ethical sourcing practices when negotiating with suppliers.

- Legal Advice: Seek legal advice to ensure compliance with all applicable laws and regulations.

By considering the legal and ethical implications of cost-cutting measures, businesses can avoid potential risks and maintain their integrity.

15. What Are Some Common Mistakes to Avoid When Trying to Save Money?

Avoiding common mistakes when trying to save money is essential for achieving long-term financial stability.

- Cutting Essential Expenses: Avoid cutting essential expenses that are critical to business operations.

- Neglecting Maintenance: Don’t neglect maintenance and repairs, as this can lead to more costly problems in the future.

- Ignoring Employee Morale: Avoid implementing cost-cutting measures that negatively impact employee morale and productivity.

- Failing to Plan: Don’t fail to plan and budget effectively, as this can lead to overspending and financial instability.

- Ignoring Customer Needs: Avoid cutting costs that negatively impact customer satisfaction and loyalty.

- Lack of Transparency: Avoid a lack of transparency with employees and stakeholders about cost-cutting measures.

- Short-Term Focus: Don’t focus solely on short-term cost savings without considering the long-term implications.

By avoiding these common mistakes, businesses can implement effective cost-saving strategies that support their long-term financial health.

16. How Can I Create a Cost-Saving Culture in My Business?

Creating a cost-saving culture in your business involves fostering a mindset of financial responsibility and efficiency among all employees.

- Set Clear Goals: Set clear cost-saving goals and communicate them to all employees.

- Lead by Example: Lead by example by demonstrating your commitment to cost-saving initiatives.

- Involve Employees: Involve employees in the process of identifying and implementing cost-saving ideas.

- Provide Training: Provide training to employees on cost-saving strategies and best practices.

- Offer Incentives: Offer incentives, such as bonuses or rewards, for employees who contribute to cost-saving initiatives.

- Recognize and Reward Success: Recognize and reward employees who achieve significant cost savings.

- Regularly Communicate Progress: Regularly communicate progress on cost-saving initiatives to keep employees engaged and motivated.

By creating a cost-saving culture, businesses can achieve significant cost reductions and improve their overall financial performance.

17. What Financial Tools Can Help with Saving Money?

Several financial tools can help businesses save money by providing insights into their financial performance and facilitating better decision-making.

- Budgeting Software: Use budgeting software to create and manage your budget, track expenses, and identify areas for savings.

- Expense Tracking Apps: Utilize expense tracking apps to monitor your expenses and identify areas where you can cut back.

- Financial Calculators: Use financial calculators to estimate the cost savings of various initiatives, such as energy-efficient upgrades or leasing equipment.

- Accounting Software: Implement accounting software to track your income and expenses, manage your cash flow, and generate financial reports.

- Invoice Management Tools: Use invoice management tools to streamline your invoicing process and ensure timely payments from customers.

- Inventory Management Software: Utilize inventory management software to optimize your inventory levels and reduce storage costs.

- Data Analytics Tools: Implement data analytics tools to analyze your financial data and identify areas for cost optimization and efficiency improvements.

By leveraging these financial tools, businesses can gain greater control over their finances and achieve significant cost savings.

18. What Are the Best Ways to Save Money on Taxes?

Saving money on taxes is an important aspect of financial management for businesses.

- Maximize Deductions: Take advantage of all available tax deductions, such as business expenses, depreciation, and charitable contributions.

- Claim Tax Credits: Claim any applicable tax credits, such as research and development credits or energy efficiency credits.

- Choose the Right Business Structure: Choose the business structure that offers the most favorable tax treatment.

- Plan for Retirement: Contribute to retirement plans to reduce your taxable income.

- Hire a Tax Professional: Hire a tax professional to help you navigate the complex tax laws and identify additional tax-saving opportunities.

- Keep Accurate Records: Keep accurate records of all income and expenses to support your tax filings.

- Stay Informed: Stay informed about changes in tax laws and regulations to ensure compliance and maximize tax savings.

By implementing these strategies, businesses can save money on taxes and improve their overall financial performance.

19. How Can I Stay Motivated While Implementing Cost-Saving Measures?

Staying motivated while implementing cost-saving measures can be challenging, but it is essential for achieving long-term financial success.

- Set Realistic Goals: Set realistic cost-saving goals that are achievable and sustainable.

- Track Your Progress: Track your progress towards your cost-saving goals and celebrate your successes along the way.

- Reward Yourself: Reward yourself for achieving significant cost savings to stay motivated.

- Focus on the Benefits: Focus on the benefits of cost-saving measures, such as improved financial stability and increased profitability.

- Seek Support: Seek support from other business owners, mentors, or financial advisors to stay motivated.

- Stay Positive: Stay positive and maintain a can-do attitude, even when faced with challenges.

- Remember Your Why: Remember why you started your business and how cost-saving measures can help you achieve your long-term goals.

By staying motivated and focused on your goals, you can successfully implement cost-saving measures and achieve lasting financial success.

20. What Are the Long-Term Benefits of Saving Money in Business?

The long-term benefits of saving money in business extend beyond immediate cost reductions and contribute to sustained growth and stability.

- Financial Security: Saving money builds a financial cushion that can help your business weather economic downturns and unexpected expenses.

- Growth Opportunities: Conserved funds can be reinvested into business growth, such as expanding operations, launching new products, or improving marketing efforts.

- Improved Profitability: Reducing expenses directly increases profits, making the business more attractive to investors and lenders.

- Competitive Advantage: Businesses that manage their finances well can offer competitive pricing, invest in innovation, and respond quickly to market changes.

- Better Decision-Making: Financial stability allows business owners to make strategic decisions without the pressure of immediate financial concerns.

- Long-Term Sustainability: Saving money enhances the long-term sustainability of the business, ensuring its survival and success.

- Increased Valuation: A financially stable business with a history of saving money is more valuable and attractive to potential buyers or investors.

By prioritizing saving money, businesses can secure their financial future and achieve long-term success.

21. How to Automate Savings in Business?

Automating savings in business streamlines financial management and ensures consistent cost reduction. By leveraging technology and setting up automatic processes, companies can optimize their spending and improve overall financial health.

- Automated Transfers: Set up automated transfers to a dedicated savings account. Regularly transfer a percentage of your revenue or profits to a separate savings account to build a financial cushion.

- Bill Payment Automation: Automate bill payments to avoid late fees. Use online banking or accounting software to schedule and automate payments for recurring bills.

- Automated Budgeting Tools: Implement automated budgeting tools for tracking and managing expenses. Use budgeting software to track income and expenses, categorize transactions, and generate financial reports.

- Energy Management Systems: Utilize smart energy management systems for automated energy savings. Install smart thermostats and energy-efficient lighting systems that automatically adjust settings based on occupancy and usage patterns.

- Inventory Management Automation: Implement automated inventory management systems for reduced waste.

- Subscription Management Tools: Use subscription management tools to cancel unused services. Regularly review and cancel subscriptions that are no longer needed or used to avoid unnecessary costs.

- Automated Investment Strategies: Consider automated investment strategies to grow savings. Use robo-advisors or automated investment platforms to invest surplus funds in diversified portfolios.

Automating savings ensures consistent financial discipline and frees up time for business owners to focus on growth and innovation.

22. How Can Savewhere.net Help Me Find Discounts and Deals for My Business?

Savewhere.net is dedicated to helping businesses find discounts and deals that can significantly reduce expenses. The platform offers a comprehensive resource for identifying savings opportunities across various categories.

- Exclusive Business Discounts: Access exclusive business discounts on savewhere.net. Savewhere.net partners with a wide range of suppliers and service providers to offer exclusive discounts to its members.

- Deals by Industry: Find deals tailored to your specific industry on savewhere.net. Savewhere.net categorizes deals by industry, making it easy to find relevant savings opportunities for your business.

- Real-Time Notifications: Subscribe to real-time notifications about new deals. Savewhere.net sends notifications about new deals and promotions as soon as they become available, ensuring you never miss a chance to save.

- Comparison Tools: Use comparison tools to find the best deals. Savewhere.net offers comparison tools that allow you to compare prices from multiple vendors and identify the best deals.

- Negotiation Support: Get negotiation support from Savewhere.net experts. Savewhere.net provides negotiation support to help you get the best possible deals from suppliers.

- User Community: Connect with other business owners to share deals. Savewhere.net’s user community allows you to connect with other business owners to share deals, tips, and strategies for saving money.

- Comprehensive Resource Library: Explore the comprehensive resource library for savings tips. Savewhere.net offers a comprehensive library of articles, guides, and tools to help you save money in every area of your business.

Address: 100 Peachtree St NW, Atlanta, GA 30303, United States. Phone: +1 (404) 656-2000. Website: savewhere.net. By leveraging Savewhere.net, businesses can unlock a wealth of opportunities to reduce costs and boost their bottom line.

23. How Can Green Initiatives Help Businesses Save Money?

Implementing green initiatives can significantly help businesses save money by reducing waste, improving efficiency, and enhancing their public image. Sustainable practices not only benefit the environment but also contribute to long-term cost savings and increased profitability.

- Energy Efficiency Improvements: Reduce energy consumption with green initiatives. Upgrading to energy-efficient lighting, heating, and cooling systems can significantly reduce utility bills.

- Waste Reduction Strategies: Minimize waste through recycling and composting with green initiatives.

- Water Conservation Measures: Implement water conservation measures with green initiatives. Install low-flow faucets and toilets to reduce water consumption.

- Sustainable Procurement Practices: Adopt sustainable procurement practices with green initiatives. Purchase environmentally friendly products and materials to reduce waste and support sustainable suppliers.

- Green Transportation Options: Encourage green transportation options with green initiatives. Promote carpooling, public transportation, and cycling among employees to reduce commuting costs and emissions.

- Paperless Operations: Transition to paperless operations with green initiatives. Use digital documents and online collaboration tools to reduce paper consumption.

- Renewable Energy Investments: Invest in renewable energy sources with green initiatives. Install solar panels or purchase renewable energy credits to reduce reliance on fossil fuels and lower energy costs.

Implementing green initiatives reduces costs, enhances reputation, and contributes to a healthier planet.

24. What Are Some Cost-Effective Employee Benefit Programs?

Cost-effective employee benefit programs enhance employee satisfaction and reduce turnover without breaking the bank. Offering valuable benefits can attract and retain top talent, boosting overall productivity and morale.

- Flexible Work Arrangements: Allow flexible work arrangements. Offer remote work options and flexible hours to reduce overhead costs and improve work-life balance.

- Wellness Programs: Implement wellness programs. Provide resources and incentives for employees to improve their health and well-being, reducing healthcare costs.

- Employee Discounts: Offer employee discounts. Partner with local businesses to offer discounts on products and services to employees.

- Professional Development Opportunities: Support professional development opportunities. Provide training and development opportunities to help employees enhance their skills and advance their careers.

- Employee Assistance Programs (EAPs): Offer employee assistance programs (EAPs). Provide confidential counseling and support services to help employees manage personal and professional challenges.

- Recognition Programs: Implement recognition programs. Recognize and reward employees for their contributions and achievements.

- Volunteer Opportunities: Organize volunteer opportunities. Encourage employees to participate in volunteer activities to foster a sense of community and purpose.

Cost-effective benefit programs attract talent, boost morale, and contribute to a positive work environment.

25. How Can Savewhere.net Help Me Connect with Other Businesses to Share Cost-Saving Strategies?

Savewhere.net offers a unique platform for businesses to connect, share insights, and collaborate on cost-saving strategies. By joining the Savewhere.net community, businesses can tap into a wealth of collective knowledge and experience.

- Community Forums: Participate in community forums. Savewhere.net hosts community forums where businesses can share ideas, ask questions, and exchange tips on cost-saving strategies.

- Networking Events: Attend networking events. Savewhere.net organizes networking events to facilitate in-person connections and collaborations among businesses.

- Case Studies: Share case studies. Savewhere.net features case studies from businesses that have successfully implemented cost-saving strategies, providing valuable insights and inspiration.

- Expert Panels: Join expert panels. Savewhere.net organizes expert panels where industry leaders share their insights and best practices on cost-saving strategies.

- Collaborative Projects: Participate in collaborative projects. Savewhere.net facilitates collaborative projects where businesses can work together to develop and implement cost-saving solutions.

- Mentorship Programs: Join mentorship programs. Savewhere.net offers mentorship programs where experienced business owners can mentor others on cost-saving strategies.

- Resource Sharing: Share resources. Savewhere.net provides a platform for businesses to share resources, such as templates, guides, and tools, to help others save money.

By connecting with other businesses on Savewhere.net, you can unlock new opportunities to reduce costs and improve your bottom line.

26. How to Build a Financial Safety Net for Business?

Building a financial safety net for your business ensures it can weather economic storms, unexpected expenses, and market fluctuations. A robust financial safety net provides stability and peace of mind, allowing you to focus on growth and innovation.

- Emergency Savings Fund: Establish an emergency savings fund. Set aside at least three to six months’ worth of operating expenses in a dedicated savings account.

- Diversify Income Streams: Diversify income streams to reduce reliance on a single source. Explore new markets, products, and services to generate additional revenue.

- Lines of Credit: Secure lines of credit for backup funds. Establish lines of credit with banks or other lenders to have access to additional funds when needed.

- Insurance Coverage: Maintain comprehensive insurance coverage. Protect your business against potential risks, such as property damage, liability claims, and business interruption.

- Contingency Plans: Develop contingency plans for various scenarios. Prepare for potential disruptions, such as economic downturns, natural disasters, and supply chain disruptions.

- Debt Management: Practice prudent debt management. Avoid excessive debt and prioritize paying down existing debt to reduce financial risk.

- Regular Financial Reviews: Conduct regular financial reviews. Monitor your financial performance, identify potential risks, and adjust your strategies as needed.

A financial safety net provides resilience and enables sustainable growth.

27. What Are Some Emerging Technologies That Can Help Businesses Save Money?

Emerging technologies offer innovative ways for businesses to save money by improving efficiency, reducing waste, and optimizing operations. By embracing these technologies, companies can gain a competitive edge and enhance their bottom line.

- Artificial Intelligence (AI): Implement AI-powered automation for cost savings. Use AI-powered tools to automate repetitive tasks, improve decision-making, and personalize customer experiences.

- Internet of Things (IoT): Utilize IoT devices for smart energy management. Install IoT sensors to monitor energy consumption, optimize lighting, and automate HVAC systems.

- Blockchain Technology: Employ blockchain for supply chain optimization. Use blockchain technology to improve transparency, reduce fraud, and streamline supply chain operations.

- 3D Printing: Adopt 3D printing for rapid prototyping and manufacturing. Use 3D printing to create prototypes, custom parts, and small-batch products at a lower cost.

- Cloud Computing: Leverage cloud computing for scalable and cost-effective IT solutions. Migrate to cloud-based services to reduce IT infrastructure costs, improve scalability, and enhance collaboration.

- Robotic Process Automation (RPA): Implement RPA to automate routine tasks. Use RPA software to automate tasks such as data entry, invoice processing, and customer service inquiries.

- Big Data Analytics: Utilize big data analytics to improve decision-making and operational efficiency. Analyze large datasets to identify trends, optimize processes, and personalize customer experiences.

Embracing emerging technologies ensures efficiency, cost savings, and competitiveness in the modern business landscape.

28. How to Track Savings and Measure ROI in Business?

Tracking savings and measuring ROI (Return on Investment) are essential for evaluating the effectiveness of cost-saving initiatives and making informed decisions about future investments.

- Establish Baseline Metrics: Define baseline metrics before implementing cost-saving initiatives.

- Use Accounting Software: Use accounting software to track expenses and income. Implement accounting software to monitor financial performance, generate reports, and track savings over time.

- Conduct Regular Audits: Conduct regular audits to identify areas for improvement.

- Calculate ROI: Calculate ROI to evaluate the effectiveness of cost-saving initiatives.

- Track Key Performance Indicators (KPIs): Monitor key performance indicators (KPIs) to measure progress and identify trends.

- Implement a Reporting System: Implement a reporting system to communicate results to stakeholders.

- Adjust Strategies as Needed: Adjust strategies as needed based on performance data.

Tracking savings and measuring ROI are vital for informed financial decisions and long-term business success.

Ready to take control of your business finances? Visit Savewhere.net now and discover a wealth of tips, tools, and resources to help you save money effectively. From exclusive discounts to expert financial advice, savewhere.net is your partner in achieving financial stability and growth. Join our community today and start saving!