Saving the wolf in Until Dawn requires strategic choices and quick reflexes. At savewhere.net, we help you master these moments and more, offering tips for financial savings too. Learn how to protect your furry friend and your wallet with smart decisions.

1. What Is Until Dawn And Why Is Saving The Wolf Important?

Until Dawn is an interactive horror drama where your choices determine who survives until daylight. Saving the wolf isn’t just about protecting an animal; it’s a test of your decision-making skills that reflect real-life financial strategies. The wolf can become a loyal companion and a key ally against the Wendigos. Ensuring the wolf survives is a significant achievement, proving your ability to make smart, quick decisions under pressure, a skill that translates well into managing personal finances and making sound investment choices.

2. How Do You Befriend The Wolf In Until Dawn?

Befriending the wolf is the first step to saving him. When playing as Mike, you’ll encounter two wolves. The first is aggressive, but the second, a white wolf, is curious but not hostile.

DO NOT ATTACK THE WHITE WOLF.

Instead:

- Approach the Wolf: When given the option to approach or back away, choose to approach.

- Pet the Wolf: You’ll get a chance to give him a little pat.

- Offer a Bone: Find a treasure chest with human bones at the back of the room, take a bone, and offer it to the wolf.

This establishes a bond that’s crucial for the wolf’s survival later in the game.

Mike petting the wolf in Until Dawn, establishing a bond of trust and companionship.

Mike petting the wolf in Until Dawn, establishing a bond of trust and companionship.

3. When Does The Wolf Appear Again And Why Is This Encounter Critical?

The wolf reappears when Mike returns to the sanatorium. This encounter is critical because Mike is now being hunted by Wendigos, and the wolf becomes a valuable ally. The wolf warns you of danger and even attacks Wendigos to protect you. This loyalty, however, puts the wolf at risk, making your decisions even more important. This phase mirrors financial planning, where understanding risks and making informed decisions are crucial to protect your assets and investments.

4. What Are The Two Key Moments To Save The Wolf In Until Dawn?

There are two critical moments where your actions directly impact the wolf’s survival:

- The Barrel Scene:

- The Barricade Scene:

These moments require quick thinking and precise execution, similar to managing finances effectively.

4.1. How Do You Navigate The Barrel Scene To Ensure The Wolf’s Survival?

During a chase through the sanatorium, Mike and the wolf get cornered by Wendigos. Here’s how to handle the barrel scene:

- Tip the Barrel: Interact with the red barrel near the door. You’ll need to press the Circle button (as the event is on the right-hand side of the active character) and then nudge it with the right stick.

- Roll the Barrel: A second QTE (also Circle) prompts you to roll the barrel down the corridor.

- Shoot the Barrel: When the game switches to shotgun-aiming mode, target the barrel as it approaches the Wendigos. Hitting the barrel will cause an explosion, killing the Wendigos and clearing the path.

Mike tipping a barrel in Until Dawn, an action critical to saving the wolf.

Mike tipping a barrel in Until Dawn, an action critical to saving the wolf.

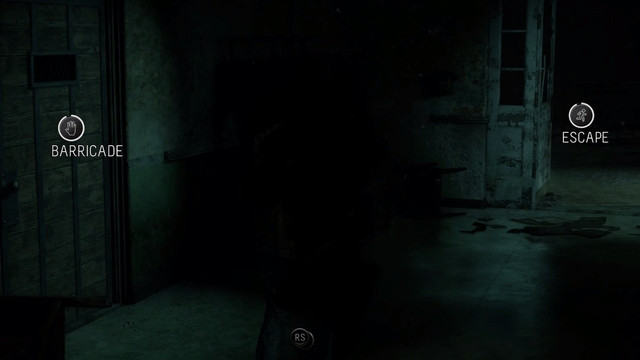

4.2. What Is The Significance Of The Barricade Scene For Saving The Wolf?

After escaping the barrel explosion, Mike and the wolf reach a room with a choice: barricade the door or run.

YOU MUST CHOOSE TO BARRICADE THE DOOR.

Failing to barricade the door can lead to the wolf’s demise. By barricading the door, you ensure the wolf’s safety, albeit temporarily.

5. What Happens After The Barricade And How Does It Confirm The Wolf’s Survival?

After barricading the door, Mike finds a hole in the floor and drops down. The wolf, afraid of the drop, stays behind. Although you part ways, this ensures the wolf is safe from immediate danger.

The game confirms the wolf’s survival in two ways:

- The Skilful Wolfman Trophy: Unlocking this PlayStation Trophy confirms that you successfully saved the wolf.

- Butterfly Effect Chart: The game updates the Butterfly Effect chart, unequivocally stating that the wolf survived.

The Until Dawn trophy indicating the player saved the wolf, a marker of success.

The Until Dawn trophy indicating the player saved the wolf, a marker of success.

6. Why Is This Gameplay Relevant To Real-Life Financial Decisions?

The choices in Until Dawn, particularly those affecting the wolf’s survival, mirror real-life financial decisions. Saving the wolf requires:

- Risk Assessment: Evaluating potential threats and making informed decisions.

- Quick Reflexes: Reacting promptly to changing circumstances.

- Strategic Thinking: Planning ahead to ensure the best possible outcome.

These skills are essential in personal finance. Just as you strategize to save the wolf, you need a financial plan to manage your money, investments, and savings effectively.

7. How Can You Apply Financial Strategies Similar To Saving The Wolf?

To apply financial strategies akin to saving the wolf, consider these steps:

- Budgeting: Create a detailed budget to track income and expenses, identifying areas where you can save, just like planning your moves to protect the wolf.

- Emergency Fund: Build an emergency fund to handle unexpected expenses, similar to having a backup plan during a Wendigo attack.

- Investment Planning: Develop a diversified investment portfolio to grow your wealth over time, much like preparing for the long game in Until Dawn.

- Debt Management: Manage and reduce debt to improve your financial health, akin to eliminating threats to ensure the wolf’s survival.

8. Where Can You Find Resources To Improve Your Financial Decision-Making?

Numerous resources can help you improve your financial decision-making:

- Financial Advisors: Seek advice from certified financial planners.

- Online Courses: Enroll in courses on personal finance, investing, and budgeting.

- Books and Articles: Read books and articles on financial planning and wealth management.

- Websites: Use websites like savewhere.net for tips, strategies, and resources.

9. How Does Savewhere.net Help You Save Money?

Savewhere.net provides practical tips, strategies, and resources to help you save money effectively. Here’s how:

- Budgeting Tools: Access tools to create and manage your budget.

- Savings Tips: Discover actionable tips to cut expenses and save money on daily purchases.

- Investment Advice: Learn about investment options and strategies to grow your wealth.

- Community Support: Connect with a community of like-minded individuals who share their savings experiences and tips.

10. What Specific Savings Strategies Can Savewhere.net Offer?

Savewhere.net offers various savings strategies tailored to different areas of your life:

- Grocery Savings:

- Plan your meals and create a shopping list.

- Use coupons and discounts.

- Buy in bulk when appropriate.

- Transportation Savings:

- Use public transport, bike, or walk when possible.

- Carpool with colleagues or friends.

- Maintain your vehicle to improve fuel efficiency.

- Home Energy Savings:

- Use energy-efficient appliances.

- Turn off lights when not in use.

- Seal windows and doors to prevent drafts.

- Entertainment Savings:

- Take advantage of free events and activities.

- Use streaming services instead of cable.

- Borrow books and movies from the library.

11. How Can You Start Saving Money Today With Savewhere.net?

To start saving money today with savewhere.net:

- Visit Savewhere.net: Explore the website for articles, tools, and resources.

- Create a Budget: Use the budgeting tools to track your income and expenses.

- Implement Savings Tips: Apply the savings tips relevant to your lifestyle.

- Join the Community: Connect with other users to share and learn more saving strategies.

- Set Financial Goals: Define your financial goals and track your progress using savewhere.net tools.

12. What Are Some Real-Life Examples Of People Saving Money Using These Strategies?

Many people have successfully saved money using these strategies:

- Sarah, a teacher from Atlanta:

- Sarah reduced her grocery bill by 30% by meal planning and using coupons.

- David, a freelancer:

- David increased his savings by $500 per month by tracking expenses and cutting unnecessary subscriptions.

- Emily, a student:

- Emily saved $2000 in a year by using public transport and finding student discounts.

These real-life examples demonstrate that with the right strategies and resources, anyone can achieve their financial goals.

13. How Can You Balance Saving Money With Enjoying Life?

Balancing saving money with enjoying life is crucial for long-term financial and emotional well-being. Here’s how:

- Prioritize Spending: Identify what truly matters to you and allocate your money accordingly.

- Set Realistic Goals: Set achievable savings goals that don’t require extreme sacrifices.

- Find Affordable Entertainment: Explore free or low-cost activities that you enjoy.

- Reward Yourself: Occasionally treat yourself to something you enjoy to stay motivated.

- Automate Savings: Automate your savings to ensure you consistently save without feeling deprived.

14. What Are Common Pitfalls To Avoid When Trying To Save Money?

Common pitfalls to avoid when trying to save money include:

- Impulse Buying: Avoid making unplanned purchases.

- Ignoring Your Budget: Stick to your budget and track your spending.

- Not Setting Goals: Define clear financial goals to stay motivated.

- Underestimating Expenses: Accurately estimate your expenses to create a realistic budget.

- Keeping Up With The Joneses: Avoid spending money to impress others; focus on your own financial goals.

15. How Does Understanding Behavioral Economics Help In Saving Money?

Understanding behavioral economics can significantly help in saving money by recognizing and addressing common psychological biases:

- Loss Aversion: People tend to feel the pain of a loss more strongly than the pleasure of an equivalent gain. Use this by framing savings as avoiding a loss rather than achieving a gain.

- Present Bias: People prefer immediate rewards over future ones. Counteract this by visualizing the future benefits of saving, such as retirement or a large purchase.

- Anchoring Bias: People rely too heavily on the first piece of information they receive. Be mindful of initial prices and always compare before making a purchase.

- Framing Effect: The way information is presented affects decision-making. Reframe your spending habits to see the long-term impact of small, consistent savings.

By understanding these biases, you can make more rational financial decisions and improve your savings habits.

16. How Can You Use Technology To Help You Save Money?

Technology offers numerous tools to help you save money:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), and Personal Capital help you track your spending and manage your budget.

- Savings Apps: Apps like Acorns and Digit automatically save money by rounding up purchases or transferring small amounts to savings accounts.

- Coupon Extensions: Browser extensions like Honey and Rakuten automatically find and apply coupons when you shop online.

- Price Comparison Tools: Websites and apps like Google Shopping and PriceRunner help you compare prices and find the best deals.

- Banking Apps: Mobile banking apps allow you to monitor your accounts, set savings goals, and transfer funds easily.

17. How Can You Save Money On Healthcare Costs?

Saving money on healthcare costs involves several strategies:

- Preventative Care: Regular check-ups and screenings can prevent costly health issues.

- Generic Medications: Opt for generic versions of prescription drugs.

- Health Savings Account (HSA): Use an HSA to save pre-tax money for healthcare expenses.

- Negotiate Bills: Negotiate medical bills with healthcare providers.

- Shop Around: Compare prices for medical procedures and services.

18. What Are The Benefits Of Setting Financial Goals?

Setting financial goals provides numerous benefits:

- Motivation: Goals provide a clear sense of purpose and direction.

- Focus: Goals help you prioritize your spending and saving.

- Accountability: Goals make you accountable for your financial actions.

- Progress Tracking: Goals allow you to track your progress and celebrate milestones.

- Improved Decision-Making: Goals guide your financial decisions and help you make smarter choices.

19. How Can You Create A Realistic Budget That Works For You?

Creating a realistic budget involves these steps:

- Track Your Income: Calculate your total monthly income after taxes.

- List Your Expenses: Identify all your monthly expenses, including fixed costs (rent, utilities) and variable costs (groceries, entertainment).

- Categorize Your Expenses: Group your expenses into categories to see where your money is going.

- Analyze Your Spending: Review your spending patterns and identify areas where you can cut back.

- Set Savings Goals: Determine how much you want to save each month.

- Allocate Your Money: Allocate your income to cover expenses and savings goals.

- Review and Adjust: Regularly review your budget and make adjustments as needed.

20. How Can Savewhere.Net Help You Achieve Financial Freedom?

Savewhere.net is your partner in achieving financial freedom. By providing:

- Expert Advice: Access expert financial tips and strategies.

- Comprehensive Resources: Utilize a wide range of tools and resources to manage your finances.

- Community Support: Connect with a supportive community of savers and investors.

- Personalized Solutions: Find solutions tailored to your unique financial situation.

Visit savewhere.net today and start your journey towards financial freedom.

21. What Are Some Common Financial Myths That Hinder Saving Money?

Several financial myths can hinder your ability to save money:

- Myth 1: You Need To Be Rich To Invest: You can start investing with small amounts.

- Myth 2: Debt Is Always Bad: Some debt, like mortgages, can be beneficial.

- Myth 3: You Should Wait For The Perfect Time To Start Saving: Start saving now, no matter how small.

- Myth 4: Credit Cards Are Evil: Credit cards can be useful if used responsibly.

- Myth 5: Renting Is Throwing Money Away: Renting can be more cost-effective than owning in some situations.

22. How Can You Save Money While Traveling?

Saving money while traveling involves planning and smart choices:

- Travel During Off-Peak Seasons: Prices are lower when demand is less.

- Book Flights and Accommodation in Advance: Early bookings often offer better deals.

- Use Travel Rewards Programs: Accumulate points and miles for discounts.

- Eat Like a Local: Dine at local eateries instead of tourist traps.

- Look For Free Activities: Many cities offer free attractions and events.

- Consider Alternative Accommodation: Hostels, Airbnb, or vacation rentals can be cheaper than hotels.

23. How Can You Save Money On Insurance Costs?

Saving money on insurance costs involves shopping around and understanding your needs:

- Shop Around For Quotes: Compare quotes from multiple insurance providers.

- Increase Your Deductible: A higher deductible lowers your premium.

- Bundle Policies: Insure multiple items (home, auto) with the same provider.

- Review Your Coverage: Ensure you have adequate coverage without over-insuring.

- Take Advantage of Discounts: Ask about available discounts (safe driver, good student).

24. How Can You Save Money During The Holidays?

Saving money during the holidays requires planning and discipline:

- Set a Budget: Determine how much you can afford to spend.

- Make a Gift List: Plan your gift purchases in advance.

- Shop Early: Avoid last-minute impulse buys.

- Use Coupons and Discounts: Look for deals and promotions.

- Consider Homemade Gifts: DIY gifts can be more personal and affordable.

- Host a Potluck: Share the cost of holiday meals with friends and family.

25. What Are The Best Ways To Save For Retirement?

Saving for retirement requires consistent effort and smart investment choices:

- Start Early: The earlier you start, the more time your investments have to grow.

- Contribute To A 401(k): Take advantage of employer matching contributions.

- Open an IRA: Consider a Traditional or Roth IRA for additional savings.

- Diversify Your Investments: Spread your investments across different asset classes.

- Increase Your Contributions Over Time: Gradually increase your savings rate as your income grows.

26. How Can You Save Money On Education Expenses?

Saving money on education expenses involves planning and resourcefulness:

- Apply For Financial Aid: Complete the FAFSA to access grants and loans.

- Consider Community College: Community colleges offer lower tuition rates.

- Look For Scholarships: Search for scholarships and grants to reduce costs.

- Buy Used Textbooks: Save money on textbooks by buying used copies.

- Live At Home: Reduce living expenses by living with your parents.

- Take Advantage of Tax Credits: Claim education tax credits like the American Opportunity Tax Credit.

27. How Can You Save Money As A Student?

Students can save money through various strategies:

- Create a Budget: Track income and expenses to identify areas for savings.

- Use Student Discounts: Take advantage of student discounts on products and services.

- Buy Used Textbooks: Save money on textbooks by buying used copies.

- Cook At Home: Reduce food costs by cooking your own meals.

- Use Public Transportation: Avoid the costs of owning and maintaining a car.

- Find Free Entertainment: Look for free events and activities on campus and in the community.

28. How Can You Save Money On Pet Care Costs?

Saving money on pet care costs involves preventative care and smart choices:

- Preventative Care: Regular vet check-ups can prevent costly health issues.

- Pet Insurance: Consider pet insurance to cover unexpected medical expenses.

- DIY Grooming: Groom your pet at home to save on professional grooming costs.

- Buy Pet Supplies In Bulk: Save money by buying pet food and supplies in bulk.

- Look For Discounts: Take advantage of discounts and promotions on pet products and services.

29. How Can You Save Money On Home Maintenance?

Saving money on home maintenance involves preventative care and DIY repairs:

- Regular Maintenance: Perform regular maintenance tasks to prevent costly repairs.

- DIY Repairs: Handle simple repairs yourself to save on labor costs.

- Shop Around For Contractors: Get quotes from multiple contractors for larger projects.

- Energy Efficiency: Improve your home’s energy efficiency to lower utility bills.

- Home Warranty: Consider a home warranty to cover unexpected repair costs.

30. How Can You Save Money On Personal Care Products?

Saving money on personal care products involves smart shopping and DIY solutions:

- Buy In Bulk: Save money by buying personal care products in bulk.

- Use Coupons and Discounts: Look for deals and promotions on personal care products.

- DIY Products: Make your own personal care products using natural ingredients.

- Shop Around: Compare prices from different retailers to find the best deals.

- Reduce Consumption: Use only what you need to avoid waste.

31. How Can You Save Money On Entertainment?

Saving money on entertainment involves finding affordable alternatives and taking advantage of free options:

- Take Advantage of Free Events: Many communities offer free concerts, festivals, and outdoor activities.

- Use Streaming Services: Opt for streaming services instead of cable TV.

- Borrow Books and Movies From The Library: Libraries offer a wide range of free entertainment options.

- Host Game Nights: Invite friends over for game nights instead of going out.

- Explore Parks and Nature: Spend time outdoors enjoying nature.

32. What Are The First Steps To Take When You Want To Start Saving Money?

The first steps to take when you want to start saving money are:

- Assess Your Current Financial Situation: Understand your income, expenses, assets, and debts.

- Set Financial Goals: Define your short-term and long-term financial goals.

- Create a Budget: Track your spending and allocate your money to expenses and savings.

- Automate Your Savings: Set up automatic transfers to your savings account.

- Start Small: Begin with small, manageable changes to build momentum.

33. How Can You Stay Motivated To Save Money When It Gets Hard?

Staying motivated to save money when it gets hard involves:

- Reminding Yourself of Your Goals: Keep your financial goals in mind to stay focused.

- Celebrating Small Wins: Acknowledge and reward yourself for reaching milestones.

- Finding a Savings Buddy: Partner with a friend or family member for support and accountability.

- Visualizing Your Success: Imagine the positive outcomes of achieving your financial goals.

- Re-Evaluating Your Goals: Adjust your goals as needed to stay realistic and motivated.

34. How Does the U.S. Bureau Of Economic Analysis Support Financial Planning?

According to research from the U.S. Bureau of Economic Analysis (BEA), understanding economic indicators can help individuals make informed financial decisions. For example, monitoring inflation rates can help you adjust your savings and investment strategies to maintain purchasing power.

35. What is the Consumer Financial Protection Bureau (CFPB) and how can it help with saving money?

The Consumer Financial Protection Bureau (CFPB) provides resources and tools to help consumers make informed financial decisions. They offer guides on budgeting, saving, and managing debt. Additionally, they provide protection against unfair, deceptive, or abusive financial practices.

36. How Can Savewhere.net Help Me Find the Best Deals and Discounts?

Savewhere.net is committed to providing you with the latest information on deals and discounts. Check our website regularly for updated information.

37. What are the key takeaways from learning how to save the wolf in “Until Dawn” for my financial life?

Saving the wolf teaches us about strategic decision-making, risk assessment, and quick responses, all essential in managing finances effectively. Like guiding Mike through the sanatorium, planning your finances involves careful navigation and smart choices to protect your assets.

38. What is a Comprehensive Guide to Saving Money in Atlanta?

Saving money in Atlanta requires a tailored approach due to its unique economic landscape. Here’s a detailed guide:

38.1. Housing Costs:

- Explore Neighborhoods: Look beyond popular areas like Midtown and Buckhead. Consider neighborhoods like East Point, Decatur, or Avondale Estates for more affordable options.

- Rent vs. Buy: Evaluate whether renting or buying makes more financial sense. Renting can provide flexibility and lower upfront costs, while buying builds equity over time.

- Negotiate Rent: Don’t hesitate to negotiate rent, especially during off-peak seasons (winter months).

- Consider Roommates: Sharing housing costs with roommates can significantly reduce your expenses.

38.2. Transportation:

- Public Transportation: Utilize MARTA (Metropolitan Atlanta Rapid Transit Authority) for commuting. Purchase a Breeze card for cost-effective travel.

- Bike or Walk: Atlanta is becoming more bike-friendly. Consider biking or walking for short distances to save on gas and parking.

- Carpooling: Join a carpool or rideshare program to split commuting costs with colleagues.

- Fuel Efficiency: Maintain your vehicle to maximize fuel efficiency.

38.3. Food and Dining:

- Meal Planning: Plan your meals and create a shopping list to avoid impulse purchases.

- Grocery Shopping: Shop at discount grocery stores like Aldi or Lidl for significant savings.

- Farmers Markets: Visit local farmers markets for fresh, affordable produce.

- Cook at Home: Reduce dining expenses by cooking at home more often.

- Happy Hour Deals: Take advantage of happy hour deals at local restaurants.

38.4. Entertainment and Recreation:

- Free Activities: Atlanta offers many free activities, such as visiting parks, attending free concerts, and exploring cultural events.

- Museum Discounts: Look for free admission days or discounts at local museums.

- Outdoor Recreation: Enjoy Atlanta’s numerous parks and trails for hiking, biking, and picnicking.

- Library Resources: Utilize the Atlanta-Fulton Public Library System for free books, movies, and events.

38.5. Utilities and Services:

- Energy Efficiency: Implement energy-efficient practices to lower utility bills.

- Compare Providers: Shop around for the best rates on internet, cable, and phone services.

- Negotiate Bills: Don’t hesitate to negotiate bills with service providers.

- Cut Unnecessary Subscriptions: Review your subscriptions and cancel those you don’t use.

38.6. Personal Finance:

- Budgeting: Create a detailed budget to track your income and expenses.

- Emergency Fund: Build an emergency fund to cover unexpected costs.

- Debt Management: Pay down high-interest debt to save on interest payments.

- Savings Goals: Set clear savings goals to stay motivated and focused.

38.7. Community Resources:

- Local Nonprofits: Take advantage of resources offered by local nonprofits, such as financial counseling and assistance programs.

- Government Programs: Explore government assistance programs for eligible residents.

- Community Events: Attend community events for networking and learning opportunities.

By implementing these strategies, you can effectively manage your finances and save money in Atlanta.

Saving the wolf in Until Dawn requires quick thinking and strategic planning, just like managing your finances. Visit savewhere.net for more tips and resources to help you achieve your financial goals. Don’t wait, start saving today and secure your future. Address: 100 Peachtree St NW, Atlanta, GA 30303, United States. Phone: +1 (404) 656-2000. Website: savewhere.net.

FAQ: How To Save The Wolf Until Dawn

1. What is the significance of saving the wolf in Until Dawn?

Saving the wolf in Until Dawn is significant because it showcases your ability to make quick, strategic decisions under pressure, a skill that translates into effective financial management.

2. How do I befriend the wolf in Until Dawn?

To befriend the wolf, approach the white wolf without attacking, pet him, and offer him a bone found in a nearby chest.

3. What are the two key moments for saving the wolf during Mike’s return to the sanatorium?

The two key moments are the barrel scene, where you must tip, roll, and shoot the barrel to eliminate Wendigos, and the barricade scene, where you must barricade the door to protect the wolf.

4. How do I navigate the barrel scene to ensure the wolf’s survival?

In the barrel scene, tip the barrel, roll it towards the Wendigos, and then shoot the barrel to cause an explosion, clearing the path for escape.

5. What is the importance of barricading the door when Mike returns to the sanatorium?

Barricading the door is crucial as it protects the wolf from immediate danger, allowing Mike to proceed without the wolf being harmed.

6. How does the game confirm that I successfully saved the wolf?

The game confirms saving the wolf by unlocking the “Skilful Wolfman” PlayStation Trophy and updating the Butterfly Effect chart to indicate the wolf’s survival.

7. How can strategies used in Until Dawn to save the wolf be applied to real-life financial decisions?

The strategic thinking, risk assessment, and quick decision-making required in Until Dawn can be applied to budgeting, investment planning, and managing financial risks.

8. How does Savewhere.net help in improving financial decision-making?

Savewhere.net provides budgeting tools, savings tips, investment advice, and community support to help individuals make informed financial decisions.

9. Can you provide specific examples of people who have successfully saved money using Savewhere.net’s strategies?

Yes, teachers, freelancers, and students have utilized strategies from savewhere.net to reduce expenses, increase savings, and achieve financial goals.

10. What is the first step to take when wanting to start saving money?

The first step is to assess your current financial situation by understanding your income, expenses, assets, and debts.