A 529 plan can save you a significant amount on taxes, offering both federal and state tax advantages, and savewhere.net is here to help you navigate these benefits. By understanding how these plans work, you can maximize your savings for education expenses, reduce your tax burden, and secure a brighter future for your loved ones. Explore our resources for financial planning, tax savings, and education funding strategies.

1. Understanding 529 Plans and Tax Benefits

Do you want to save on taxes while planning for future education expenses? 529 plans offer an appealing way to do so. They provide both federal and state tax benefits that can help you grow your education savings more effectively. Let’s examine how these plans work and how much they can potentially save you on taxes.

A 529 plan is a savings plan designed to encourage saving for future education costs. These plans are state-sponsored but available to residents of any state, offering a range of investment options to grow your savings. The primary benefit of a 529 plan lies in its tax advantages.

1.1 Federal Tax Benefits of 529 Plans

529 plans offer two key federal tax benefits:

- Tax-Free Growth: Your contributions grow without being subject to federal income tax.

- Tax-Free Withdrawals: When you withdraw funds for qualified education expenses, the earnings are not subject to federal income tax. This includes up to $10,000 for K-12 tuition expenses and student loan payments.

1.2 State Tax Benefits of 529 Plans

Many states offer additional tax benefits for contributions to a 529 plan. Over 30 states, including the District of Columbia, provide a state income tax deduction or tax credit for 529 plan contributions. This can significantly reduce your state income tax liability.

Example: New York residents can deduct up to $5,000 per year for single filers or $10,000 for those married filing jointly.

1.3 Savewhere.net: Your Guide to Maximizing 529 Plan Benefits

Savewhere.net provides detailed information and resources to help you understand and maximize the benefits of 529 plans. We offer insights into various state-specific regulations and tax advantages to help you make informed decisions.

2. How State Income Tax Benefits Work

How do state income tax benefits for 529 plans work? State income tax benefits are usually based on the total amount of your contributions to a 529 plan during the tax year. While there are no annual contribution limits for 529 plans, many states do limit the total contributions that qualify for a state income tax credit or deduction.

2.1 Deduction vs. Credit

Most states offer a state income tax deduction, where the amount you contribute reduces your taxable income. However, some states offer a tax credit, which directly reduces the amount of tax you owe.

- Deduction: Reduces the amount of income subject to tax.

- Credit: Directly reduces the amount of tax you owe, providing a dollar-for-dollar reduction.

2.2 Contribution Limits

While you can contribute as much as you want to a 529 plan, most states set limits on the amount you can deduct or claim as a credit.

Example: In New York, single filers can deduct up to $5,000, while those married filing jointly can deduct up to $10,000. If you contribute more, only that amount is deductible.

2.3 States with Specific Rules

Some states have specific rules regarding 529 plan contributions and tax benefits.

- Tax Parity States: Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, and Pennsylvania offer a state income tax benefit for contributions to any 529 plan, even those outside the state.

- Time Limits: Montana and Wisconsin have time limits to prevent the state tax deduction loophole, while Michigan and Minnesota base state income tax benefits on annual contributions net of distributions.

2.4 Savewhere.net: Keeping You Informed

At savewhere.net, we continually update our resources to provide the most current information on state-specific rules and regulations. Our goal is to ensure you can optimize your savings while remaining compliant with state tax laws.

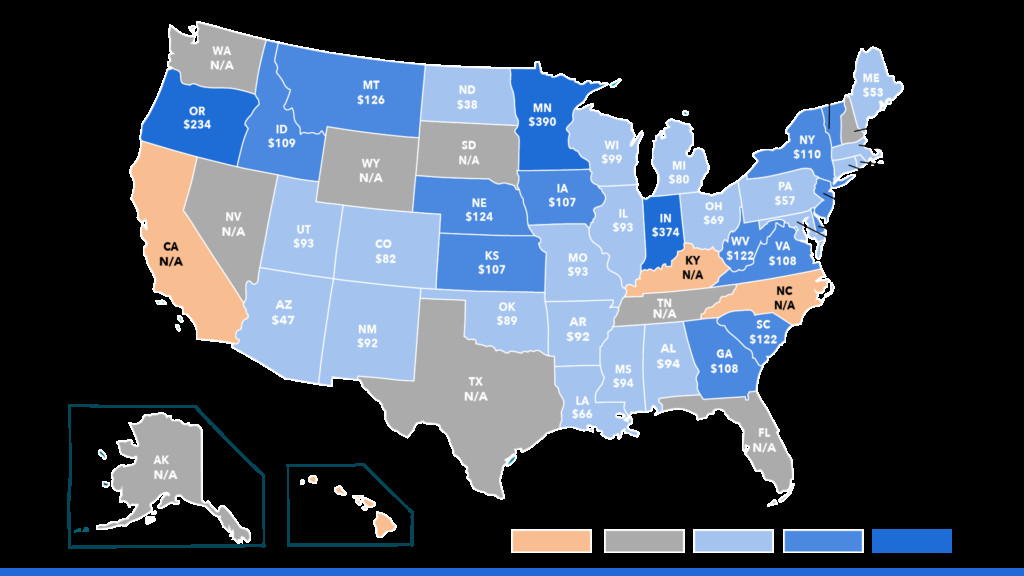

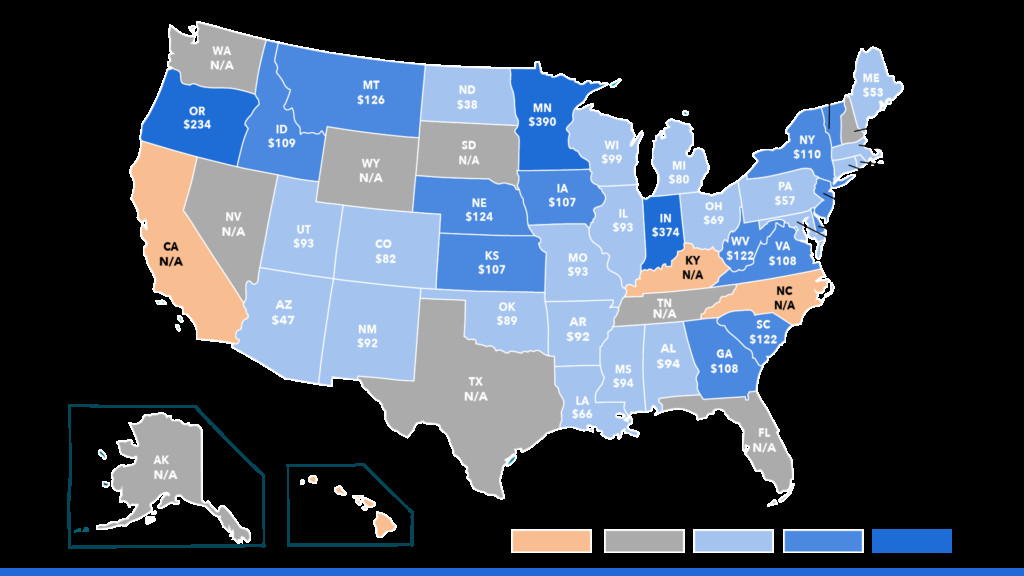

3. States with Income Tax Benefits for 529 Plans

Which states offer income tax benefits for 529 plans? Over 30 states and the District of Columbia offer a state income tax deduction or tax credit for contributions to 529 plans. Generally, to qualify for these benefits, taxpayers must contribute to their home state’s plan. However, some states offer tax parity, allowing benefits for contributions to any 529 plan.

3.1 States with Tax Parity

Nine tax parity states offer a state income tax benefit for contributions to any 529 plan, not just in-state plans:

- Arizona

- Arkansas

- Kansas

- Maine

- Minnesota

- Missouri

- Montana

- Ohio

- Pennsylvania

3.2 States with Income Tax Deductions

Most states offer a deduction for 529 plan contributions. The amount you can deduct varies by state and filing status. Here’s a look at some examples:

| State | Deduction Limit (Single) | Deduction Limit (Married Filing Jointly) |

|---|---|---|

| Colorado | $20,700 per beneficiary | $20,700 per beneficiary |

| Connecticut | $5,000 | $10,000 |

| New York | $5,000 | $10,000 |

| South Carolina | Full Deduction | Full Deduction |

| West Virginia | Full Deduction | Full Deduction |

3.3 States with Income Tax Credits

Some states offer a tax credit instead of a deduction. A tax credit directly reduces the amount of tax you owe.

- Indiana: Offers a tax credit for 529 plan contributions.

- Oregon: Provides a state income tax credit for 529 plan contributions.

- Utah: Offers a state income tax credit for 529 plan contributions.

- Vermont: Provides a state income tax credit for 529 plan contributions.

- Minnesota: Depending on adjusted gross income, taxpayers are eligible for a state income tax deduction or credit.

3.4 States Without Income Tax Benefits

Four states with a state income tax do not offer a contribution deduction:

- California

- Hawaii

- Kentucky

- North Carolina

3.5 Savewhere.net: Your State-Specific Guide

Savewhere.net offers detailed guides for each state, outlining specific 529 plan benefits, contribution limits, and eligibility requirements. Use our resources to find the best 529 plan for your needs and maximize your tax savings.

4. Estimating Potential Annual Tax Savings by State

How much can you potentially save in taxes annually with a 529 plan? The amount you save depends on your state’s tax laws, your income, and your contribution amount. Let’s look at some examples to illustrate potential savings.

4.1 Example Scenario

Consider a couple filing jointly with $100,000 in taxable income, contributing $100 per month to each of their two children’s 529 plans (totaling $2,400 per year). The estimated tax savings vary by state.

4.2 State-Specific Savings Examples

| State | Annual Contribution | Deduction Limit (Married Filing Jointly) | Tax Rate | Estimated Savings |

|---|---|---|---|---|

| New York | $2,400 | $10,000 | 6.33% | $151.92 |

| Colorado | $2,400 | $20,700 per beneficiary | 4.40% | $105.60 |

| Connecticut | $2,400 | $10,000 | 5.00% | $120.00 |

| South Carolina | $2,400 | Full Deduction | 7.00% | $168.00 |

| West Virginia | $2,400 | Full Deduction | 6.50% | $156.00 |

Note: Tax rates are approximate and may vary based on income level.

4.3 Factors Affecting Tax Savings

Several factors can influence the amount of tax savings you realize:

- State Income Tax Rate: Higher tax rates generally result in more significant savings.

- Deduction Limits: States with higher deduction limits allow you to deduct more of your contributions.

- Filing Status: Married couples filing jointly often have higher deduction limits than single filers.

- Contribution Amount: The more you contribute, up to the deduction limit, the more you can save.

4.4 Savewhere.net: Personalized Savings Estimates

Savewhere.net provides tools and calculators to help you estimate your potential tax savings based on your specific circumstances. Our resources consider your state of residence, income, and contribution amounts to provide a personalized estimate.

5. Maximizing State Income Tax Benefits

How can you maximize state income tax benefits with a 529 plan? To get the most out of these benefits, it’s crucial to understand the rules and regulations in your state and to plan your contributions accordingly.

5.1 Contribute Up to the Deduction Limit

Make sure to contribute up to the maximum deductible amount each year. This will allow you to claim the full state income tax benefit available to you.

Example: If your state allows a deduction of up to $5,000, aim to contribute that amount to maximize your savings.

5.2 Understand Tax Parity

If you live in a tax parity state, you can choose any 529 plan and still receive the state income tax benefit. This allows you to select a plan with lower fees or better investment options, regardless of where it is located.

5.3 Time Your Contributions

Most states require 529 plan contributions to be made by December 31 to qualify for a state income tax benefit for that year. However, some states offer an extension.

- States with Extended Deadlines: Taxpayers in certain states have until April to make 529 plan contributions that qualify for a prior-year income tax deduction.

5.4 Be Aware of Holding Periods

While most states do not require you to hold funds in a 529 plan for a specified amount of time before claiming a state income tax benefit, some states, like Montana and Wisconsin, impose time limits to prevent tax deduction loopholes.

5.5 Savewhere.net: Expert Tips for Maximizing Savings

Savewhere.net provides expert tips and strategies for maximizing your 529 plan benefits. We offer insights into state-specific rules, contribution timing, and other factors that can help you optimize your savings.

Child With Piggy Bank Saving for College

Child With Piggy Bank Saving for College

6. Eligibility for 529 Plan State Income Tax Benefits

Who is eligible for a 529 plan state income tax benefit? Typically, states offer state income tax benefits to taxpayers who contribute to a 529 plan. This includes parents, grandparents, or other loved ones who contribute to a beneficiary’s education savings.

6.1 Account Owner vs. Contributor

In most states, any contributor can claim the tax benefit. However, some states only allow the 529 plan account owner (or the account owner’s spouse) to claim the benefit.

- States with Account Owner Restrictions: Only the account owner (or spouse) may claim a state income tax benefit in certain states.

6.2 Age and Time Limits

Eligible taxpayers may continue to claim a 529 plan state income tax benefit each year they contribute, regardless of the beneficiary’s age. There are no time limits on 529 plan accounts, so families may continue to contribute throughout the child’s education and beyond.

6.3 Residency Requirements

Generally, you must be a resident of the state to claim its state income tax benefits. However, tax parity states allow residents to claim benefits for contributions to any 529 plan.

6.4 Savewhere.net: Clarifying Eligibility Requirements

Savewhere.net offers clear and concise information on eligibility requirements for 529 plan state income tax benefits. Our resources help you understand whether you qualify for these benefits and how to claim them correctly.

7. Choosing the Right 529 Plan

How do you choose the right 529 plan? Selecting the right 529 plan involves considering several factors, including fees, investment options, and performance. State income tax benefits should not be the only factor in your decision.

7.1 Fees and Expenses

Pay attention to the fees and expenses associated with the 529 plan. Lower fees can significantly impact your long-term savings.

- Types of Fees: Look for annual maintenance fees, program management fees, and underlying fund expenses.

7.2 Investment Options

Consider the investment options available in the 529 plan. Choose a plan that offers a variety of investment options to meet your risk tolerance and investment goals.

- Age-Based Portfolios: These portfolios automatically adjust the asset allocation as the beneficiary gets closer to college age.

- Static Portfolios: These portfolios maintain a fixed asset allocation.

7.3 Performance

Evaluate the historical performance of the 529 plan’s investment options. While past performance is not indicative of future results, it can provide insight into the plan’s management and investment strategy.

7.4 State Income Tax Benefits

If you live in a state that offers income tax benefits for 529 plan contributions, consider the potential tax savings when choosing a plan. However, do not let this be the only factor.

7.5 Savewhere.net: Comprehensive 529 Plan Comparisons

Savewhere.net offers comprehensive comparisons of 529 plans, including information on fees, investment options, performance, and state tax benefits. Our tools help you evaluate your options and choose the best plan for your needs.

8. Avoiding Common 529 Plan Mistakes

What are some common mistakes to avoid with 529 plans? To maximize the benefits of your 529 plan, it’s essential to avoid common pitfalls. Understanding these mistakes can help you make informed decisions and optimize your savings.

8.1 Not Starting Early Enough

One of the biggest mistakes is waiting too long to start saving. The earlier you begin, the more time your investments have to grow.

- Power of Compounding: Starting early allows you to take advantage of the power of compounding, where your earnings generate additional earnings over time.

8.2 Only Considering In-State Plans

While it’s tempting to choose your in-state plan for the tax benefits, remember that tax parity states allow you to choose any plan and still receive the state income tax benefit.

- Evaluate All Options: Consider plans from other states that may offer lower fees or better investment options.

8.3 Not Understanding Qualified Expenses

Make sure you understand what qualifies as a qualified education expense. Withdrawing funds for non-qualified expenses can result in taxes and penalties.

- Qualified Expenses: Include tuition, fees, books, supplies, and room and board at eligible educational institutions.

- K-12 Tuition: Up to $10,000 per year can be used for K-12 tuition expenses.

- Student Loan Payments: Can be used to pay off student loans, up to certain limits.

8.4 Neglecting to Rebalance

Regularly rebalance your portfolio to maintain your desired asset allocation. This helps manage risk and ensure your investments align with your goals.

- Automatic Rebalancing: Some 529 plans offer automatic rebalancing features.

8.5 Overlooking Fees

Ignoring fees can significantly reduce your returns. Pay attention to annual maintenance fees, program management fees, and underlying fund expenses.

8.6 Savewhere.net: Expert Guidance to Avoid Pitfalls

Savewhere.net provides expert guidance to help you avoid common 529 plan mistakes. Our resources offer tips on starting early, evaluating plans, understanding qualified expenses, and managing your investments effectively.

9. 529 Plans for K-12 Tuition and Student Loans

Can 529 plans be used for K-12 tuition and student loans? Yes, 529 plans can be used to pay for K-12 tuition expenses and student loans, providing additional flexibility and tax benefits.

9.1 K-12 Tuition

The federal government allows you to withdraw up to $10,000 per year from a 529 plan to pay for K-12 tuition expenses at public, private, or religious schools.

- State Variations: Not all states follow the federal tax treatment of K-12 tuition. Check with your state’s regulations to understand the tax implications.

9.2 Student Loans

You can also use a 529 plan to pay off student loans. The SECURE Act of 2019 expanded the definition of qualified education expenses to include student loan repayments.

- Lifetime Limit: There is a lifetime limit of $10,000 per beneficiary for student loan repayments.

- Sibling Loans: You can also use a 529 plan to pay off the student loans of a beneficiary’s sibling.

9.3 Savewhere.net: Staying Updated on Policy Changes

Savewhere.net keeps you updated on the latest policy changes and regulations regarding 529 plans. We provide timely information on how these changes impact your savings and tax benefits.

10. The Future of 529 Plans

What does the future hold for 529 plans? 529 plans are likely to remain a valuable tool for saving for education expenses, with ongoing discussions and potential enhancements to their benefits.

10.1 Potential Expansions

There is ongoing discussion about expanding the uses of 529 plans to cover additional education-related expenses.

10.2 Legislative Changes

Future legislative changes could further enhance the benefits of 529 plans, making them even more attractive for savers.

10.3 Savewhere.net: Your Resource for Future Planning

Savewhere.net is committed to providing you with the most current and reliable information on 529 plans. As the landscape of education savings evolves, we will continue to update our resources to help you plan for the future.

Child With Piggy Bank Saving for College

Child With Piggy Bank Saving for College

FAQs About 529 Plans and Tax Savings

Here are some frequently asked questions about 529 plans and tax savings:

1. Do 529 Contributions Reduce State Taxable Income?

Yes, 529 contributions may reduce your state taxable income to varying degrees in each state. For example, Colorado allows you to deduct $20,700 per taxpayer per beneficiary, while Connecticut allows you to deduct a maximum of $5,000 ($10,000 if filing jointly) in a single year.

2. Do You Get a Tax Deduction for Contributing to a 529 Plan?

There isn’t a 529 federal tax deduction, but there may be for state income tax. 529 contributions are tax-deductible for most states, allowing you to lessen your tax burden at the end of each fiscal year.

3. Which States Allow Tax Deductions for 529 Contributions?

Over 30 states allow tax deductions for 529 contributions. Savewhere.net has a full list of state deductions and credits.

4. Can You Deduct Out-of-State 529 Contributions?

If you file state income taxes in one of the nine tax parity states, which are Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, and Pennsylvania, you may be able to claim a state tax deduction on 529 plan contributions you make to an out-of-state plan.

5. Are 529 Contributions Pre-Tax or Post-Tax?

529 contributions are post-tax.

6. Are 529 Contributions Tax-Deductible for Grandparents?

Yes, some 529 contributions may be tax-deductible for grandparents. However, some states only permit the account holder to deduct contributions.

7. What Happens if I Don’t Use All the Money in a 529 Plan?

If the beneficiary decides not to attend college, you have several options:

- Change the Beneficiary: You can change the beneficiary to another family member.

- Keep the Account Open: You can keep the account open in case the beneficiary decides to go to college later.

- Withdraw the Funds: You can withdraw the funds, but the earnings portion will be subject to income tax and a 10% penalty.

8. Can I Have More Than One 529 Plan?

Yes, you can have more than one 529 plan for the same beneficiary, but it’s usually simpler to manage a single account.

9. How Do I Open a 529 Plan?

You can open a 529 plan directly through the state or through a financial advisor. Savewhere.net provides resources to help you find and compare 529 plans.

10. Do 529 Plans Affect Financial Aid Eligibility?

529 plans are considered an asset of the parent, so they generally have a minimal impact on financial aid eligibility.

Ready to explore the potential tax savings and educational opportunities that a 529 plan can offer? Visit savewhere.net today to discover valuable tips, resources, and state-specific information. Start planning for a brighter future and take control of your financial well-being. Join our community of savvy savers in Atlanta, GA, and across the USA, and let us help you make informed decisions that can positively impact your financial goals. Explore our website now and unlock the secrets to smart saving! Address: 100 Peachtree St NW, Atlanta, GA 30303, United States. Phone: +1 (404) 656-2000. Website: savewhere.net.