Hurricane Ida brought devastation to many parts of the United States, and Pennsylvania was among the states significantly impacted. The Internal Revenue Service (IRS) has announced crucial tax relief measures for individuals and businesses in specific Pennsylvania counties affected by this natural disaster. This means if you reside or operate a business in the designated areas, you now have more time to file various tax returns and make payments. This guide will explain the details of this tax relief, ensuring you understand the extended deadlines and how they apply to your situation.

Who in Pennsylvania Qualifies for Hurricane Ida Tax Relief?

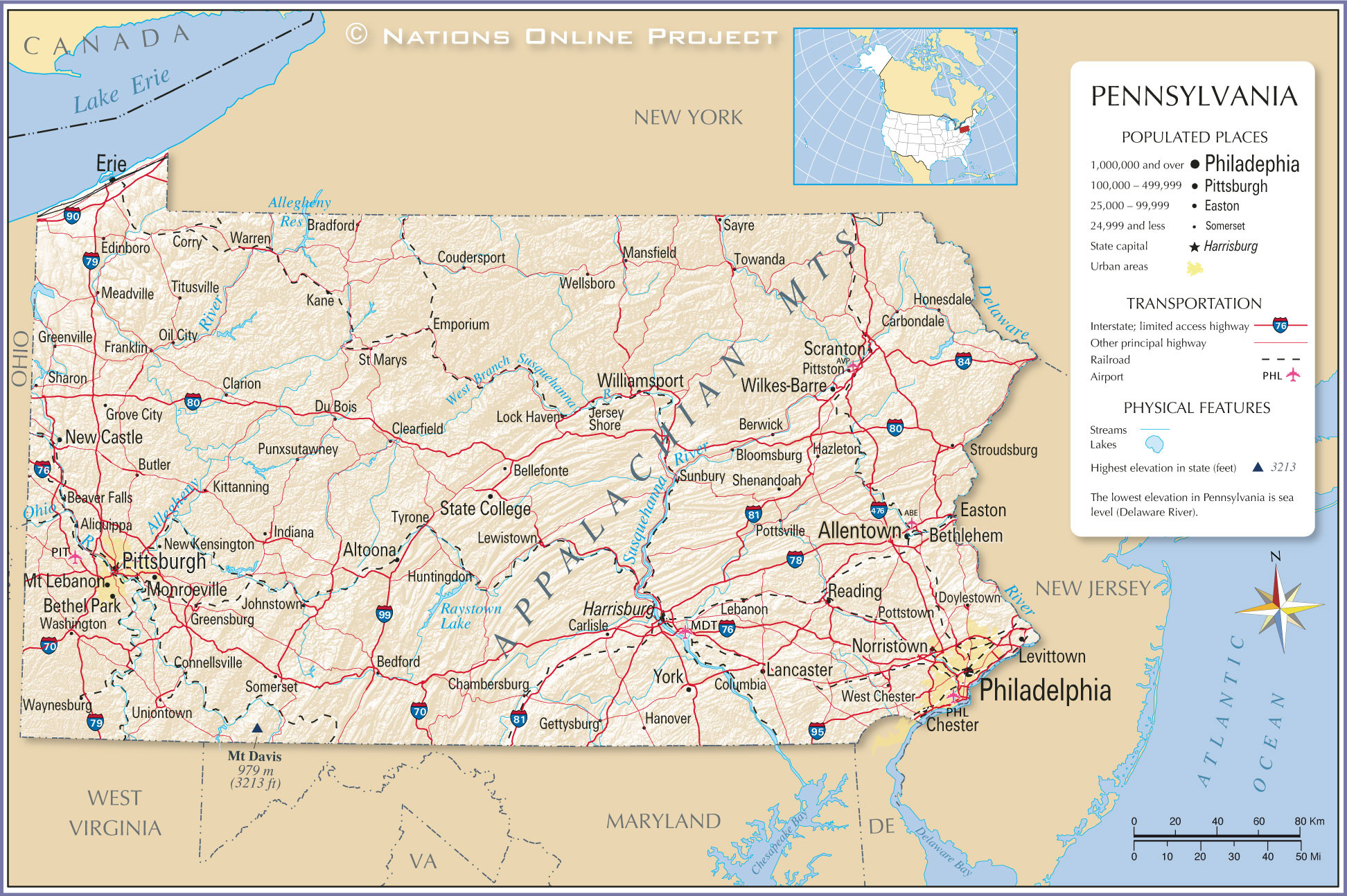

The IRS is granting relief to areas in Pennsylvania that have been declared disaster zones by the Federal Emergency Management Agency (FEMA). Initially, this includes residents and businesses in the following counties:

- Bucks

- Chester

- Delaware

- Montgomery

- Philadelphia

- York

Map of Pennsylvania counties

Map of Pennsylvania counties

It’s important to note that this list is not exhaustive. If FEMA designates other areas in Pennsylvania as disaster areas due to Hurricane Ida in the future, those localities will automatically be included in this tax relief program. To stay updated on the most current list of eligible locations, you can visit the disaster relief page on the IRS website.

What are the Extended Tax Deadlines?

The tax relief provided by the IRS is significant as it postpones various tax filing and payment deadlines that initially fell on or after August 31, 2021. Individuals and businesses affected now have until January 3, 2022, to meet these obligations.

Here’s a breakdown of key deadlines extended to January 3, 2022:

- Individual Income Tax Returns: This extension applies to individual income tax returns, including those who received an extension to file their 2020 tax return. If you had a valid extension until October 15, 2021, you now have until January 3, 2022, to file. However, it’s crucial to remember that this extension does not apply to tax payments for the 2020 tax year, which were due on May 17, 2021.

- Quarterly Estimated Income Tax Payments: The deadline for the quarterly estimated income tax payments, typically due on September 15, 2021, is also extended to January 3, 2022.

- Quarterly Payroll and Excise Tax Returns: Businesses that are usually required to file quarterly payroll and excise tax returns by November 1, 2021, now have until January 3, 2022.

- Tax-Exempt Organizations: Calendar-year tax-exempt organizations with a valid extension expiring on November 15, 2021, also benefit from this extended deadline.

- Business Returns: Various business returns with original or extended due dates are included. This encompasses calendar-year partnerships and S corporations with 2020 extensions ending on September 15, 2021, and calendar-year corporations whose 2020 extensions end on October 15, 2021.

Furthermore, the IRS will abate penalties for payroll and excise tax deposits that were due on or after August 31, 2021, and before September 15, 2021, provided that these deposits are made by September 15, 2021.

For a comprehensive list of all returns, payments, and tax-related actions that qualify for this extended relief, it’s recommended to visit the IRS disaster relief page.

Do You Need to Contact the IRS for Relief?

Generally, if your IRS address of record is located within the designated disaster area, the IRS will automatically apply filing and penalty relief. Therefore, in most cases, you do not need to contact the IRS to receive this relief.

However, if you receive a late filing or late payment penalty notice from the IRS for a period falling within the postponement timeframe, and you are eligible for relief, you should call the number on the notice to have the penalty removed (abated).

Additionally, if your records needed to meet a tax deadline are located in the affected disaster area, but you live outside of it, you are still eligible for relief. In such cases, or if you are a worker assisting with relief efforts affiliated with a recognized government or philanthropic organization, you should contact the IRS at 866-562-5227.

Claiming Disaster-Related Losses

If you experienced uninsured or unreimbursed disaster-related losses due to Hurricane Ida, you have the option to claim these losses in one of two ways:

- On your return for the year the loss occurred (2021 return, normally filed in 2022).

- On your return for the prior year (2020 return).

Choosing to claim the losses on your 2020 return can potentially result in an earlier refund. When claiming disaster losses, it is essential to write the FEMA declaration number for Pennsylvania, DR-4618, on any return where you are claiming the loss. For detailed information on claiming casualty, disaster, and theft losses, refer to IRS Publication 547.

Where’s My Refund? Checking Your Refund Status

While this tax relief focuses on extended deadlines, you might also be wondering about the status of your tax refund, especially if you are filing or have filed a return impacted by Hurricane Ida. The IRS provides an online tool called “Where’s My Refund?” to check the status of your refund. You can access this tool on the IRS website (IRS.gov). Keep in mind that processing times can be affected by disaster situations, so patience is appreciated during these times.

Alt text: Screenshot of the IRS “Where’s My Refund?” tool interface, showing fields to enter Social Security number, filing status, and refund amount to check refund status.

Need Further Assistance?

The IRS is committed to supporting taxpayers affected by Hurricane Ida. This tax relief is part of a broader federal effort to aid in the recovery process. For more information on disaster recovery and assistance, you can visit DisasterAssistance.gov. Remember to prioritize safety and recovery during this challenging time, and utilize the resources available to you for tax-related and disaster relief assistance.